Semiconductor shares are getting hammered on news that Trump isn’t happy with the technology sector’s warmth toward Beijing. President Biden, meanwhile, is rushing to potentially implement the harshest of penalties to chip firms that trade with China in efforts to toughen up on the geopolitical front and possibly shore up his dwindling odds of reelection. Rates are jumping against the backdrop, as Trump and JPMorgan Chase Chief Dimon, who is considered a top contender for head of the Treasury next year, sent separate messages to the Fed urging the central bank to hold off on reducing its key benchmark. Yields are also receiving support from London’s hotter-than-expected inflation figures, which are serving to extend the Kingdom’s journey across the monetary policy bridge; traders are pricing in just 30% odds of a trim next month.

Presidential Positions Shake Up Capital Markets

The US campaign season is already sending shockwaves through capital markets as former head of state Donald Trump and President Joe Biden seek to gain in the polls by sharpening their proposed restrictions on China. Additionally, Trump and his running mate, J.D. Vance, have said the US dollar is too strong, fueling expectations that a change in White House occupancy could lead to efforts to weaken the currency. Trump has also teamed up with JPMorgan Chase CEO Jamie Dimon to urge the Fed to delay cutting rates until after the election, with the banking executive arguing that inflationary pressures could strengthen if policymakers ease prematurely. Investors currently anticipate one rate cut before the election and one more after the next president has been selected. Regarding Beijing, Biden has just proposed using the most drastic measures available to clamp down on countries that export technology to China that could be used for military purposes. Trump, for his part, has proposed large increases of existing tariffs on imports from China and he recently said Taiwan should foot the bill for any military aid that the US might provide if China attempts to invade the archipelago. Trump has also alluded to evening the playing field for international trade by weakening the US dollar amidst weak yen and yuan currencies, making China and Japan more appealing as exporters.

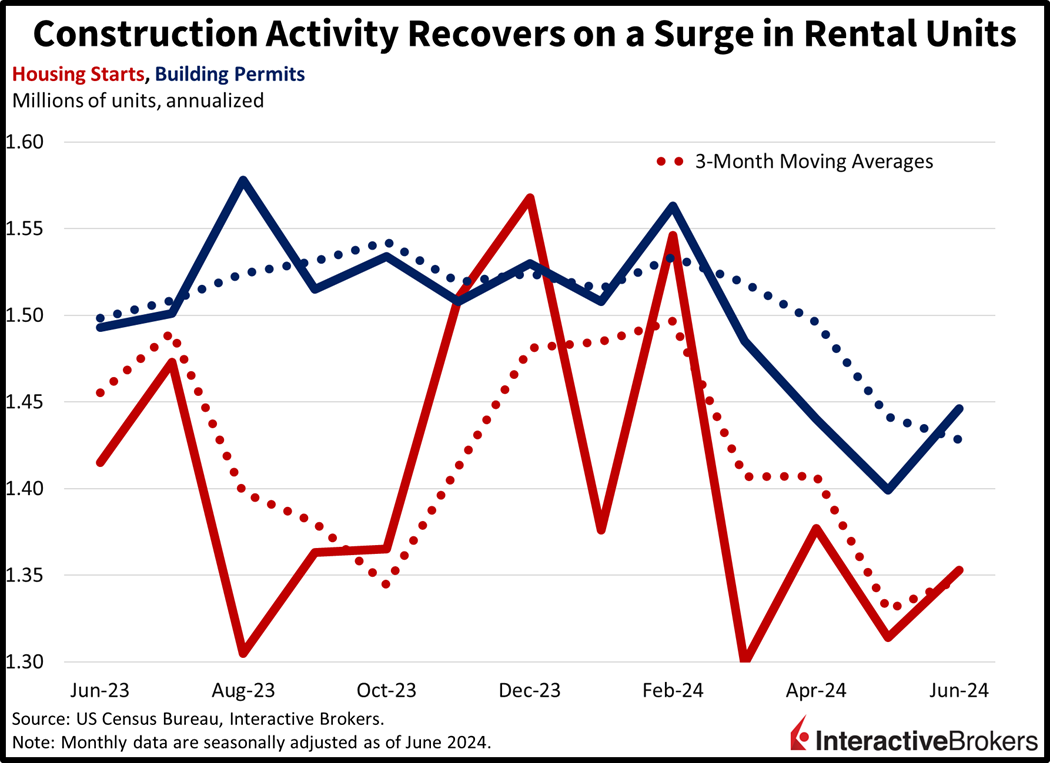

Surge in Rental Units Helps Construction Activity

This morning’s residential construction data showed the industry was rescued by a surge in rental units coming through the pipeline. On the contrary, single-family new builds continued contracting, as that segment carries greater sensitivity to affordability dynamics that have been hampered by all-time high prices and generationally elevated mortgage rates. The pace of building permits and housing starts ticked up to 1.446 million and 1.353 million seasonally adjusted annualized units in June, ahead of expectations of 1.40 million and 1.3 million and May’s 1.399 million and 1.314 million. The 19.2% and 22% month-over-month (m/m) increases in the annualized rate of multi-family permits and starts overwhelmed the 2.3% and 2.2% m/m declines in the single-family segment. Results weren’t as uniform from a regional perspective, with overall permit activity rising in the Midwest and South by 15.6% and 2.8% m/m, while the Northeast experienced a 2.5% decline amidst an unchanged West. For starts, the Northeast and Midwest led with gains of 34.4% and 26.8% m/m, which were modestly offset by declines of 6.1% and 1.7% in the Midwest and South.

UK Rate Cut Bets Dwindle

Across the Atlantic in London, the Bank of England experienced a setback in its inflation battle, which is winding down optimistic wagers of an August rate reduction. Price pressures rose 0.1% m/m and 2% year over year (y/y) in June, ahead of the anticipated 1.9% y/y. The core segment, which excludes food and energy, increased 0.2% m/m and 3.5% y/y, loftier than the expectation for 0.1% m/m. Cost momentum resulted from the service sectors, which overwhelmed the impact of goods deflation. Propping up charges were the restaurant/hotel, owner occupied housing and rental categories, which expanded 0.9%, 0.6% and 0.4% m/m. On the other hand, apparel, communication, alcohol/tobacco and transportation saw overall discounting, with m/m prices at the registers declining 1.2%, 0.4%, 0.4% and 0.2% during the period. In comparison, headline figures rose 0.3% m/m and 2% y/y in May while core gained 0.5% and 3.5%.

Geopolitics Rattle Semiconductor Industry

It appears Americans are sitting tight on furniture, but beyond the living room, geopolitical tensions are weighing on the performance of semiconductor companies. U.S. Bancorp, meanwhile, has become the latest financial firm to report a drop in net interest income (NII) but an increase in noninterest revenue. Those are a few observations from the following second-quarter developments:

- J.B. Hunt Transport Services posted second-quarter revenue and earnings that missed analyst consensus expectations and declined from the year-ago period. Without adjusting for one-time expenses, the company’s earnings per share fell 27% y/y while revenue retreated 7%. J.B. Hunt reported mixed demand for shipping bulky items with stable volumes for appliances and exercise equipment logistics, while furniture was weak. During the second quarter, the logistics company’s gross revenue per load in its Intermodal area and volumes in Integrated Capacity Solutions both declined. Truckload, or simply trucking, and Dedicated Contract Services, a product that allows clients to reserve shipping capacity at pre-determined rates, also experienced weakness. The company says its trucking capacity will be stable during the next five months, and it expects to use attrition to manage headcount. The price of J.B. Hunt shares sank roughly 7.5% this morning.

- ASML Holding, a provider of semiconductor manufacturing systems, posted earnings and revenue that exceeded analysts’ expectations, but its share price declined in response to fears that the US might increase restrictions on trade with China. This could include applying additional pressure on non-US companies to curtail exporting technology to China that could be used for military purposes. ASML has already complied with US requests, but if semiconductor providers face similar pressure, it could weaken demand for chip manufacturing equipment. Despite surpassing analysts’ forecasts, both net sales and net income declined y/y. However, the company’s net bookings, a measurement of orders, climbed 24% y/y as semiconductor manufacturers prepare to make products for artificial intelligence computing. Shares of ASML fell approximately 11% this morning.

- Johnson & Johnson reported profits and revenue that surpassed analyst estimates and earnings per share (EPS) that increased y/y, but revenue declined from the year-ago period. The health care company lowered its full-year EPS guidance to below analysts’ estimates, explaining the revision is required because of the impact of acquisitions. During the recent quarter, strong sales of multiple myeloma drug Darzalex partially offset the impact of soft demand for the company’s other medications, but net income still softened 12.8%. The company’s stock price climbed approximately 3% in early trading.

- U.S. Bancorp joined a growing list of financial firms with earnings that have been hurt by declining NII, or the difference in the cost of capital and interest collected on loans. U.S. Bancorp’s NII dropped 9% y/y, which contributed to the company’s adjusted profit contracting 10%. The bank’s cost of capital has increased because it has raised interest rates paid on deposit accounts as customers increasingly seek out higher yielding savings accounts and money market funds. Despite the decline, earnings and revenue exceeded analyst consensus estimates. Noninterest income grew y/y while noninterest expenses and a provision for credit losses declined. Its credit card debt issuance increased 8.8%. Shares of U.S. Bank advanced roughly 4.40% in early trading.

Dow Jones Hangs in There

Despite major averages getting obliterated against the backdrop of tough talk from the campaign trail and the White House, the Trump trade is gaining momentum under the surface. Still, the tech-heavy concentration of the top US indices has sent them into a tailspin, with the Nasdaq Composite, S&P 500 and Russell 2000 losing 2.4%, 1.2% and 0.5%. Despite the heavy pain, sectoral participation is actually positive, with the Trump favored Dow Jones Industrial Average up 0.2%. Offsetting some of the selling pressures are the real estate, energy and consumer staples segments, which are leading the bulls and are up 1.1%, 1% and 0.9%. Technology, consumer discretionary and communication services are suffering most, they’re moving south by 3%, 1.5% and 1.2%. Borrowing costs are levitating on the back of a Republican Party that appears committed to a message supporting no cuts before the election. The 2- and 10- year Treasury maturities are changing hands at 4.47% and 4.18%, 5 and 2 basis points (bps) loftier on the session. Fiercer yields and modestly subdued Fed easing projections aren’t extending to the greenback, which is suffering due to the Trump/Vance ticket appearing to penalize nations that artificially devalue their currency. Furthermore, the duo favors a stateside manufacturing advantage, whose export volumes are boosted by a weaker US currency. The Dollar Index is down 42 bps to 103.83 as the US currency depreciates relative to the euro, pound sterling, franc, yen and yuan. It is appreciating versus the Aussie and Canadian dollars though. Commodities are mixed, with silver, copper and gold lower by 3.1%, 1% and 0.2% but lumber and crude oil higher by 1.6% each. WTI crude is trading at $82.11 per barrel on a drop in stateside stockpiles, a softer greenback and increasingly intensifying geopolitical tension, especially out of the Red Sea. Lumber is being supported by the strong results in rental unit construction reported by the US Census Bureau earlier this morning.

Can 2024’s Rally Continue Without Tech?

Much of this year’s equity gains have come from a handful of names which currently happen to be under direct threat from the political arena. An important question is if the rest of the market, which generally lacks thrilling tales on a relative basis, can offset waning momentum in the magnificent 7 stocks. Another significant consideration centers around expectations for equity price increases amidst the appearance of front-loading stock gains; the S&P 500 is up 40% since the beginning of 2023. As we progress through what’s traditionally been the worst performing quarter for equities amidst decelerating economic data and uncertain fed funds, the bar for more upside has been elevated while the door for downside volatility opens up. Finally, selling pressure may intensify further during or immediately after this Friday’s monthly stock option expiration while Wall Street ears remain focused on Washington developments.