Markets are mixed as investors reexamine the pace of Fed rate cuts while embarking on the last full trading week in September. A few speakers from the central bank came out to signal that they remain attentive to inflationary risks and dialed back probabilities for another 50-bp reduction in November, as yield watchers are now favoring a 25-bp trim by a narrow margin. Meanwhile, the economic calendar reminded us that financing charges remain too elevated for the manufacturing sector, which remains in dire straits globally. But stateside services activity is buoyant, as the American consumer continues to power on. Across the Atlantic, however, the end of the Paris Olympics served to hamper experiences spending in the eurozone.

US Consumer Doesn’t Let Up

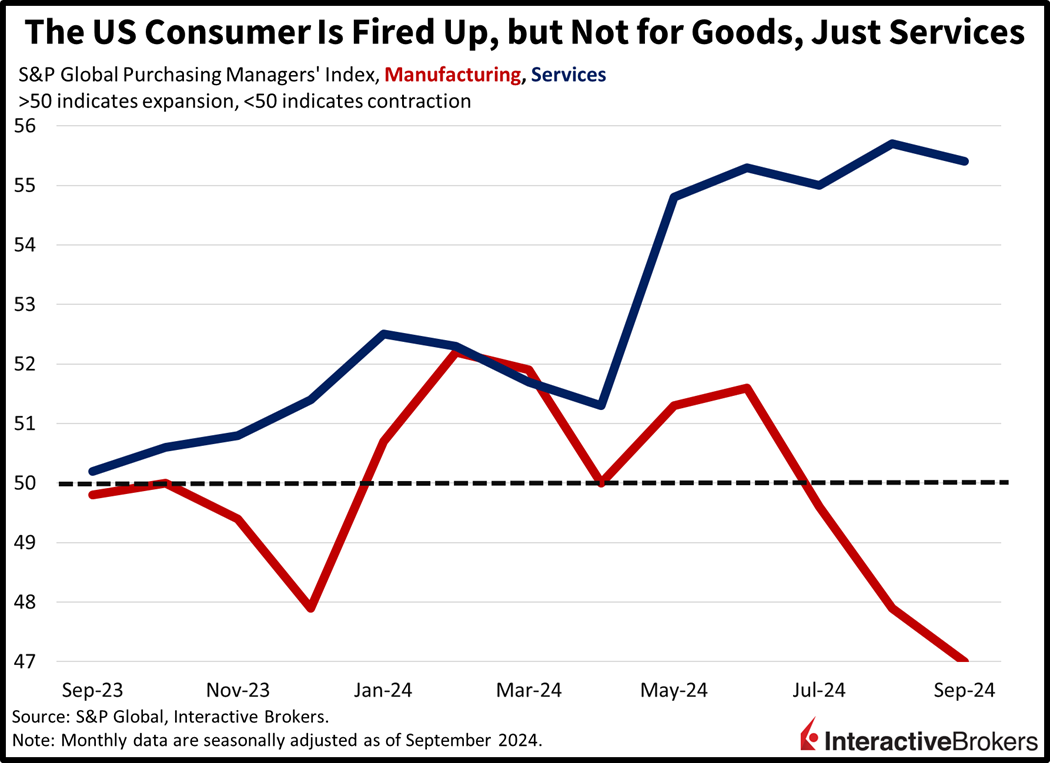

The US continues to overly rely on services consumption to extend the economic expansion, with this morning's Flash Purchasing Managers’ Indices (PMI) from S&P Global reflecting persistent strength. Indeed, this month’s figure of 55.4 exceeded the contraction-expansion threshold of 50 by a wide margin and the median forecast of 55.3, despite decelerating slightly from August’s 55.7. Servicers reported stellar demand, which was unfortunately accompanied by fiery price pressures. Employment and confidence declined though, as employers had trouble replacing job leavers and weren’t overly aggressive in hiring due to uncertainty related to the upcoming presidential election as well as the economy’s trajectory.

But Affordability Bites Manufacturing

The manufacturing segment was dismal though as elevated prices, lofty borrowing costs, reduced credit availability and job uncertainty weighed on order books. The flash PMI for the goods-producing sector fell to 47 this month, missing projections of 48.5 and the previous month’s 47.9. Driving the fragility were broad-based drags, including demand weakening at the sharpest pace since December 2022 and employment cratering to its worst pace since the pandemic’s heights in June 2020. Production also worsened on the back of lackluster capital expenditure plans, but shorter delivery times did offer some alleviation. Price pressures were also a burden and led by selling charges as input costs did decline due to softening oil prices and supply chain improvements.

Not Much Sun Across the Atlantic

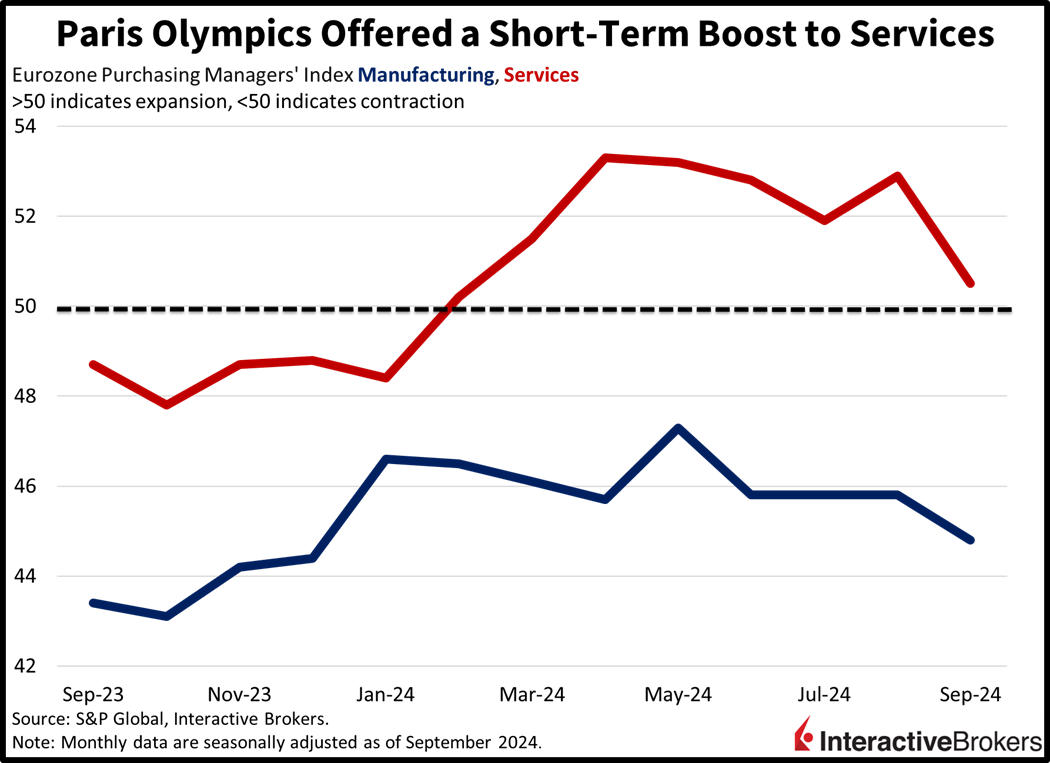

Economic conditions fared much worse in Europe, with manufacturing tanking significantly while the services sector barely stayed positive. Flash PMIs reported a score of 44.8 for the goods-producing sector this month, better than the 45.6 projected and the 45.8 from August. In services, the 50.5 figure was a downside miss, with the Street expecting 52.1 while slowing from the prior month’s 52.9. New orders and business confidence were extremely soft, resulting in subdued inflationary pressures and contracting employment. The Paris Olympics served to offer a temporary boost to the region, which is clearly waning at this juncture. France was offsetting much of the sluggishness from the East in Berlin, the continent’s most influential economy, but both nations are now contributing to the overall underperformance of the European economy.

Markets Are Careful in Response

Rates are climbing in response to flash PMIs reporting accelerating price pressures in the US economy, while stocks are unsure if they should take their cue from firmer growth or from heavier borrowing costs. Equity indices are mixed with the S&P 500, Nasdaq Composite and Dow Jones Industrial gaining 0.2%, 0.2% and 0.1%, but the rate-sensitive Russell 2000 is losing 0.5%. Sectoral breadth is titled positive with 6 out of 11 components loftier on the session and led by consumer discretionary, real estate and materials; they’re all up 0.3%. The laggards are comprised of financials, healthcare and energy, which are losing 0.4%, 0.4% and 0.1%. Treasurys are being sold at the margins, with the 2- and 10-year maturities changing hands at 3.60% and 3.77%, 1 and 3 basis points (bps) higher on the session. The dollar is near the flatline as it appreciates relative to the euro, yuan and yen but depreciates versus the pound sterling, franc and Aussie and Canadian tenders. Commodities are varied as lumber, copper, and gold are higher by 1.6%, 0.6% and 0.3%, but crude oil and silver are both lower by 1.1%. WTI crude is trading at $70.40 per barrel on news that Beijing is seeking lower costs from Moscow, with Russian imports up significantly in the short-term.

Weak Economy Brings Fed Liquidity

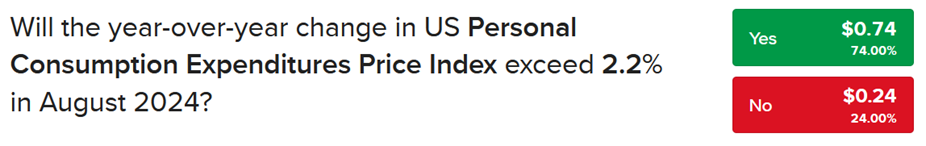

Anecdotal evidence and market behavior suggest that investors aren’t too worried about a slowing economy, with the answer to potential vulnerabilities landing at central banks. The Fed put is back, ladies and gentlemen, as central bankers are looking to defend labor conditions hell or high water. My hunch is that Powell’s recalibration will reignite inflationary pressures even as they remain near the 2% objective today. Just look at the 2.2% threshold on the IBKR Forecast Trader contract for the headline PCE inflation figure that is set to be released this Friday (Source ForecastEx). Finally, a rush to accommodate monetary policy will push that figure north and closer to 3%, which won’t mean much to Wall Street, but it will certainly impair an already wounded Main Street.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here.

Related: Bulls Chant “Don’t Fight the Fed”