Investors are parsing through employment and inflation data while listening to central bankers discuss the path of monetary policy. The main Fed event this afternoon, however, is Chair Powell delivering a presentation at the central bank’s Dallas branch in its eleventh district. Meanwhile, unemployment claims and wholesale prices came in largely as expected, but cost pressures at the consumer and producer stages appear to be gaining modest momentum. Trading action has been quiet amidst declining equity volatility, with stocks, fixed-income and the greenback swinging between gains and losses. And while the stock rally has been ferocious, investors see few reasons to sell prior to the shift in Washington control, which is being viewed widely as positive for risk assets and the economy.

Goods Disinflation Reverses

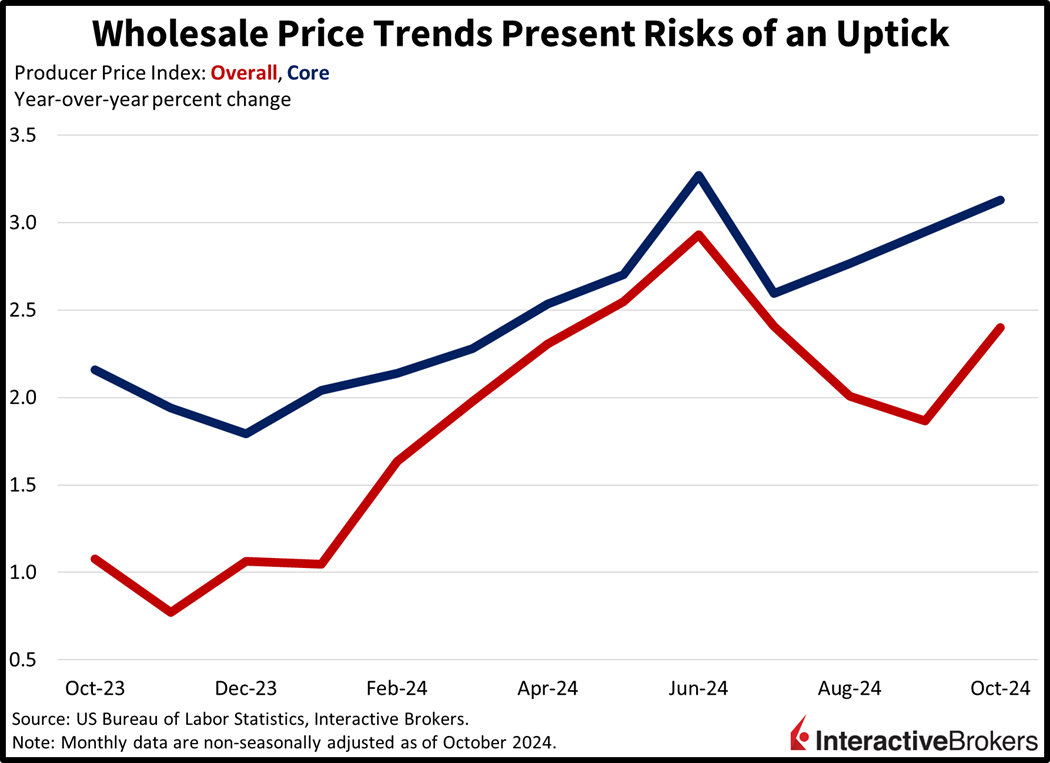

The Producer Price Index (PPI) climbed slightly in October, with goods prices climbing after two months of retreating. The headline number increased 0.2% month over month (m/m) and 2.4% year over year (y/y) compared to September’s readings of 0.1% and 1.9%, respectively. While the m/m rate matched expectations, the y/y figure exceeded the forecast of 2.3%. Meanwhile, the m/m Core PPI, which excludes volatile food and energy, rose 0.3%, in-line with estimates but up from 0.2% in the preceding month. On a y/y basis, the 3.1% figure exceeded September’s rate of 2.9% and the 3.0% anticipated.

Within the headline PPI, overall goods charges increased 0.1% m/m after declining 0.2% and 0.1%, respectively, in September and August. Goods inflation was driven by an 8.4% increase in carbon steel scrap and bigger stickers for meats, diesel fuel and vegetables. The categories of energy and foods, however, fell 0.3% and 0.2%, respectively.

The services industry continued to demonstrate sticky inflation with a 0.3% advance shift compared to increases of 0.2% and 0.4% in September and August. The lion’s share of the change was driven by higher prices in the transportation and warehousing category, which moved north by 0.5%. Other services and trade services increased 0.3% and 0.1%, meanwhile.

Unemployment Claims Ease

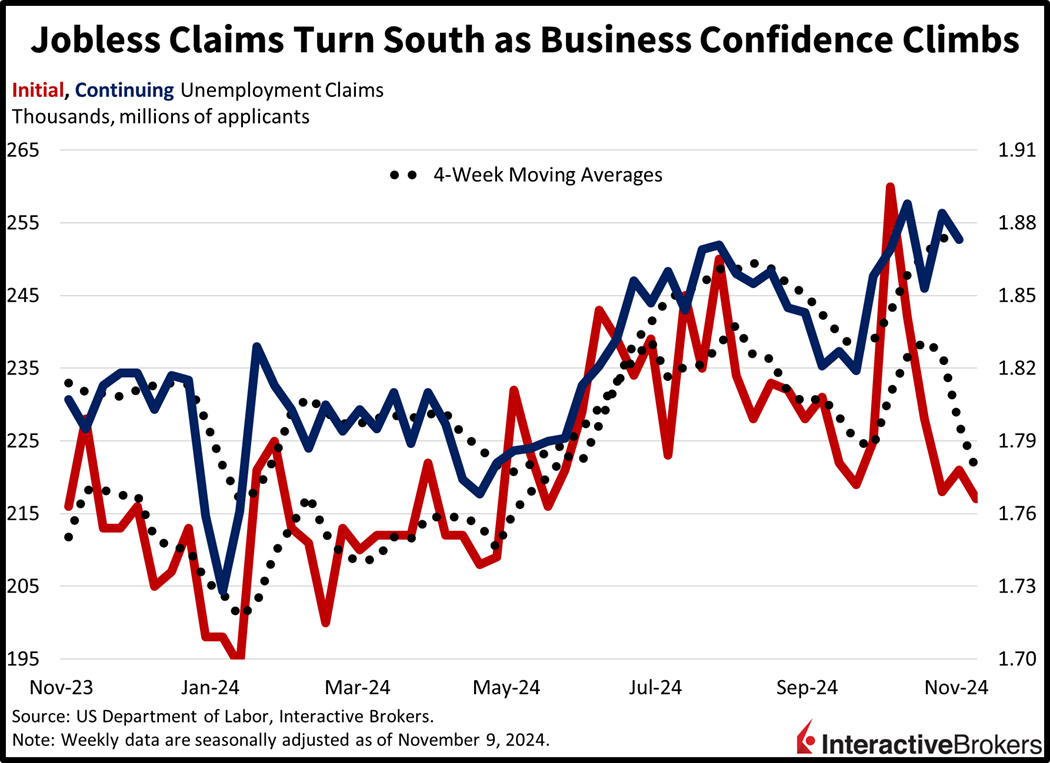

This morning’s unemployment claims report was softer than expected with both initial filings and continuing claims declining from last week’s results and coming in below expectations. Initial unemployment claims during the week ended Nov. 9 fell from 221,000 to 217,000. Analysts expected 223,000. The decrease of 4,000 claims brought the reading to the lowest level since May. Meanwhile, for the week ended Nov. 2, continuing claims fell from 1.884 million to 1.873 million compared to the projection of 1.880 million. Continuing claims represent individuals who are already receiving benefits and provide insight into the ease with which individuals can return to the workplace. On a longer-term basis, the four-week moving averages for initial and continuing benefit requests declined from 227,000 and 1.884 million to 221,000 and 1.874 million, respectively.

In other developments, Boeing (BA) announced it will lay off 17,000 workers due to the company’s financial struggles while Advanced Micro Devices (AMD) has disclosed it will send pink slips to 4% of its workforce, which is believed to equal approximately 1,040 employees. The staff reduction is part of the company realigning its workforce to better compete in the artificial intelligence market.

Rates Take a Breather

Stocks are trading in a narrow range as interest rates across the curve and the greenback pause from their relentless climbs. The Dow Jones Industrial and S&P 500 benchmarks are nearly flat, but the Russell 2000 and Nasdaq 100 indices are losing 0.5% and 0.2%. Sector breadth is split with 5 out of 11 sectors in the green and being led by utilities, energy and consumer staples, which are higher by 0.3%, 0.2% and 0.2%. Weighing on overall performance, on the other hand, are healthcare, materials and consumer discretionary. They are down 0.6%, 0.5% and 0.4%. Bonds are catching bids with the 2- and 10-year maturities changing hands at 4.26% and 4.41%, 3 and 5 basis points lighter on the session. The dollar gauge is unchanged as the US currency appreciates versus the franc, yen, yuan and Aussie and Canadian tenders but depreciates relative to the euro and pound sterling. Commodities are mostly gaining with crude oil, silver, copper and gold gaining 0.9%, 0.6%, 0.3% and 0.2%. Lumber is going the other way by 0.4%.

Next Up: Retail Sales

Tomorrow’s economic calendar is likely to reflect persistent consumer spending with the Commerce Department’s retail sales report due at 8:30 am ET. This time though, the Wall Street and IBKR ForecastTrader expectations are in-line, with both groups expecting a figure near 0.3%. In contrast, yesterday’s commentary highlighted a wide discrepancy between estimates from both sources, which positioned the Yes PPI contract to potentially benefit from the differential. Also tomorrow, we’ll get another look at US manufacturing activity, with industrial production from the Fed out 45 minutes after retail sales. The result is likely to show that the sector continues to suffer from recessionary conditions, as order flow is hampered by elevated prices and heavy rates of financing.

Source: ForecastEx