Markets are buckling as investors worry that President-elect Trump’s trade policies could weigh on economic performance and corporate earnings. This week’s announcements featured hawkish tariff talk with Trump proposing imminent duties on Canada, China and Mexico with the news erasing some of the progress stemming from the nomination of Scott Bessent to become head of the Treasury. Indeed, stocks and bonds rallied on the cabinet selection, with traders expecting Bessent to offer a soothing effect on Trump, especially as it relates to global commerce, geopolitics and fiscal matters. Anecdotal evidence suggests that the calming pep talks haven’t made much headway yet, however, but it’s still early. Meanwhile, the economic calendar served a familiar bifurcation: consumer confidence posted its loftiest print since 2023, but the pace of new home sales sunk to the lowest level in two years.

Investors React to Tariff Proposals

Trump’s latest proposals have sparked a selloff of equities in Europe and choppy trading in the US with automobile manufacturer shares weakening considerably. Yesterday, Trump said he will impose an additional 10% levy on all Chinese goods and threatened 25% tariffs on products from Mexico and Canada. Both countries currently enjoy a free-trade agreement with the US. Trump has previously proposed a 60% duty on China and a 10% border fee on products and services from all other countries. Vehicles assembled in the US include a significant portion of imported components, making the industry susceptible to international friction. Meanwhile, concerns that the development may be inflationary have increased speculation that the Fed will take a slower-than-expected approach to lowering its benchmark interest rate, which has caused the US dollar to appreciate.

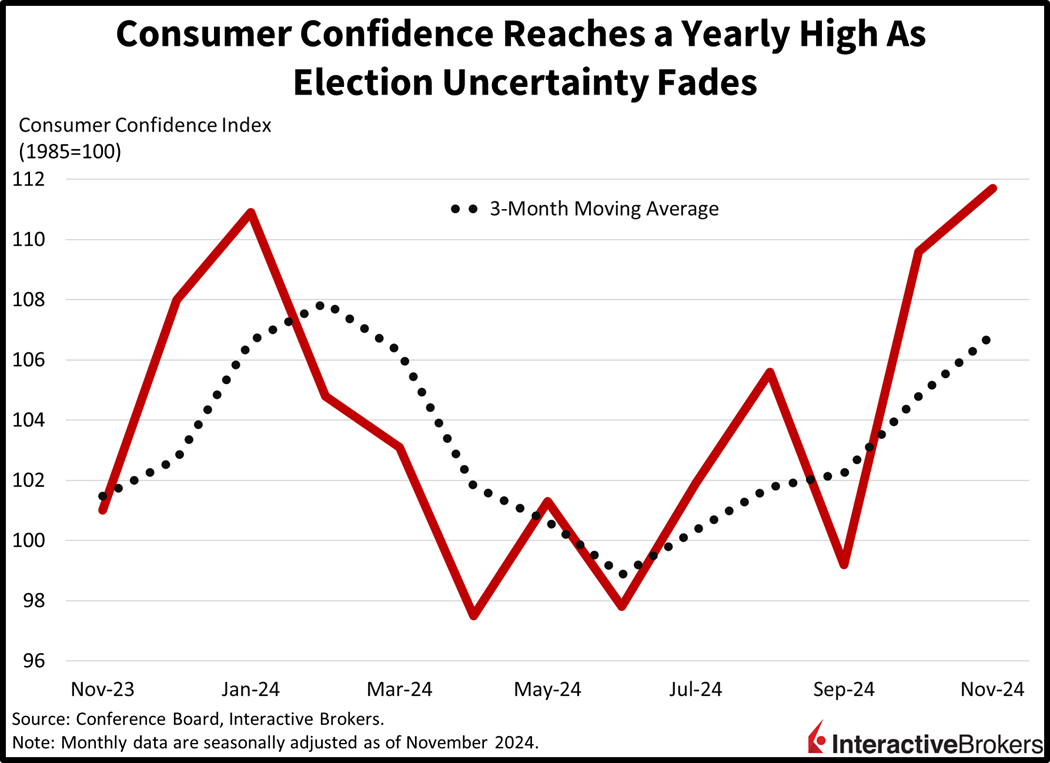

Labor Market Outlook Lifts Sentiment

The passing of election day has removed a cloud of uncertainty from consumer psyche with confidence jumping to its strongest figure since July 2023. The Conference Board’s Consumer Confidence Index came in at 111.7 for this month, exceeding October’s 109.6 and the median estimate of 111.3. Both critical components contributed to the headline beat, with the benchmarks for Present Situations and Expectations rising to 140.9 and 92.3 from 136.1 and 91.9. Positive assessments regarding job availability and stock market performance amidst outlooks supporting disinflation and softer borrowing costs drove the indicator north.

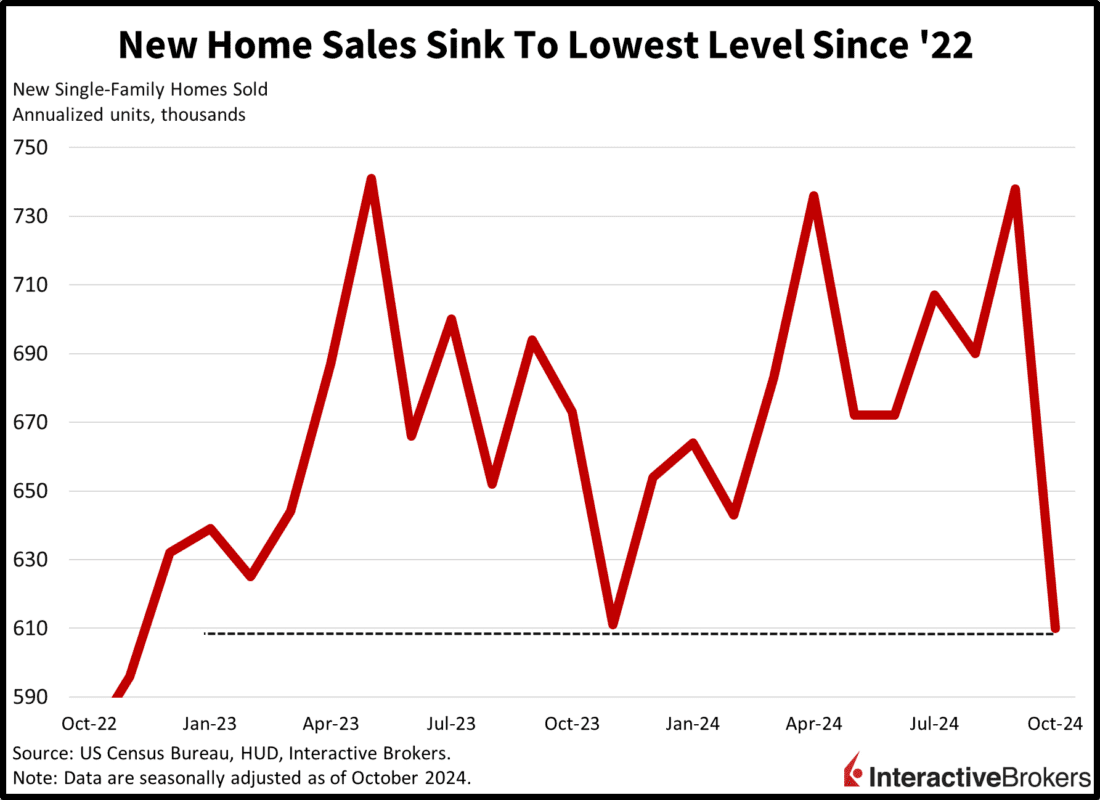

New Homes Sales Tumble

Costly mortgages, sky-high valuations and adverse weather conditions led to a huge miss with October new home sales this morning. The pace of transactions plummeted 17.3% month over month (m/m) to 610,000 seasonally adjusted annualized units, the lightest reading since November 2022. Additionally, the result arrived beneath the projected 730,000 as well as September’s 738,000. Progress of 53.3% and 1.4% m/m in the less active Northeast and Midwest regions wasn’t enough to counter the large 27.7% and 9% m/m declines in the more mobile South and West. Meanwhile, inventories, as measured by the ratio of new houses for sale to new houses sold, rose to 9.5 months, the heaviest number since October 2022.

Retailers Struggle with Tough Macro

Despite improving sentiment, American consumers are still refraining from buying appliances and other big-ticket items, causing Best Buy (BBY) to post its 12th consecutive quarter of year-over-year (y/y) declines in same-store sales. Earnings and revenue for the recent quarter both missed analyst expectations. The company said macro uncertainty, anticipation of discounted sales in the near future and the distraction of the presidential election created headwinds. It also lowered its guidance. Kohl’s also reported weak results, including a 9.3% decline in same-store sales. Its CEO abruptly resigned, and the company’s shares dropped more than 20% this morning. Macy’s also dished out bad news, announcing that it would delay its earnings release because it discovered that an employee had hid as much as $154 million in delivery expenses during the past three years. While consumers are avoiding upgrading home electronics and splurging at department stores, many have sent their children to school with updated athletic gear and clothing. This morning, Dick’s Sporting Goods (DKS) posted better-than-expected results with back-to-school shopping helping the company’s comparable sales to grow 4.2%.

Markets Tilt South

Markets are tilted bearishly with most stock sectors lower and interest rates backpedaling some of the Bessent rally. Major equity benchmarks are diverging against this backdrop, with the Dow Jones Industrial and Russell 2000 both lower by 0.5% while the Nasdaq 100 and S&P 500 are higher by 0.5% and 0.3%. But sectoral breadth is negative, with 7 out of 11 segments losing and weighed down by materials, energy and real estate, which trimmed 0.9%, 0.4% and 0.2%. Upside leadership, on the other hand, is being offered by utilities, communication services and consumer discretionary, which are gaining 0.7%, 0.6% and 0.3%. Treasurys are getting sold at the margin, with the 2- and 10-year maturities changing hands at 4.29% and 4.31%, 1 and 4 basis points (bps) heavier on the session. Hawkish trade talk and loftier borrowing costs are sending the dollar higher as well, with its gauge up 18 bps. The greenback is appreciating versus most of its major counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian tenders. It is depreciating against the yen, however. Commodities are mostly bullish with crude oil, lumber, silver and gold higher by 0.9%, 0.8%, 0.6% and 0.1%, while copper bucks the trend; it’s down 0.7%. WTI crude is trading at $69.70 per barrel on rumors that OPEC+ will delay its production hike due to a market carrying ample supplies.

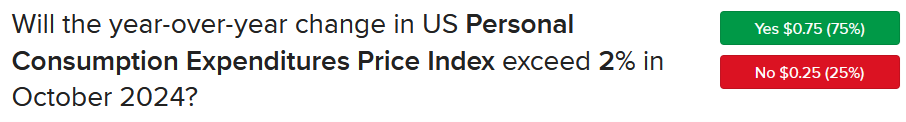

ForecastEx Pick: PCE

As Thanksgiving quickly approaches, tomorrow’s economic calendar is heavier than usual for the last Wednesday of the month, considering that weekly unemployment claims and the Fed’s preferred inflation gauge have been moved up from their typical Thursday and Friday schedules due to the holiday. Additionally, we also have a revision to third-quarter GDP, corporate profits, durable goods orders and pending home sales. Furthermore, in this week’s edition of ForecastEx picks, IBKR Chief Strategist Steve Sosnick and I have spotted a unique opportunity pertaining to tomorrow’s October Personal Income and Outlays report. For the PCE Price Index, IBKR Forecast Traders are pricing in a sizable downside miss on the y/y headline figure. The probability of a number north of 2% is just 75%, but my model points to a reading above the specified threshold as a near certainty, considering that the pivotal Consumer and Producer Price inputs for last month are already available. The dynamics reflect strong odds that investors on the Yes side will achieve a profit.

Source: ForecastEx