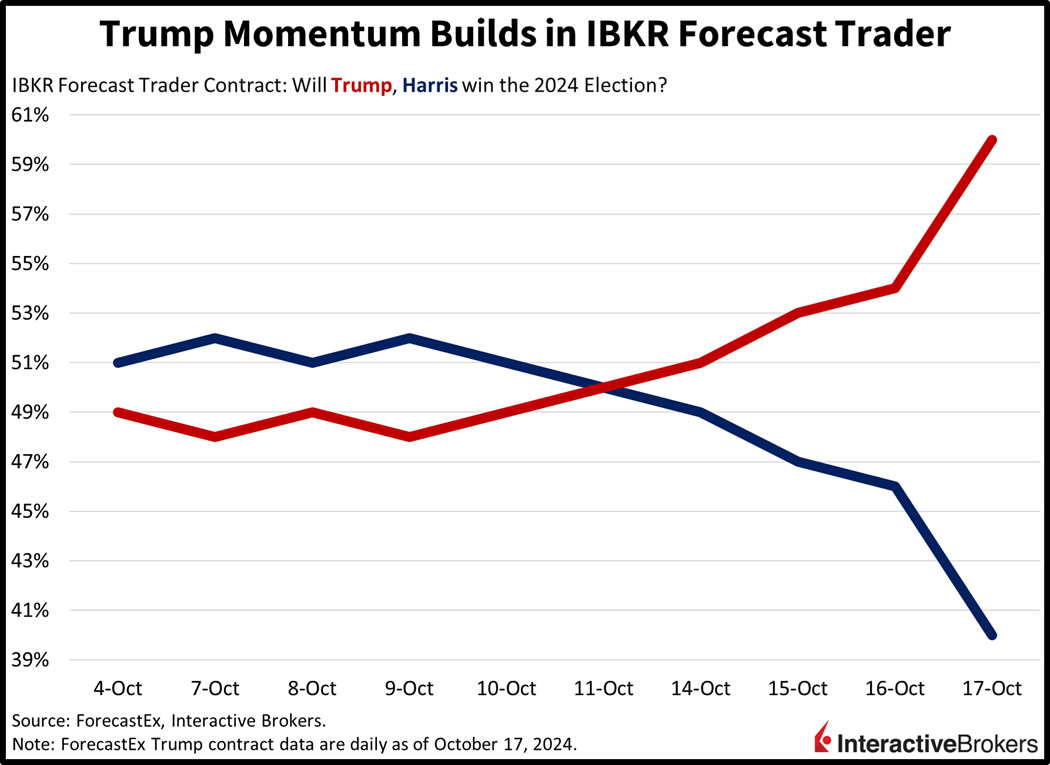

Yields are jumping this past week following a series of hotter-than-projected economic data as well as another interest rate reduction from the ECB. Retail sales, unemployment claims and homebuilder sentiment all arrived ahead of estimates while most corners of the equity market have suffered, a result of expectations for an increasingly slower walk down the Fed’s monetary policy stairs. But optimism on the AI front is helping to keep most benchmarks positive, as Taiwan Semi pleased investors with loftier-than-anticipated earnings and forward guidance. Meanwhile, our election contracts reflect fresh all-time high odds of former President Trump reclaiming the Oval Office, with Vice President Kamala Harris continuing to lose momentum. Furthermore, the probability of a red sweep is also ticking north with investors now pondering which policies would be enacted if the GOP controls both chambers of Congress and the White House, which is weighing on overall stocks.

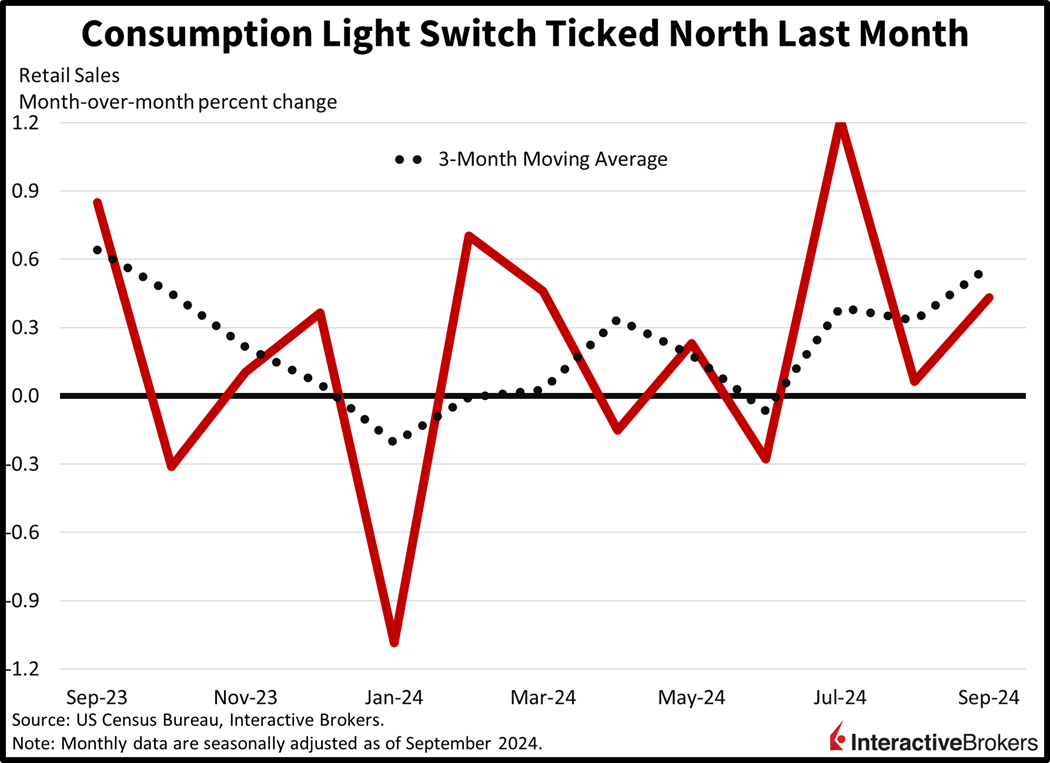

Easing Gas Prices Spark Shopping Spree

US consumers’ spending has been fickle, with bouts of splurging followed by purse string tightening, much like frequently switching a light switch on and off. After climbing only 0.1% month over month (m/m) in August, the illumination was once again sparked, with spending jumping 0.4% in September, exceeding the analyst consensus expectation for a 0.3% gain. After excluding automobiles and gasoline, outlays headed north by 0.7%, up from 0.3% in the preceding period. The increase occurred despite households’ optimism about making minimum debt payments having fallen to levels not seen since April 2020, according to a recent New York Federal Reserve Bank survey of consumers. On a favorable note, however, falling gasoline prices are believed to have driven traffic to cash registers.

While only five categories posted increases in August, spending expanded in nine areas during the recent reporting period. Sales were flat in only one group and declined in only three. The miscellaneous store group, the clothing segment and the health and personal care category led with increases of 4%, 1.5% and 1.1% m/m, respectively.

Other positive segments and their increases included the following:

- Food and beverage stores, 1%

- Food services and drinking places, 1%

- General merchandise stores, 0.5%

- Ecommerce, 0.4%

- Sporting goods, hobby and music, 0.3%

Motor vehicle and parts dealers spending was flat while the following categories contracted at the stated rates:

- Furniture and home furniture stores, 1.4%

- Gasoline stations, 1.6%

- Electronics and appliance stores, 3.3%

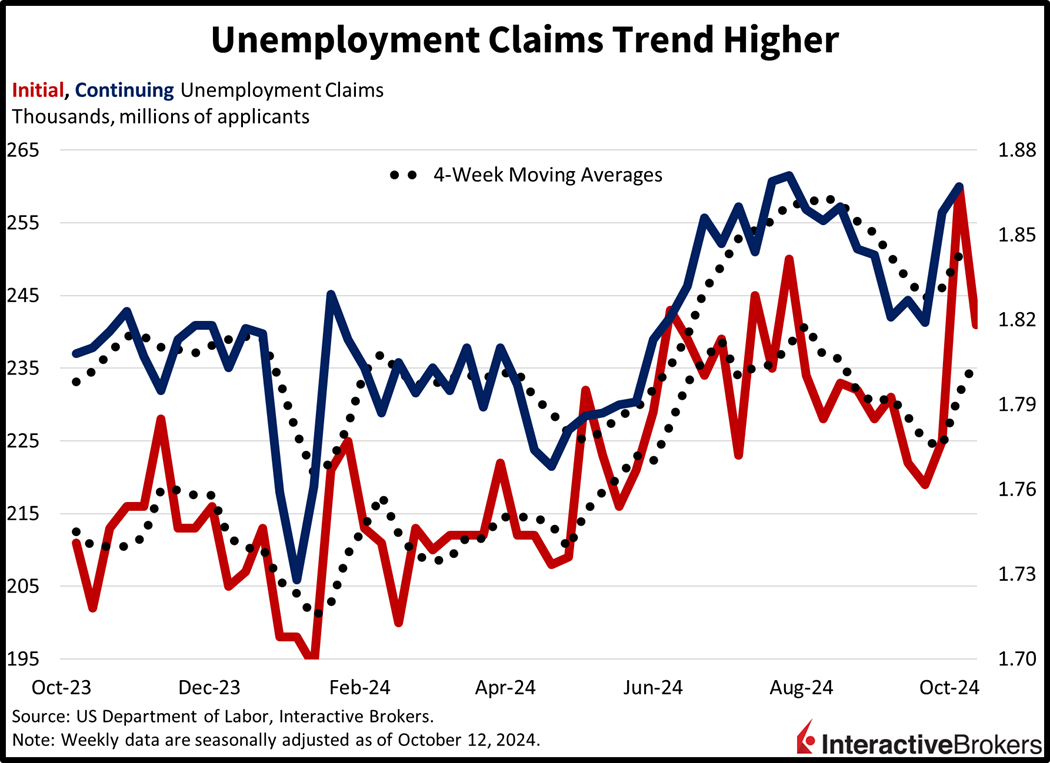

Unemployment Claims Trend Higher

Initial unemployment claims declined after previously jumping due to hurricanes and labor disputes. For the seven-day period ended Oct. 12, 241,000 individuals filed for benefits, missing expectations of 260,000 which would’ve been unchanged from the prior period. Continuing claims, which represent people who are already receiving assistance, moved from 1.858 million to 1.867 million as of Oct. 5, but fell 3,000 short of expectations. Meanwhile, four-week moving averages, which are less volatile than data for shorter periods, climbed from 231,500 to 236,250 and from 1.831 million to 1.842 million for initial and continuing claims, respectively.

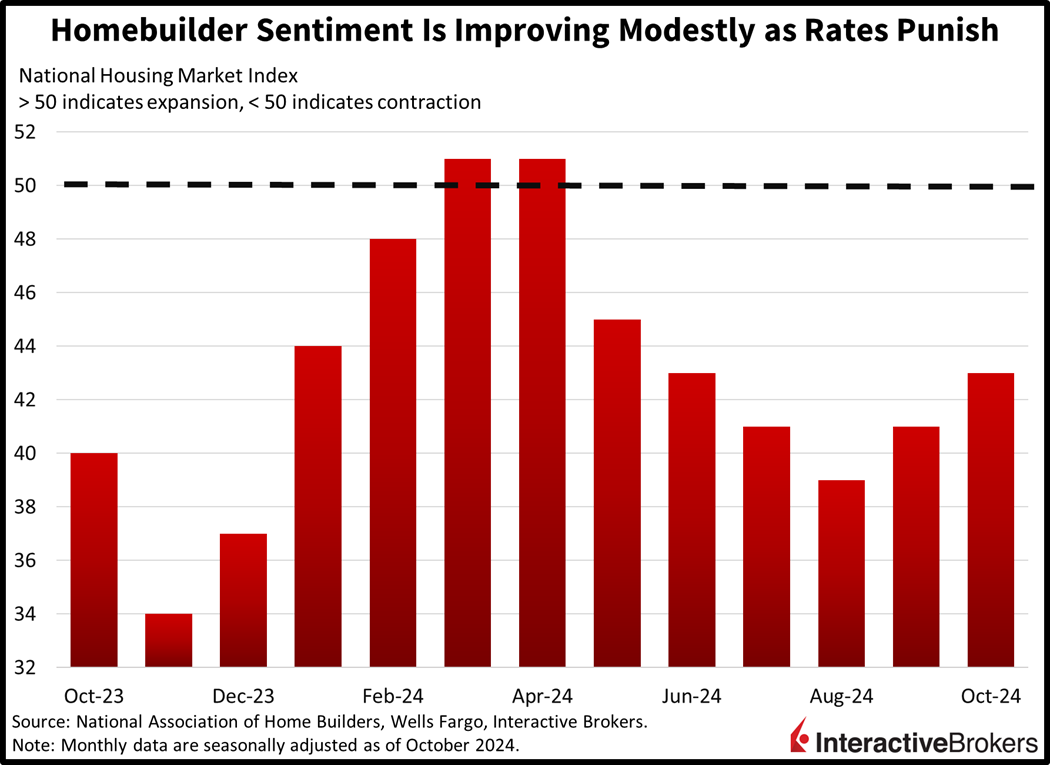

Short-Lived Dip in Financing Costs Supports Homebuilder Sentiment

Sentiment among home construction companies inched upward for the third-consecutive month in October, moving from 41 to 43, but is still substantially below the positive territory score of 50 or higher, according in this morning’s NAHB/Wells Fargo Homebuilder Sentiment Index. The result barely exceeded the Wall Street expectation of 42 and is believed to have strengthened due to declining mortgage rates during the period. However, the 30-year fixed has since climbed from a September low of near 6% to north of 6.6% today. Similar to last month, all three major components climbed with the outlook for single-family transactions in the next six months leading. It posted a gain of four points from September’s score of 53. Traffic from prospective buyers strengthened two points to 29 while current sales conditions rose only two points to 47. In a related matter, the percentage of builders reducing prices was steady at 32%. The size of the average price reduction increased one point to 6%. Additionally, three regions improved m/m as follows:

• Midwest, 41 to 43

• South, 40 to 43

• West, 41 to 44.

The northeast declined from 55 to 52.

European Policymakers Trim

The European Central Bank (ECB) cut its key interest rate 25 basis points (bps) this morning, marking the first time in 13 years that it has lowered the benchmark in two consecutive months. After establishing the 3.25% rate, ECB President Christine Lagarde said, “The disinflationary process is well on track.” Earlier this month, policymakers downplayed the likelihood of an October reduction, citing persistent inflation in the services sector, but a combination of September’s headline price pressure falling to an unexpectedly low level of 1.7% and recent weaker-than-expected economic data prompted the bank, which oversees 20 countries that use the euro, to take action.

Semiconductors Defy Market Weakness

Equity investors are gearing up for Trump 2.0 by placing the car in park while awaiting greater clarity from Washington. In the meantime, however, firm economic data is sending yields and the dollar north. While the return of 45 is becoming increasingly likely, the Trump trade is losing steam, with the small-cap, value-tilted, Russell 2000 Index down 0.7%. The Nasdaq 100, Dow Jones Industrial and S&P 500 benchmarks are up 0.4%, 0.2% and 0.1% though. Semiconductors are doing all the heavy lifting, ladies and gentlemen, with market sector breadth deeply negative. Technology and financials are the only gainers of the session; they’re up 0.9% and 0.3%. The other nine major segments are all lower, led south by real estate, healthcare and consumer staples, which are losing 0.6%, 0.6% and 0.5%. In fixed-income, currency and commodity land, the 2- and 10-year Treasury maturities are changing hands at 3.99% and 4.10%, 4 and 8 bps heavier on the session. Taller borrowing costs and robust economic data are supporting the dollar, with its gauge up 24 bps. The greenback is appreciating relative to most of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Canadian currency, but it is depreciating versus the Aussie tender. Commodities are seeing mixed action with gold leading, following another all-time high. Gold, silver and lumber are gaining 0.7%, 0.1% and 0.1% while copper and crude oil are down 0.8% and 0.3%. WTI crude is trading at $70.39 per barrel as a reduced geopolitical premium and disappointing activity out of Beijing weigh.

Not Just Election Contracts!

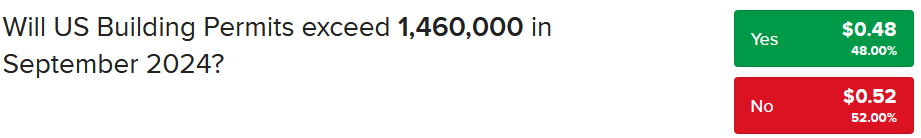

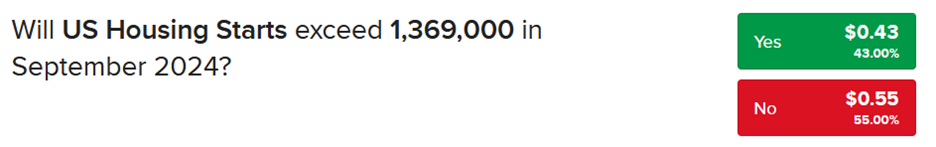

While our presidential and political forecast contracts have been the most popular thus far in IBKR Forecast Trader’s short history, we do have a vast suite of economic indicator instruments as well. Today’s retail sales and initial unemployment claims were certainly well represented in our plethora of choices, while tomorrow’s economic calendar features stateside building permits and housing starts. Our participants are expecting a number near 1.46 million on the former and 1.369 million on the latter, relatively in-line with Wall Street estimates. The Yes or Over contracts on those figures are priced at $0.48 and $0.43, while the No or Under choices are offered at $0.52 and $0.55.

Source: ForecastEx

Related: Investors Rush to Trump Trades as 45's Election Odds Rise