This week, auto giant Tesla (NASDAQ: TSLA) announced its quarterly results for the period ending in December 2022. Let’s see what impacted the company in Q4 of 2022.

Tesla reports record sales in Q4

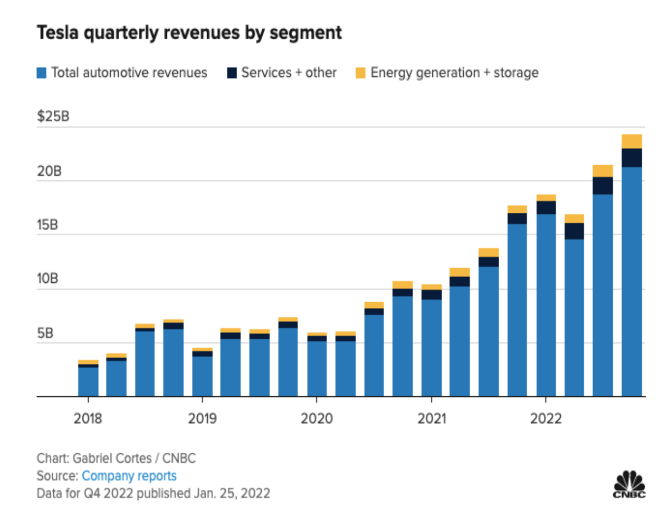

In the last two trading sessions, TSLA stock has surged over 10% after the company reported revenue of $24.32 billion and adjusted earnings of $1.19 per share. Comparatively, Wall Street forecast Tesla to report revenue of $24.16 billion and adjusted earnings of $1.13 per share in Q4.

In the year-ago period, the electric car manufacturer reported sales of $17.72 billion and adjusted earnings of $0.85 per share.

TSLA stock gained pace after the company beat consensus estimates, reported record revenue in Q4, and also claimed it might manufacture two million vehicles in 2023. Its automotive sales in Q4 grew 33% year over year to $21.3 billion. Regulatory credit sales surged by almost 50% to $467 million in the December quarter.

In 2022, Tesla reduced the prices of its vehicles to boost demand. But this came at a cost as gross margins for the automotive business stood at 25.9%, the lowest in the last five quarters. Tesla’s operating cash flow also fell by 29% year over year to $3.3 billion.

Tesla explained average sales prices have fallen in recent years as the company is willing to sacrifice the bottom line to eventually sell millions of cars each year. The company reduced prices globally in the second half of 2022, which upset its customer base in the United States and China, resulting in a decline in used Tesla car prices.

But price cuts have expectedly led to higher demand. During the earnings call, CEO Elon Musk confirmed, “Thus far in January we’ve seen the strongest orders year-to-date than ever in our history. We’re currently seeing orders of almost twice the rate of production.”

What next for TSLA stock and investors?

While Tesla did not issue any guidance for 2023, Musk stated the auto giant would continue to expand production in line with its 50% annual growth rate outlined in 2021. Analysts tracking TSLA stock now expect it to increase revenue by 28.9% to $105 billion in 2023 and by 32% to $138.5 billion in 2024. Comparatively, its adjusted earnings are expected to expand from $4.07 per share in 2022 to $4.17 per share in 2023 and $5.90 per share in 2024.

So, TSLA stock is priced at four times forward sales and 39x forward earnings, which is quite reasonable for a growth stock.

Tesla’s other business segments also gained traction in Q4. Its Services and other revenue stood at $1.6 billion. This includes revenue earned from fees for vehicle repairs. Further, sales from energy generation and storage rose to $1.31 billion, but the cost of sales for the business was also high at $1.15 billion in Q4.

Its installed capacity across multiple facilities will allow Tesla to manufacture 100,000 Model S and X vehicles as well as 1.8 million Model Y and Model 3 vehicles annually.

Moreover, the company continues to expand its product portfolio as the Cybertruck pickup will begin production in Texas this year. However, Tesla stated that volume production will be reached in 2024.