Collect a Bitcoin Dividend Without Owning the King of Cryptos

Bitcoin celebrated its 11th birthday on January 3. And what a party it's been, with the world's first and most famous cryptocurrency now trading near $40,000.

Warren Buffett famously referred to Bitcoin as "rat poison squared." The Oracle of Omaha might never own the King of Cryptos. But even he has to admit that it is charting a path higher… one that is as unique as the asset itself.

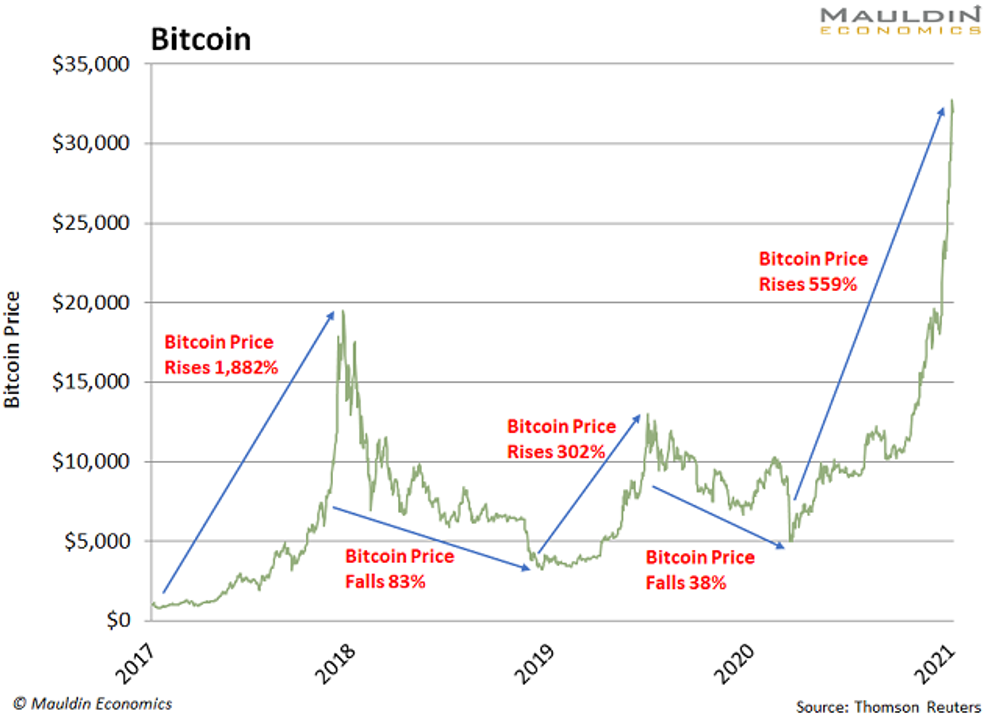

Bitcoin once shot up 1,882% in a little under a year. It went from $998 in January 2017 to $19,783 in December 2017. One year later, it dropped around 83% to $4,935.

Now we’re back in a Bitcoin bull market. Since the March 2020 lows, Bitcoin’s price has rallied over 500%. And there are plenty of reasons to believe it's going to go a lot higher.

Most people can’t stomach that much volatility and risk. And you don't have to. Nor do you have to miss out on the next leg of the Bitcoin bull market.

Even better, you don't have to spend as much as a base-model Tesla (TSLA) on a single stake.

A Different Way to Trade Cryptocurrencies

You are familiar with financial exchanges. These are companies that facilitate the buying and selling of stocks, bonds, commodities, and now—you guessed it—bitcoin.

Some of these exchanges support futures trading. At its simplest level, futures contracts let people bet on how much the price of something will rise or fall.

Now, I'm not recommending you trade Bitcoin futures. But you can make money off the trading action. That's because the exchanges charge fees for these transactions.

When trading volume goes up, like it is now, so does the bottom line of the exchanges.

And now, so can yours…

2 Low-Risk Ways to Profit from Bitcoin

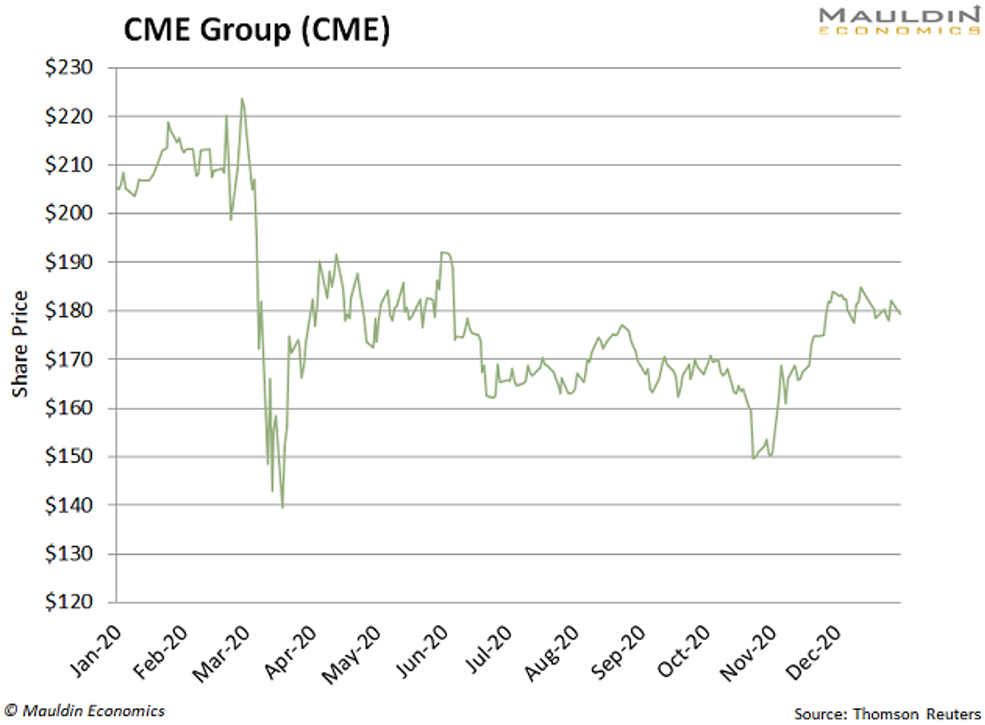

CME Group (CME) operates the leading Bitcoin futures exchange. And business is booming.

The company reported record volume on its Bitcoin futures exchange on May 13. It processed 33,700 contracts, equal to $1.35 billion.

And this is a sliver of its $5 billion-per-year business. That's why CME Group can pay a safe and stable 1.6% dividend.

Then there’s the cherry on top: The company has a history of paying a special dividend every year. So a special dividend could more than double CME’s dividend yield.

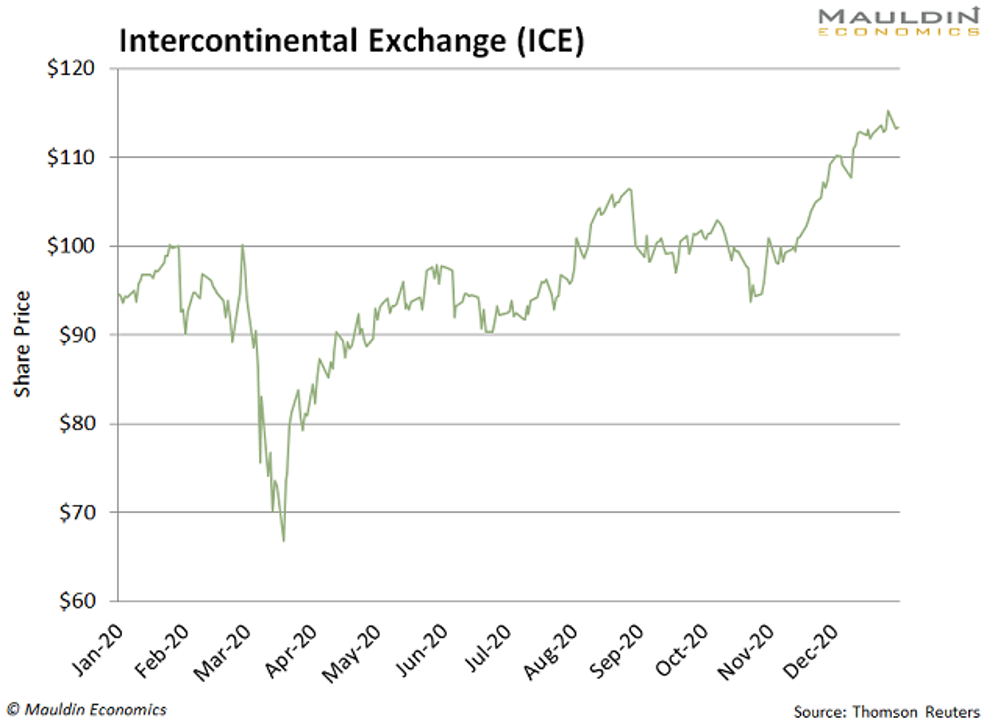

The second company on my list is Intercontinental Exchange (ICE).

The company introduced its bitcoin exchange in September 2019. It’s been a huge hit, as the company saw 16,000 contracts trade on a single day in September 2020.

That was 36% more than the previous record set in July 2020.

While ICE’s dividend is small at 1%, it’s rock-solid. The company has strong free cash flow and has a five-year average payout ratio of 27%.

I think Bitcoin is going to smash a lot more records in the future when it comes to the price of this cryptocurrency and the trading volume on exchanges like CME and ICE.

Both of these stocks are trading in the triple digits. Not only do they offer a less expensive way to bet on big-ticket Bitcoin, but they pay you to wait for the King of Cryptos to trade even higher.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

Related: 3 Stock Market Predictions for Another ‘Year Like No Other’

DISCLOSURE: The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.