The stock market is broadening out. There’s good and bad news there.

If you have only been following the stock market since the start of 2021, you would think pretty highly of so-called “value” stocks. That is the market segment that includes stocks and sectors that tend grow their earnings slower than “growth stocks.”

Naturally, there are many variants on value and growth investing. However, the general rationale for owning value stocks is that long-term returns are more likely if you buy a stock when it is statistically cheap and undervalued compared to its future prospects.

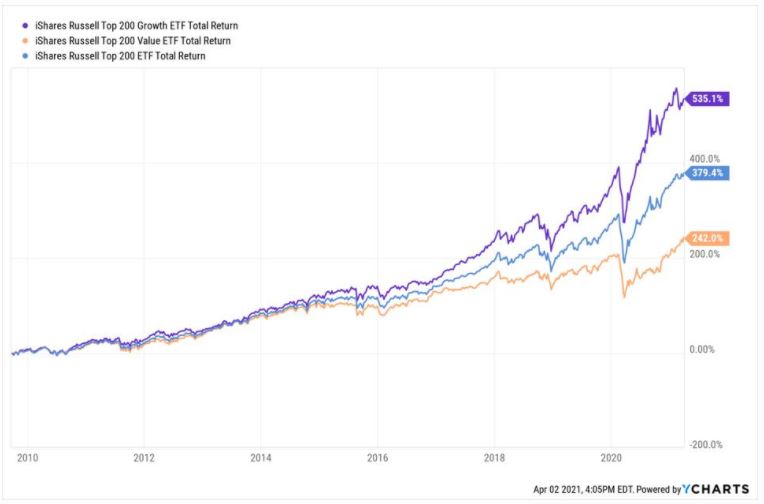

That brings us to the current investor conundrum. You see, the largest growth stocks have been outperforming the largest value stocks for a long, long time. In fact, as this chart shows, when you split the 200 largest U.S. stocks into growth and value groups, you see that growth has outperformed value by more than 2:1 since ETFs were created to track this slice of the stock market in late 2009.

Growth outperformed value for over a decade

This may explain in part why some stock investors think their investment advisor is a genius, and others think their advisor is not trying hard enough. If you are a devout value investor, you have underperformed the Large Cap market (blue line above) by about 150% over this period. However, if you are a growth devotee, you outperformed the “market” by about 150% over that same time frame.

Those numbers are too big to ignore. They say a lot about where we’ve been. However, what you should care about is not where we’ve been, but where we are going. So, let’s look at that next.

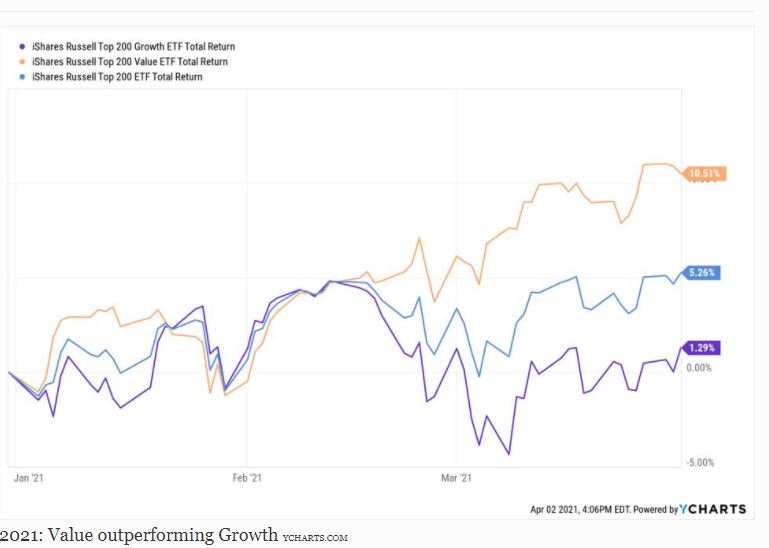

It is a small 3-month sample size, but value stocks are having a nice start to 2021. Meanwhile, growth stocks are just above break-even. If LeBron James has a bad game, you don’t change your mind about how great he has been for his full career. So, growth stocks are lagging in 2021, but they have been THE place to be with 20-20 hindsight.

The value crowd has been shouting about a value comeback for years. It happens for a little while, then growth goes right back to dominating.

Since neither you nor I can predict the future with pinpoint accuracy, I will instead point out a few bottom-line facts about value and growth stock indexes as they stand today.

- The growth index is VERY top-heavy. 6 stocks make up about 47% of the Russell Top 200 Growth Index. You can probably guess which ones, but for the record, they are Apple AAPL +2%, Microsoft MSFT +1%, Amazo AMZN +2.2%n, Facebook, Tesla TSLA -1% and Alphabet (the parent company of Google). In fact, the first 3 of that group make up about 1/3 of that index.

- The value index is just the opposite. As opposed to 6 stocks making up 47% of that segment, it takes 26 stocks to do the same in the Russell Top 200 Value Index.

- This indicates that large cap growth investing has become a victim of its own success. That is, so much money has crowded into large cap growth indexes, and a dominant portion of that money is invested in a small number of stocks, it creates a potentially dangerous situation. Any trend change in the leaders at the top could topple the whole growth stock run. If you own some of the other stocks in that growth index, but not the biggest ones, you risk being caught up in the storm, so to speak.

- Value stocks are gaining on growth stocks, but they too have come a long way. Their rate of performance the last decade would still qualify as excellent in a historical context. So, value investors should not be disappointed, just maybe a bit jealous of their growth counterparts. But jealously is not a good way to invest!

- What the value crowd has going for it is that the stocks that make up “big value” are more diverse. Financial stocks, some consumer and even technology giants are in the value category these days. The implication is that there is less of a “follow the leader down the well” risk, such as what exists in growth stock investing now.

No time like the present

Regardless of your investment process, this may be the best time ever to scrutinize the way the market indexes are structured when it comes to the growth/value paradigm. That is because growth’s success has skewed it into a potential danger zone, and value, while lagging, still lacks the kind of deep-discount valuations that tend to produce strong long-term performance.

In other words, there are no easy calls in the stock market. Attention to detail is paramount. Doing so will help you size up whether you are taking more risk than you realized, and help you consider how you may re-think your allocation between value and growth. That is the case whether you are investing in individual stocks or ETFs.

Related: How to Put Alternative ETFs to Work for Clients