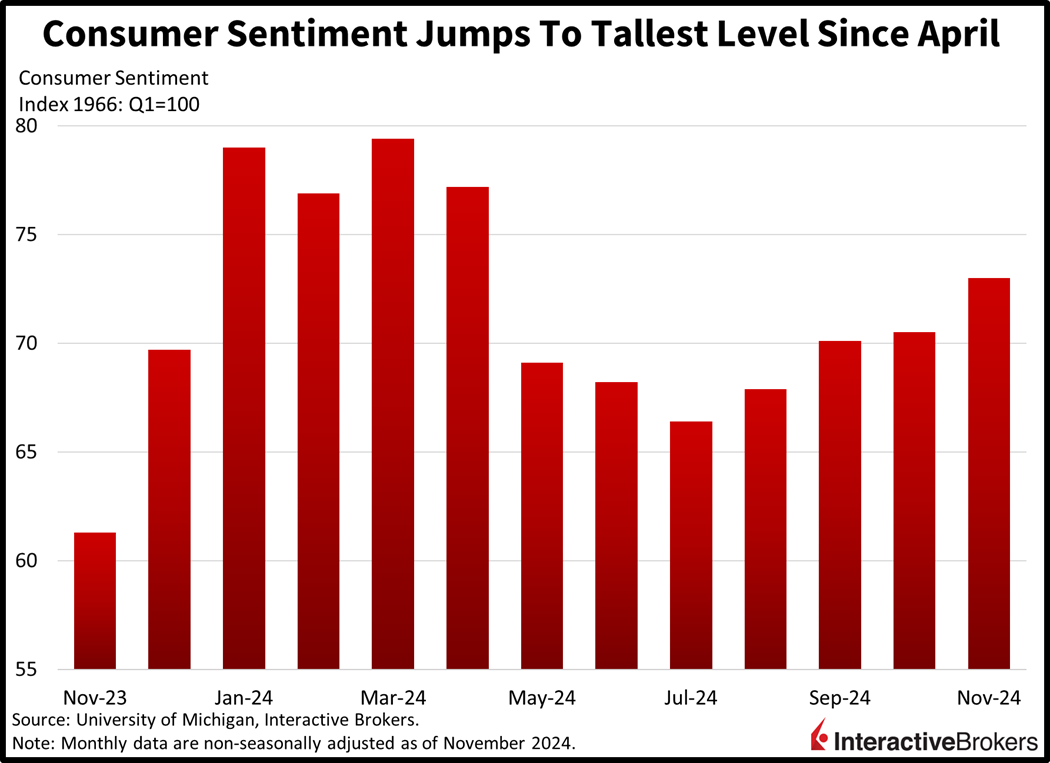

The Trump rally isn’t over with stocks reaching fresh all-time highs as investors look ahead to tax cuts, deregulation and made in America policies to power future gains. Market participants are also catching a tailwind from a dovish Federal Reserve, which remained committed to walking down the monetary policy stairs during yesterday’s decision to reduce its key benchmark by 25 bps. Furthermore, news that consumer sentiment jumped to its tallest level since April is also empowering equity bulls and supporting earnings expectations, with the UMich beat dialing down the probabilities of revenue sluggishness.

Sentiment Gains on Improved Expectations

The University of Michigan Survey of Consumer Sentiment Index recorded its fourth-consecutive month of gains today, climbing to 73.0, up from October’s 70.5 and above the anticipated score of 71.0. The advancement, however, was driven by consumers’ outlook, with the expectations benchmark increasing from 74.1 to 78.5. Consumers’ optimism regarding improving incomes and short-term business opportunities helped push up the headline result. Conversely, the current economic conditions measure fell slightly from 64.9 to 64.4. The outlook for price pressures, however, was mixed, with anticipation for year-ahead inflation easing marginally from 2.7% to 2.6%, the lowest forecast since December 2020. The longer-term inflation result moved in the opposite direction, bumping from 3.0% to 3.1%. The survey was conducted prior to the presidential election.

Powell Strikes a Defiant Tone

Federal Reserve policymakers unanimously cut the Fed Funds yesterday to a range of 4.50% to 4.75%, a 25-basis point (bps) reduction, and Chairman Jerome Powell provided somewhat optimistic comments but cautioned that the long-term economic outlook is uncertain. The move followed the Fed’s surprisingly large 50-bp cut in September. In discussing the recent easing, Powell added that the Fed will continue to reduce its balance sheet, and he said risks to the central bank’s dual mandate of achieving full employment and price stability are balanced. In response to media questions, he declined to rule out the possibly of increasing the overnight lending rate in a year or so due to growing uncertainties about the economy over the long term. He also struck a defiant tone when asked if he would honor a potential request from President-elect Donald Trump to resign. Powell, a Trump appointee, has been criticized by the Republican leader, who has implied in the past that the institution is politically motivated. Trump was particularly critical during his first term when he thought the Fed should have been accommodating but was on pause instead. He was also particularly vocal about the central bank lowering borrowing costs a few weeks prior to the election on September 18. Powell, however, has resisted the pressure, explaining that Trump has no legal authority to force him to quit. The chair has also emphasized the importance of central banks having independence from political influences. Powell’s term expires in May 2026. In a related matter, Powell said the Fed will continue to base its decisions on economic data rather than attempting to anticipate the potential impacts of Trump’s proposed policies.

Equities Ride Wave of Optimism

Markets are buoyant with equities climbing higher while bonds also add to gains as yields retreat. The dollar is also in the green and serving to tighten financial conditions as it weighs on commodities. All stock indices are pointing north with the Dow Jones Industrial, S&P 500, Russell 2000 and Nasdaq 100 benchmarks up 0.6%, 0.4%, 0.3% and 0.1%. Sector breadth is positive with seven out of eleven equity segments up and being led by real estate, utilities and consumer discretionary, which are higher by 1.6%, 1.4% and 1.3%. Meanwhile, communication services and materials are the biggest laggards; they’re losing 0.6% and 0.5%. Rates on the 2- and 10-year Treasury maturities are moving lower by 1 and 5 bps with the instruments changing hands at 4.20% and 4.28%. The greenback’s index has climbed 36 bps as the US currency appreciates versus most of its major counterparts, including the euro, pound sterling, franc, yuan and Aussie and Canadian tenders. It is depreciating relative to the Japanese yen, however. In commodities, crude oil, copper, silver and gold are lower by 2.5%, 2.3%, 1.7% and 0.5%. Lumber is bucking the trend due to relief at the long end. The critical construction material has advanced 1.2%. WTI crude is trading at $70.33 per barrel on curbed weather concerns related to Hurricane Rafael that could have harmed stateside energy infrastructure.

Forecast Contract Traders Turn to PPI, CPI and Retail Sales

Much of my conversations this week focused on the accuracy of the IBKR Forecast Trader platform relative to national polling sources regarding this year’s elections. As we all know, polls were reflecting a neck and neck race while our IBKR Forecast Trader marketplace during most trading days since early October favored a Trump win by a wide margin. Now that election day is behind us, we have a long list of economic indicator contracts available to trade as well. Participants may choose Yes or No. Finally, I’m seeing some compelling opportunities in our marketplace for next week, with the Consumer Price Index (CPI), Producer Price Index (PPI) and Retail Sales report on the economic calendar. The Yes for the PPI is priced at 72% for a figure above 1.3% year over year (y/y), but wholesale prices have increased during the period while Wall Street economists’ have a median estimate of 2.3%. CPI and Retail Sales don’t offer much of a discrepancy relative to expectations, with the Yes priced at 72% and 51% for data above 2.5% y/y and 0.3% month over month while the median projections stand at 2.6% and 0.3%, respectively.