Market participants are screaming “no recession” as they aggressively scoop up stocks following this this week’s strong corporate earnings releases and robust economic data. Walmart’s beat and raise alongside a significant surge on retail sales are indicating that the economic cycle has legs. Furthermore, news that the labor market strengthened in the past two weeks, according to initial and continuing unemployment claims, is propelling confidence that the consumer, despite confronting tough budgetary choices, can continue to power business revenues in the foreseeable future. Yields and the dollar are jumping against this backdrop, however, as sturdy activity does collect its tolls via apprehensive central bankers and taller inflation expectations.

Off in June, but on in July

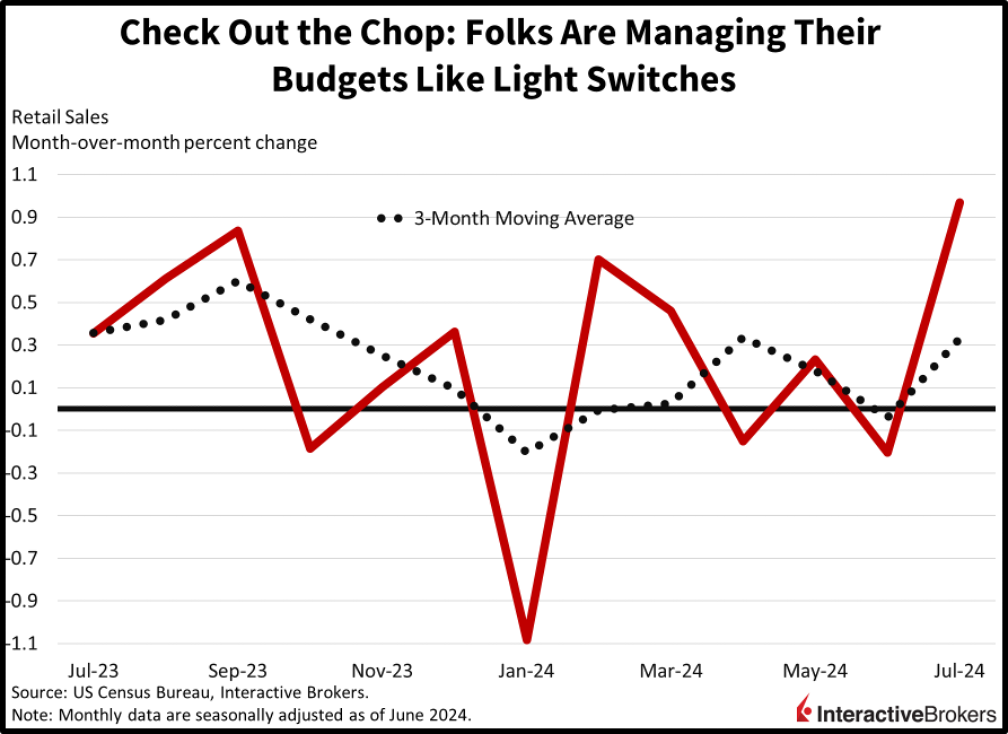

Households have been managing the headwinds caused by towering stickers, airy interest rates and reduced credit availability by transitioning their spending like a light switch. Particularly, they are splurging in certain months while stalling their consumption in others. July definitely proved to be a party: retail sales surged a whopping 1% month over month (m/m), trouncing expectations calling for 0.3% and recovering from June’s 0.2% decline. As we can see, the light switch was on last month but off in June. Results excluding automobiles and gasoline were also favorable, with the adjusted measures without the former and without the two categories both increasing 0.4% during the period.

Shopping pattern strength was broad-based across components, with 10 out of 13 segments reflecting growth. Folks ramped up their spending at car dealerships and mechanic shops, electronics and appliance destinations, building materials and equipment stores, supermarkets, health and personal care retailers, furniture showrooms and general merchandise establishments with the categories seeing transactions increase 3.6%, 1.6%, 0.9%, 0.9%, 0.8%, 0.5% and 0.5% on a m/m basis. Meanwhile, restaurants and drinking parlors, ecommerce and gasoline stations saw revenues increase 0.3%, 0.2% and 0.1%. Consumers did take a break from miscellaneous retailers, sporting goods stores and apparel shops, however, as the fragment’s saw sales slip 2.5%, 0.7% and 0.1%.

Reduced Layoffs Inspire Confidence

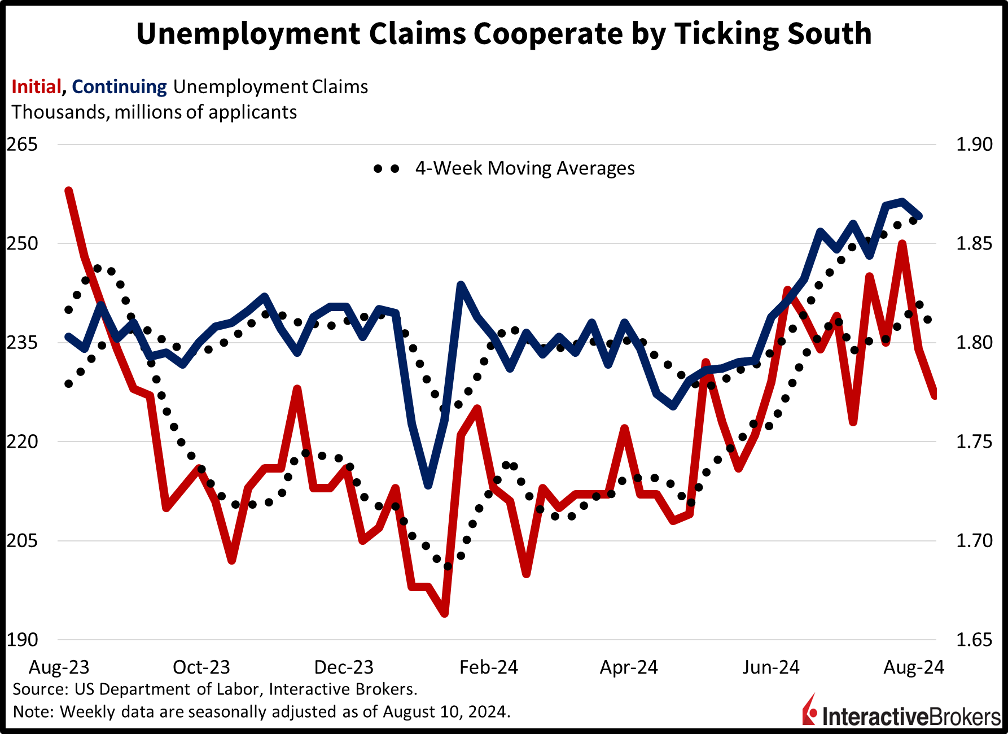

Turning to the labor market, developments were favorable in the past two weeks as corporate layoffs were tempered. Initial unemployment claims fell to 227,000 for the week ended August 10, beneath projections of 235,000 and the prior week’s 234,000. Telling a similar story were continuing claims for the week ended August 3, which declined to 1.864 million, below the median estimate of 1.880 million and the previous period’s 1.871 million. Four-week moving average trends did move in bifurcated fashion though, with initial claims dropping from 241,000 to 236,500 and continuing claims rising from 1.861 million to 1.862 million.

Homebuilders Don’t Share Consumers’ Optimism

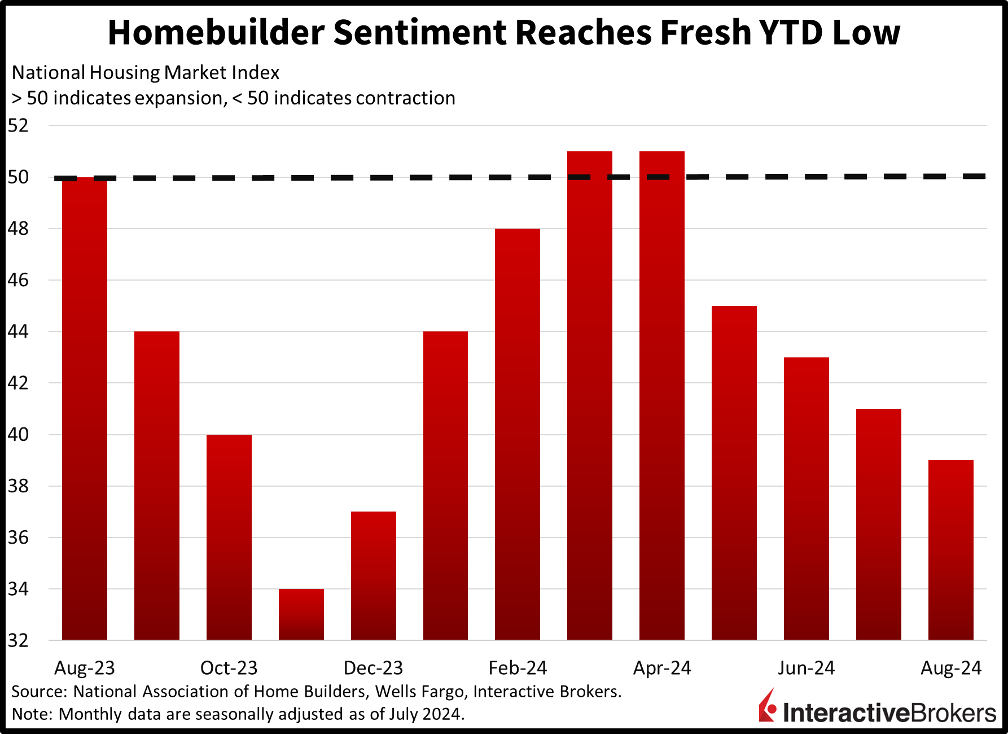

Homebuilder sentiment weakened this month despite construction folks feeling upbeat about transactions in the approaching six months. The NAHB/Wells Fargo Homebuilder Sentiment index dropped to 39 in August, which is disappointing considering that the Street expected an increase to 43 from July’s 41. The single-family sales in the present and prospective buyer components weighed the most, slipping to 44 and 25 from 46 and 27, but the outlook for single-family transactions in the next six months climbed a point from 48 to 49. Finally, no region showed progress this month, with the Northeast and South dropping to 46 and 39 from 47 and 43, while the Midwest and West held steady at 39 and 37. The contraction-expansion threshold is 50.

Walmart Scores and AI Delivers but Ag and Construction Spending Languish

Walmart is continuing to benefit from consumers seeking bargains in response to inflation crimping their budgets, while global spending on construction and agriculture equipment continues to sag. On a positive note, Alibaba says its artificial intelligence services have generated strong revenue growth. Consider the following earnings highlights:

- Walmart (WMT) posted stronger-than-expected results and upgraded its full-year guidance, but it also provided a cautious assessment of US consumers. Additionally, its revised outlook reflects impressive results for the first two quarters of 2024, rather than increased optimism for the company’s next two reporting periods. For the recent quarter, Walmart posted a 5% gain in revenue and said traffic to its stores and website climbed. In another encouraging metric, the average ticket size climbed 0.6% y/y. Despite upgrading its expectations, the revised adjusted earnings per share (EPS) estimate fell short of Wall Street expectations. Chief Financial Officer John David Rainey told CNBC this morning that consumer sentiment could face the headwinds of the 2024 election, unrest in the Middle East and other dynamics. Despite these concerns, Walmart isn’t anticipating a recession. WMT jumped more than 7% following the earnings release this morning.

- Deere & Company’s (DE) results for its fiscal-third quarter ended July 28 exceeded analyst consensus estimates despite net sales and revenue declining 17% and net income dropping 42% y/y. The company expects sales for its full fiscal year to decline as much as 25% and announced plans to cut an undisclosed number of workers, which will eliminate $150 million in expenses as part of reducing costs by $210 million annually. Higher prices for agriculture equipment partially offset the impact of declining sales and global weaknesses across the company’s business lines. Shares of DE climbed approximately 7% in early trading.

- Alibaba missed revenue and earnings predictions for the second quarter, with the company facing increased competition and cautious Chinese consumers. However, artificial intelligence (AI) was a bright spot. Overall revenue climbed in the low single digits y/y while profit fell 29%, as result of weak income from operations and impairment charges. Sales for Taobao and Tmall, which are the company’s China ecommerce segments, dropped 2% despite the total value of merchandise sold on the platforms increasing. Sales for Alibaba’s international ecommerce, however, jumped 32% and its overall cloud computing revenue advanced 6%. On a positive note, artificial intelligence services generated a triple-digit y/y gain, the fastest growth since early 2022. Alibaba shares climbed 4% in morning trading.

Equity Bulls and Rate Bears Party Together

Markets are trading aggressively in both directions as both equity bulls and bond bears join in celebration. Indeed, stocks and fixed-income alike receive non-recessionary data differently, with one side excited that earnings can continue to pull through, while the other worries about price pressure projections and central bank moves. Indeed, investors that focus on profits think very differently than participants that center their attention on yields.

Led by the Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial indices, which are traveling north by 2.6%, 2.1%, 1.4% and 1.1%, all major US equity benchmarks are gaining on the session. Most sectors are higher, with just 2 out of 11 in the red. Piloting the bulls are consumer discretionary, technology, and energy categories, which are sporting increases of 2.9%, 2.5% and 1.4%. Utilities and real estate are the day’s laggards; they’re flying south by 0.2% and 0.1%. Joining the equity bull party are the bond bears, with rates jumping across the curve. The 2- and 10-year Treasury maturities are changing hands at 4.11% and 3.94%, 14 and 10 basis points (bps) north on the session. The dollar is taking its cue from taller yields, with the greenback appreciating relative to the euro, franc, yen, and yuan, but depreciating against the pound sterling and Aussie and Canadian dollars. Commodities are green across the screen in response to favorable demand outlooks. Silver, copper, crude oil, lumber and gold are gaining 3.1%, 2.6%, 1.4%, 0.9% and 0.3%. WTI crude is trading at $78.31 per barrel as bulls look forward to persistent ordering while monitoring the Middle Eastern threat that hasn’t materialized.

Consumer Sentiment and Building Activity on Tap

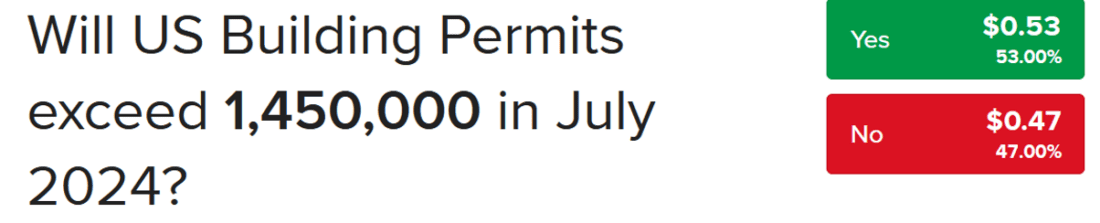

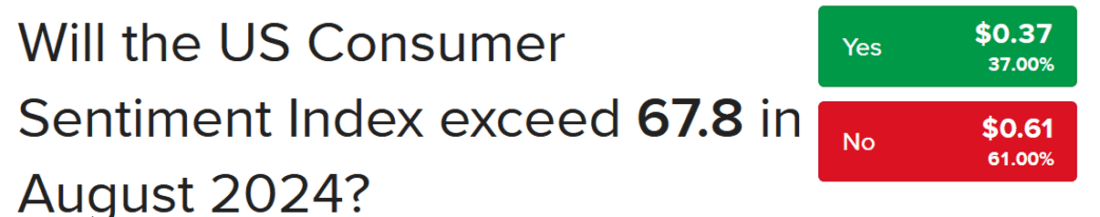

While today’s data provides important insights on the state of the American shopper, the behavior of stateside employers and the sentiment of homebuilders, tomorrow’s economic calendar will provide the Street with even more information. Friday’s agenda includes the pace of construction activity and permits filed last month as well as a better look on how consumers feel this month. The Wall Street consensus for building permits and consumer sentiment stands at 1.43 million seasonally adjusted annualized units and a headline score of 66.9. Meanwhile, our IBKR Forecast Trader is pricing the over, or Yes contract, at $0.53 for permits above 1.45 million. The under, or No contract, is priced at $0.61 for consumer sentiment arriving at/or below 67.8. The highest bids for the underdogs on these two indicators are $0.47 and $0.37. I’m favoring the under on both here, as I’m expecting that builders get more active after the Fed’s first cut and I think consumers are feeling the weight of economic headwinds based on anecdotal data. Good luck!

To learn more about ForecastEx, view our Traders’ Academy video here.

Related: Shelter Costs Accelerate on Slipping Mortgage Rates