The recent rise in long-term interest rates has sent homebuilders to their bunkers, causing construction activity to sink sharply last month. Higher yields are also weighing on the stock market’s performance, as traders contend with a central bank that appears increasingly unsatisfied with inflation’s trajectory amidst longer-term excesses in government debt levels, Treasury issuance and budget deficits. Investors are also highly attentive to geopolitical risks, with Israeli officials vowing retaliation for the recent Iranian offensive.

Mortgages Weigh on Residential Construction

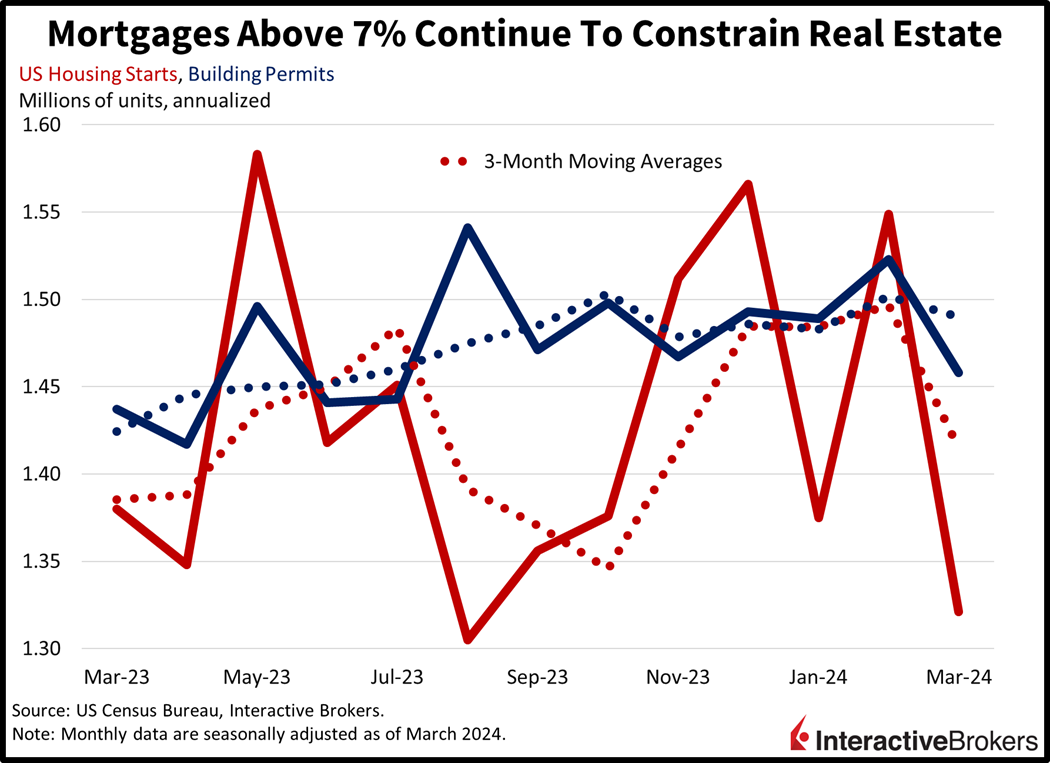

Mortgage rates exceeding 7% continue to punish the real estate sector via lighter construction levels, reduced transactions and a sharp contraction in prices for new homes. The pace of construction sank significantly last month, as both housing starts and building permits declined 14.7% and 4.3% month over month (m/m), according to data from the Commerce Department. Starts came in at 1.321 million seasonally adjusted annualized units (SAAU), way below projections of 1.48 million and February’s 1.549 million. The multi-family segment drove much of the weakness, slipping 20.8% while single-family dropped 12.4% m/m. The Northeast, Midwest and Southern regions led the charge lower with m/m declines of 36%, 23% and 17.8%. The West offset some of the weakness with a gain of 7.1%. Meanwhile, permits, which reflect plans for future construction, were weighed down by single-family, with the component’s pace falling 5.7% m/m while multi-family was unchanged during the period. Similar to permits, applications in the Northeast, Midwest and South declined 20.8%, 14.7% and 0.6%, while the West experienced a 5.1% increase.

Homebuilder Optimism Continues

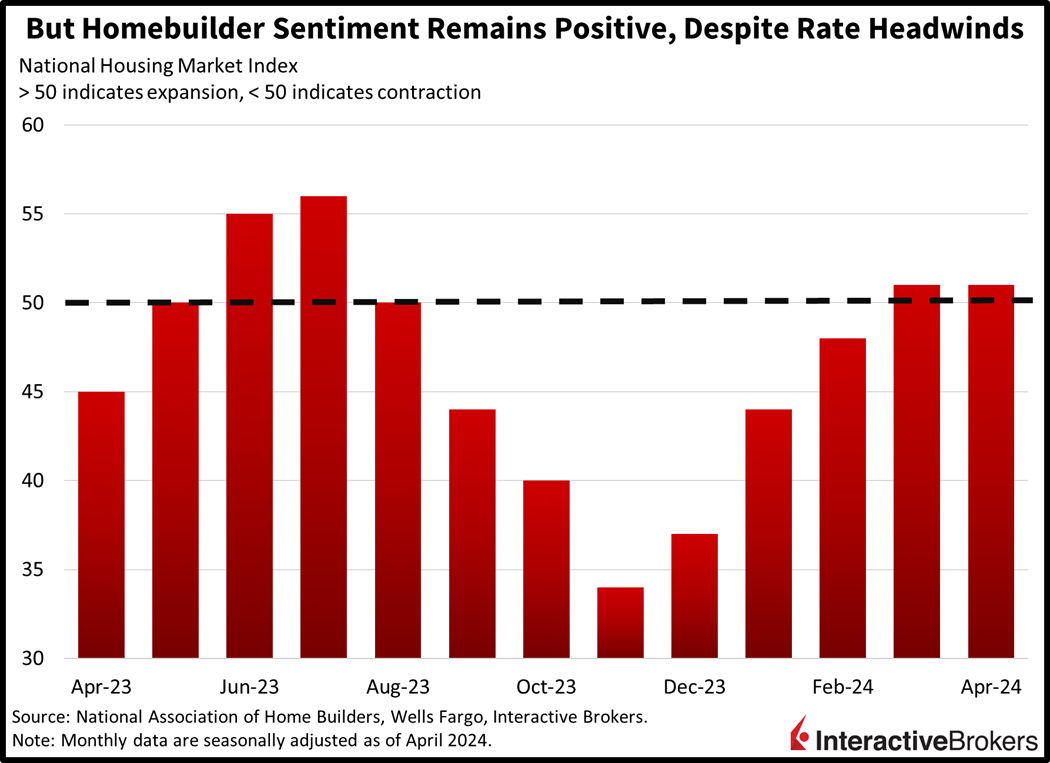

Even though March permits and starts were weak, contractors remain enthusiastic with homebuilder sentiment lingering slightly above the negative/positive threshold of 50. April’s homebuilder sentiment figure of 51 met the analyst consensus estimate and was unchanged from last month. The sub-indices of current single-family sales and traffic of prospective buyers rose from 56 and 34 to 57 and 35, respectively, m/m. But the outlook for sales in the next six months slipped from 62 to 60. Builder motivation increased in three regions by the following amounts:

- Northeast, up to 65 from 61

- Midwest, up to 50 from 49

- West, up to 49 from 45

The South slightly offset the positive moves in the other regions. Sentiment dropped from 52 to 51.

Middle East Turmoil Appears to Escalate

Israel’s rhetoric regarding Tehran’s missile and drone attack on Saturday strengthened this morning when the country’s leaders stated they had no choice but to retaliate. Israel’s war cabinet today continued to discuss its possible reaction to the attack while some reports claim US officials believe that any retaliation will be limited. Despite that, Iran has stated that even small actions will provoke the country to unleash a “severe, extensive and painful” reaction. Investors appear to be assessing how much of Israel’s actions are posturing, or seeking to make the country look strong, rather than a dramatic counterattack that could escalate the conflict. Indeed, oil prices have declined in early trading while bond yields have climbed, implying that the worst may very well be over.

Consumers Flock to Health Care

This morning’s earnings reports illustrate that demand for health care, including elective surgery, is robust, and separately, banks are benefiting from strong equity market performance and improved sentiment among business leaders. Consider the following earnings highlights:

- UnitedHealth Group, the parent company of UnitedHealthcare, beat analysts’ expectations for earnings and revenue during the first quarter despite a cyberattack on its ChangeHealth unit. The company’s revenues grew in the upper double digits year over year (y/y), a result of UnitedHealthcare increasing the number of consumers it serves both through employers and direct sales to individuals. The company’s Optum unit, which provides pharmacy services and data for improving clinical outcomes, also experienced impressive growth with results supported by new clients and expanded relationships with existing customers.

- Johnson & Johnson’s first-quarter results benefited from strong demand for medical care driven by surgeries that were delayed during the Covid-19 pandemic. J&J CFO Joseph Wolk told CNBC that the uptick in surgeries following the opening of the economy hasn’t softened. He believes consumers who are cutting expenses for non-health items aren’t willing to sacrifice their quality of living by reducing or avoiding medical care. As a result, J&J experienced strong demand for its surgical devices. Additionally, its pharmaceutical revenue increased 7% after excluding sales of its Covid-19 vaccine. The company’s earnings missed the analyst forecast but revenues matched expectations.

- Morgan Stanley reported first-quarter results that reiterated a theme from earnings statements released by banks yesterday—improving sentiment among business executives drove an increase in investment banking revenues as more companies raised capital. The company’s earnings and revenues significantly exceeded analysts’ forecasts with profits jumping 14% y/y. Additionally, recent market gains drove an increase in wealth management fees and equity trading revenue also climbed.

- Bank of America’s revenue declined but exceeded analysts’ forecasts while earnings met expectations despite the bank paying an FDIC special assessment and experiencing a decline in net interest income (NII). Additionally, the company said its unrealized losses from its fixed-income portfolio increased from $98 billion at the end of 2023 to $109 billion as higher yields have eroded the value of lower interest bonds. Like other banks, Bank of America was required to pay a special assessment to the FDIC to replenish the organization’s insurance fund that was drawn down when various regional banks failed. Meanwhile, higher deposit rates have reduced the bank’s NII. Credit card transactions expanded, illustrating strong consumer sentiment, but credit card loan charge offs also increased.

Markets Struggle

Markets are weaker even as equity and bond bulls alike try to hold on amidst yesterday’s painful debacle. Top of mind for stock traders is whether or not the S&P 500 Index can remain above the pivotal 5,000 level, as the benchmark is down 0.3% to 5,047. Meanwhile, the rate sensitive, small-cap Russell 2000 is taking the most pain with the basket down 1%. Against the backdrop, the Nasdaq Composite Index is near the flat line while the Dow Jones Industrial Average gains a modest 0.1%. Fixed-income instruments are getting pounded, as investors think the worst is over in the Middle East for now, contributing to incrementally less demand for risk-off investments and lower oil prices. The 2- and 10-year Treasury maturities are trading at 4.96% and 4.67%, 3 and 6 basis points (bps) loftier on the session. WTI crude is down 0.4%, or $0.35, to $85.26 per barrel. The dollar is benefiting from higher yields with the greenback’s index up 10 bps to 106.29. The US currency is up relative to most of its major, developed market counterparts including the franc, pound sterling, yen, yuan and Aussie and Canadian dollar. It is down slightly against the euro though.

Housing Prices Remain a Huge Problem for 2%

While tighter monetary policy has helped to slow price pressures, home values remain at all-time highs. A combination of an undersupplied market and many homeowners who are locked in at 2% to 4% mortgages has constrained inventory. These headwinds have led to sticky rents as well, with landlords managing margins against the backdrop of rising costs related to interest, labor, maintenance, materials, taxes and insurance. An important goal of economic policy is homeownership, but with affordability at its worst level in history, policymakers are in a pickle. Lower interest rates will bring demand back but will also propel prices. The key to an improved housing market remains supply, but builders won’t build with mortgages above 7%. They will construct with mortgages at 6%, however, but prices will remain unfriendly, as bidders rush to pick up inventory. These concerns are not just relevant to Americans that would like to purchase a home, they’re also a critical component of inflation’s shelter segment, which makes up roughly 40% of the Consumer Price Index and continues to pose a head-scratching problem for the Fed, Congress and the White House.