Stocks are on a five-day winning streak with today’s UMich Consumer Sentiment print reflecting improved optimism amidst reduced inflation fears. The results are curbing recession angst and providing market participants with another data point to rally on despite September being a weak seasonal period. Still, equities are at an important level against the backdrop, with the S&P 500 reaching 5635, a lower high from August’s 5651 and July’s 5669 ahead of next week’s pivotal Federal Reserve meeting. Meanwhile, the de-inversion across the 2- and 10-year Treasury maturities continues to widen, just as retailers and financial institutions alike are warning of trade downs and rising consumer delinquencies. A 50-bp reduction next week by the Fed will certainly lead to an even steeper yield curve, with some folks concerned that a speedy horizontal roll down the monetary policy stairs will send risk assets to the cleaners.

Consumers’ Moods Brighten

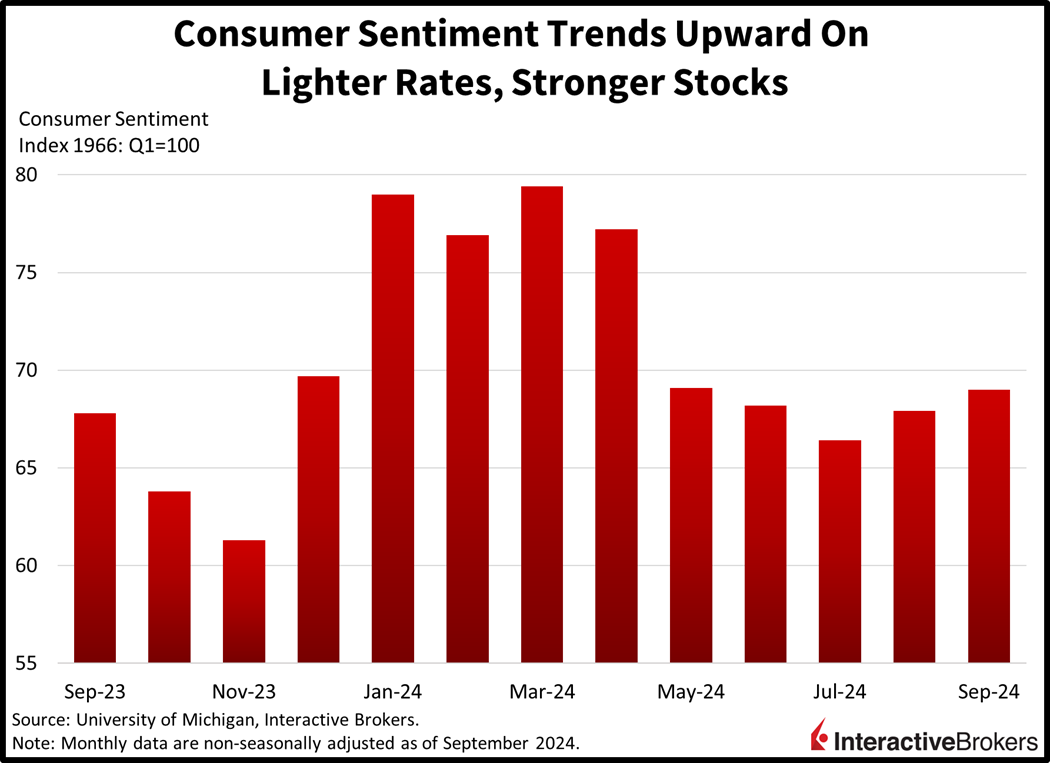

Consumers are feeling the most optimistic since spring, as softening price pressures, lighter borrowing costs and loftier stock values provide budgetary alleviation for individuals and families. The University of Michigan reported an index score of 69 for this month, exceeding forecasts of 68 as well as August’s 67.9, with the current and future components both contributing to the upside beat. Inflation expectations were mixed, however, ladies and gentlemen, as the one-year projection slipped to 2.7% from 2.8%, but the five-year outlook ticked up to 3.1% from 3%. Against this backdrop, surveyed participants registered across party lines anticipate Vice President Harris to step up to the Oval Office in January. Harris, an immigration dove, may very well propel housing costs further on the back of underbuilt conditions, fear of missing out, substantial newcomers and an incentive system somewhat comparable to President Bush 43’s American Dream plan.

Coin-Flip Odds for Next Week

Speaking of central banks, odds are nearing a coin-flip of the US Federal Reserve dishing out a 25 or a 50. On the one side, you have accelerating housing expenses, while on the other, there are risks of the labor market cooling. Furthermore, one important trend has been that automobile prices have declined for eight consecutive months, a pattern unlikely to continue as financing charges begin to ease. Indeed, pricing power at dealerships is likely to build as yields continue dwindling south, particularly for lower- and middle-income borrowers that suffer from much wider spreads.

Equity Investors Catch Optimism

Turning to markets, equities are defying the trend of racking up September losses with major indices in positive territory while bond yields decline and the US dollar weakens. The equity rally is being led by the Russell 2000 Index gain of 2.3%, followed by the Dow Jones Industrial, the S&P 500 and the Nasdaq Composite, which are up 0.9%, 0.5% and 0.4%, respectively. All sectors are in positive territory with the materials, industrials and energy categories ahead of the pack and climbing 1.2%, 1.2% and 1.1%. Treasury yields are moving in a bull steepening fashion with two-year and 10-year maturity yields down 5 and 10 basis points (bps) and changing hands at 3.58% and 3.65%. The Dollar Index is down 22 bps with the greenback depreciating relative to the euro, pound sterling, franc, yuan, and yen but appreciating against the Aussie and Canadian dollars. Most commodities are commanding higher prices with silver, gold copper and crude capturing gains of 3.1%, 0.8%, and 0.7% while lumber and crude oil are down 0.4% and 0.2%.

Stock Bulls Should Chant 25!

If the Fed does a 50 next week, we will likely see a dramatic bull steepening of the yield curve alongside a bullish yen. Historical evidence points to a 25 being more favorable to risk assets, as a 50 will leave reporters in the room and investors behind their computers wondering if the central bank knows something they don’t. This is especially true considering the authority’s regulatory capacity and confidential information related to financial institutions. Finally, slow adjustments downward have been more friendly to equities than hasty moves south, with the former more supportive of soft landings and income stability while the latter has been associated with economic stress and bottom-line weakness.

Related: Employers Back Off Gas Pedal