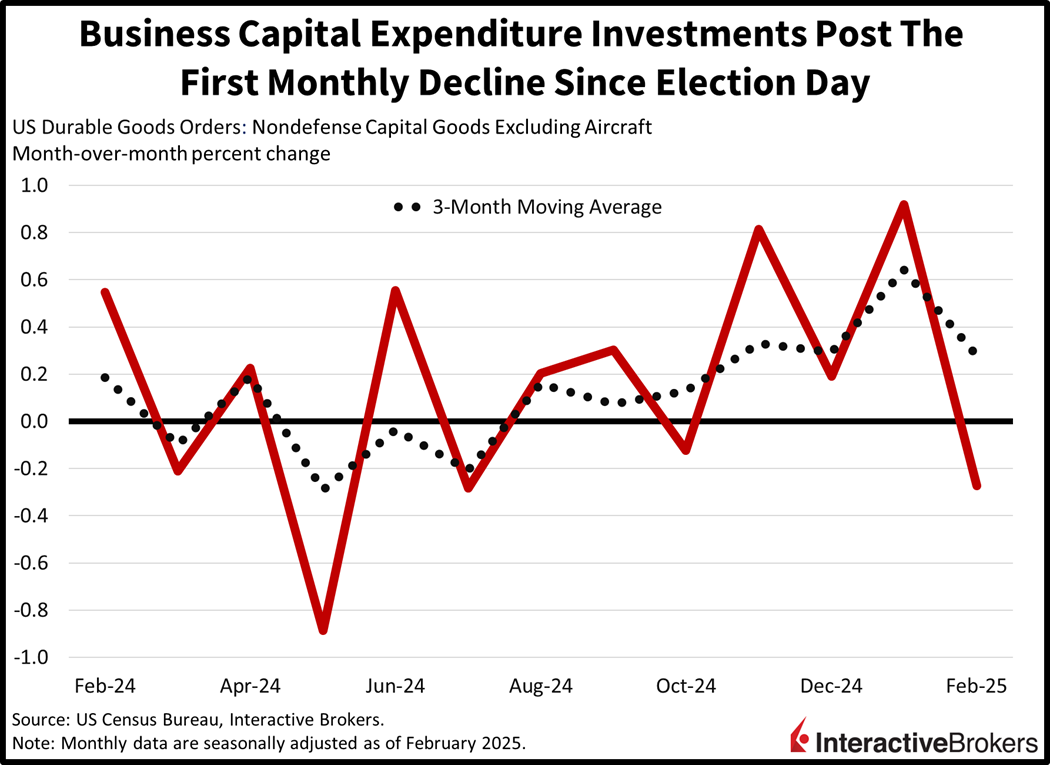

Investors are growing increasingly confused regarding the US tariff policy with just seven sunsets away from April 2, the day in which the White House has scheduled the implementation of wide-ranging levies. The intensity and magnitude of the duties are top of mind for market participants, who are having trouble gaining clarity on the situation. Sometimes President Trump appears merciful on the international front, but last night the Commander in Chief tilted to a tougher stance, expressing limited exceptions concerning trade measures and an intention to place fees on copper imports. In light of the uncertainty, capital expenditures declined for the first time since October last month as businesses adopt a wait-and-see approach ahead of a shifting landscape for global commerce. Against this fickle backdrop, markets are mixed as traders sell tech stocks and Treasurys but scoop up shares in the defensive areas of the equity space while upping their energy, real estate and financial exposures. Also seeing buying interest are IBKR Forecast Contracts as well as crude oil, copper and greenback futures.

Durable Goods Orders Increase

Durable goods orders advanced for the second consecutive month amidst broad-based purchasing activity across most major categories. The headline result rose 0.9% month over month (m/m) in February, easily surpassing the -1% median estimate but decelerating from January’s 3.3% increase. Driving the gains were transactions for defense aircraft, automobiles and electrical equipment, which climbed 9.3%, 4% and 2% m/m. Primary metals, computers and related products, fabricated metal products and the other category registered modest increases. Passenger airplanes, defense capital goods and communications equipment did offset overall progress though, declining 5%, 1.6% and 0.3% during the period. Furthermore, capital goods excluding defense and aircraft, a proxy for business investment, declined for the first time since October, contracting 0.3% m/m. The figure came in below projections of 0.2% and pared back some of the previous month’s sharp 0.9% gain.

Markets Struggle with Cloudy Tea Leaves

Markets are mixed as investors await clues on tariff and tax policy from the White House while analyzing incoming economic data. Most major equity benchmarks are trading lower with the Nasdaq 100, S&P 500 and Russell 2000 gauges down 1%, 0.5% and 0.5% but the Dow Jones Industrial up 0.2%. Sectoral breadth is strongly positive, however, as energy, consumer staples and materials gain 1.2%, 1% and 0.3%. Just 3 out of the 11 major segments are losing. More specifically, technology, consumer discretionary and communication services are 1.4%, 0.8% and 0.2% weaker. Meanwhile, rates and the dollar are rising, with yields across the 2- and 10-year Treasury maturities being offered at 4.02% and 4.35%, 1 and 4 basis points (bps) heavier on the session. The greenback’s index is up 12 bps against the backdrop and the currency is appreciating relative to the euro, pound sterling, franc, yen and yuan but depreciating versus the loonie and Aussie tender. Commodities are varied, with lumber trimming 1.2%, gold and silver near their respective flatlines, but crude oil and copper are higher by 1.4% and 0.4%. Crude oil is benefitting from this morning’s Energy Information Administration report depicting contracting stateside inventories while copper jumps to a fresh all-time high on the back of President Trump’s levy threats on imports of the metal.

Investors Wait for Tariff News

As “Liberation Day” approaches on April 2, investors will be closely awaiting any important updates on potential plans and developments from the Oval Office. And the economic calendar will also offer significant details regarding how the landscape is faring in light of the substantial uncertainty on the horizon. A crucial consideration is that the headwinds of the Trump administration’s policy mix have been front and center since inauguration day, but the probable tailwinds are incoming. As trade confrontations, government spending reductions and immigration restrictiveness weigh on activity in the short-term, there’s a decent chance that those challenges will be overcome by the tailwinds of lower taxation, milder regulations and manufacturing onshoring. In the meantime, however, incremental collaboration across borders can help to cushion the possible blow from what could end up being a major international restructuring.

International Roundup

Industrial Production Declines in Singapore

Singapore’s industrial production declined last month, with demand dropping after exporters frontloaded orders to avoid potential US tariffs. Following climbs of 2.8% m/m and 8% year over year (y/y) in January, activity dropped 7.5% m/m and 1.3% y/y last month and was significantly below the consensus forecasts of -0.3% and 7.5%. Biomedical manufacturing fell 14.3% y/y with the drop led by the category’s pharmaceuticals segment, which tanked 30%. Electronics, with a 6.4% decrease, also contributed to the weak results. Conversely, precision and transportation engineering jumped 16.2% and 16% during the period.

Inflation Eases in Australia

Australia’s Consumer Price Index was flat m/m in February but climbed 2.4% y/y, according to the Australian Bureau of Statistics. Analysts anticipated the y/y result to repeat January’s 2.5% reading.

UK Inflation Reverses Monthly Decline

The UK Consumer Price Index climbed 0.4% m/m in March, reversing from a 0.1% decline in the preceding month and arriving slightly below the consensus expectation of 0.5%. On a y/y basis, the gauge climbed 2.8%, easing from 3% in February and arriving a tenth of a percent lighter than the median estimate. The core CPI, which excludes items with volatile prices such as energy, food, alcohol and tobacco, climbed 0.4% m/m and 3.5% y/y compared to estimates of 0.5% and 3.6%. In February, the core CPI fell 0.4% m/m while climbing 3.7% y/y.

UK Finance Leader Trims Spending Plan

UK British finance minister Rachel Reeves announced additional spending cuts this morning as she looks to offset a fiscal deficit amidst stagnating activity, elevated financing costs and sticky inflation. Reeves blamed a changing world order and rising global uncertainty as reasons for the expenditure reductions. British gilts appreciated following the news, which also included a 2025 GDP downgrade from the UK’s budget watchdog down to 1% from 2%.

Related: Tariff Fears Drive Wholesale Prices to 25-Month Peak