Markets are breathing a sigh of relief as better-than-expected job growth is curbing fears of an economic slowdown and dialing down the projected speed of the Fed’s walk down the monetary policy stairs. Robust employment data are also supporting buoyant corporate earnings expectations, which ironically occur as Nike and Tesla disappoint on the revenue and delivery fronts yesterday evening and this morning. And while stocks, rates and gold seem confident that escalating hostilities in the Middle East won’t expand to a wider-spread regional conflict, energy supplies are being questioned, with crude oil adding heavily to yesterday’s sharp gains. Meanwhile, striking dockworkers don’t appear to be inching closer to a deal, and the ramifications of an augmented impasse include the reduced availability of goods alongside taller charges.

Soft Landing Odds Rise

This morning’s ADP employment report is adding credence to the argument that economic and labor conditions remain sturdy, especially following yesterday’s upside beat on job openings. Of course, tomorrow’s read on unemployment claims and ISM-services will provide further details, but the main event occurs on Payroll Jobs Friday. Market participants and central bankers will be paying close attention to the entire buffet of information, as seasonal adjustment difficulties following the pandemic, elevated immigration flows and late-cycle dynamics have weighed on data collection and quality efforts.

Broad-Based Gains in Hiring

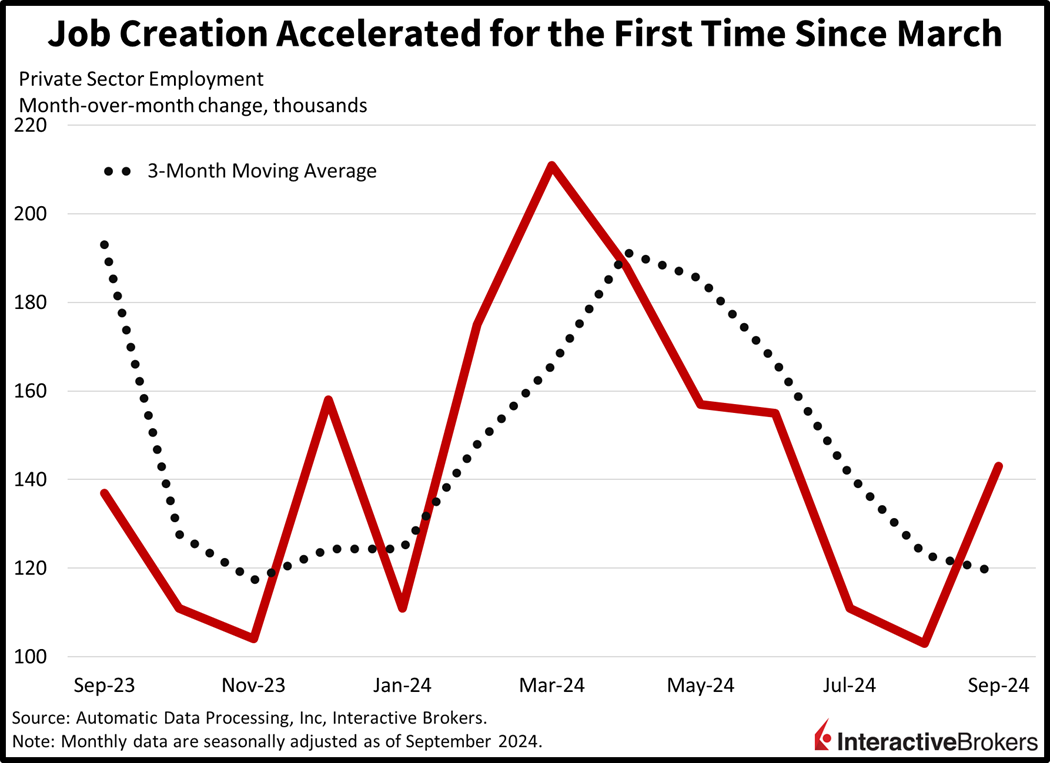

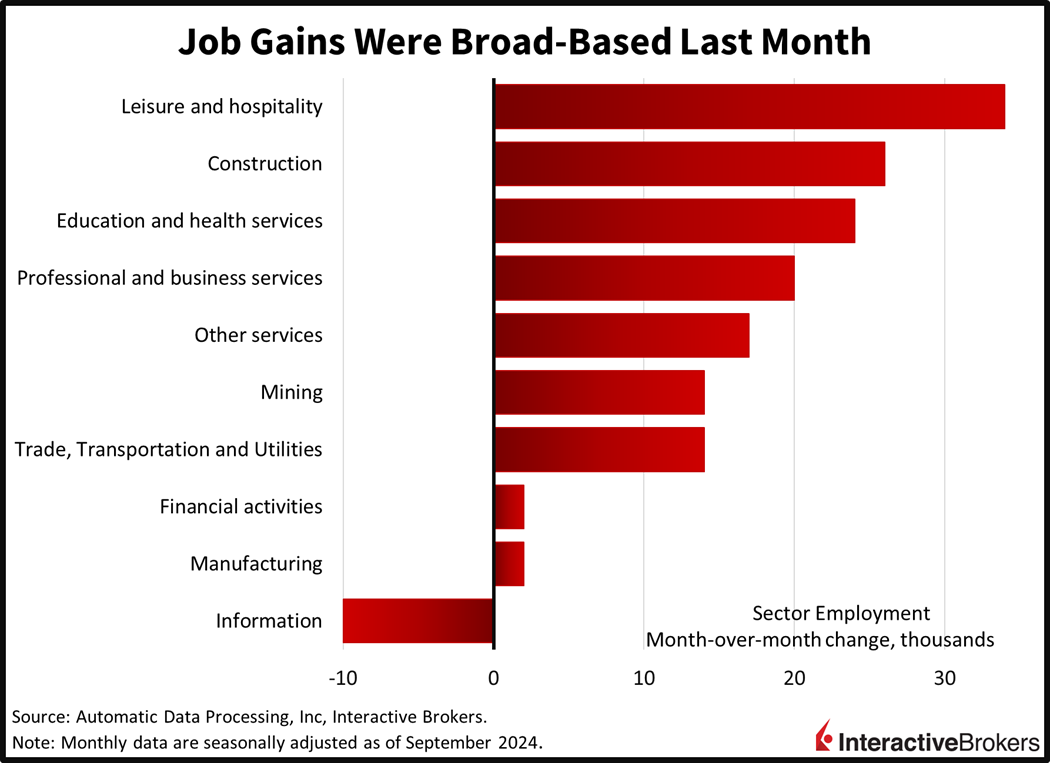

The private sector ramped up its pace of hiring for the first time since March, as payrolls grew by 143,000, the fastest since June. Furthermore, September’s headcount additions came in above estimates of 120,000 and August’s 103,000. Gains were broad-based across sectors, but information was the only industry that trimmed, dropping rosters by 10,000. Leading the headline were leisure/hospitality, construction, education/health services, and professional business services; the components grew payrolls by 34,000, 26,000, 24,000, and 20,000. Contributing to a lesser degree were the other services, mining, trade/transportation/utilities, financial activities, and manufacturing industries.

Small Firms and Wages Less Positive

There were some weaknesses under the hood of the report, however, with smaller operations reducing labor and wage gains decelerating. Indeed, large and mid-sized firms employed an additional 86,000 and 64,000 workers, but small establishments lost 8,000. Moreover, compensation increases for job changers and job stayers slowed from 7.3% and 4.8% year over year to 6.6% and 4.7%, respectively, indicating cooler circumstances.

Investors Scoop the Dip

Markets are mostly positive, but borrowing costs and the greenback are heavier in response to the firm ADP report and weaker safe haven demand relative to yesterday. All major US equity benchmarks are in the green, with the Nasdaq 100, Dow Jones Industrial, S&P 500, and Russell 2000 gaining 0.5%, 0.2%, 0.2% and 0.1%. Sector breadth is mixed, though, with 6 out of 11 industries higher and being led by technology, energy, and industrials which are gaining 1%, 0.4% and 0.1%. Piloting the laggards lower are consumer staples, real estate, and consumer discretionary, which are losing 0.8%, 0.8% and 0.7%. Treasurys are being sold, and the dollar is gaining in response to improving economic prospects, subdued projections for more supersized reductions from the Fed, and “worst is over” geopolitical sentiment. The 2- and 10-year maturities are seeing yields move north by 3 and 6 basis points (bps) and are trading at 3.64% and 3.79%. The Dollar Index is up 39 bps as the greenback appreciates versus most of its counterparts, including the euro, pound sterling, franc, and yen, but it is depreciating relative to the Aussie and Canadian currencies. Commodities are mostly higher with crude oil, copper, silver, lumber up 1.5%, 1.2%, 1.1% and 0.9%, but gold is lower by 0.5%.

Central Banks Are on the Same Page

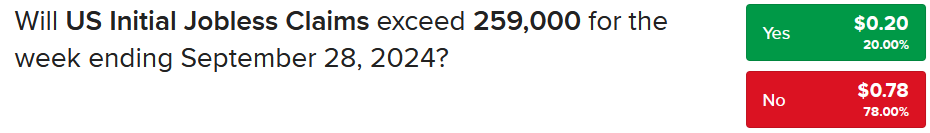

Today’s recovery in stocks is supported by a perspective of “the worst is over” regarding geopolitics, as well as rising momentum concerning central bank easing. We’re seeing continued strength in Chinese stocks in response to aggressive liquidity and credit accommodations. Meanwhile, the new Japanese Prime Minister Shigeru Ishiba, rapidly ditched his monetary policy hawkishness shortly after winning the election. Turning west, European Central Bank members are supporting another step down at the institution’s decision 15 days from today. The euro area certainly needs it, as its economy is teetering on the edge of recession. Another development boosting animal spirits are countless references to the magical 6,000 on the S&P 500, amidst rising sell-side targets for year-end. But in the meantime, we’ll analyze incoming labor market information while hoping that it continues to stiff-arm growth fears. Finally, Wall Street is expecting a figure of 220,000 and 51.7 in tomorrow’s prints for initial unemployment claims and ISM-services (Institute for Supply Management). The IBKR Forecast Trader offers the initial claims contract with a threshold of 259,000, and the under, or the No, is priced at $0.78. A figure beneath 259,000 will yield a 28% return as the winner collects $1.00.

Source: ForecastEx.

To learn more about ForecastEx, view our Traders’ Academy video here

Related: Late Cycle Alert: Monitor Light Switch Spending Trends