Investors are booking gains ahead of the new year despite a government shutdown being avoided, with stocks slipping and rates climbing.

The stateside economic calendar hasn’t supported much optimism, with consumer confidence and durable goods orders missing expectations, but the predominant force currently driving markets is the hawkish shift in Fed expectations. While durable goods slipped last month, business investment and new home sales posted gains ahead of the incoming Trump administration as corporations increase capital expenditures against the backdrop of an anticipated mix of lighter taxation, relaxed regulation and an onshoring push. Tilting to global events, Canada’s economy posted an unexpected contraction last month, but Singapore’s inflation figures arrived softer than estimates.

Business Investment Jumps

Durable goods orders fell last month as reduced aircraft purchases hurt results. Transactions slipped 1.1% month over month (m/m), worse than the 0.4% decline projected and the 0.8% growth rate from October. The passenger airplane, defense jet, fabricated metal products and computer and electronic products, and motor vehicle and part categories saw transactions drop 7%, 2.6%, 1.6%, 0.7% and 0.3% during the period. Machinery, primary metals and electric equipment segments countered some of the weakness, as transactions rose 1%, 0.7% and 0.4%, respectively, during the period. Finally, the non-defense, capital goods excluding aircraft segment, a proxy for business investment, posted its sharpest monthly gain in over a year, increasing a sharp 0.7% m/m as businesses push capital expenditure outlays prior to the new administration taking office.

Consumer Confidence Drops Unexpectedly

After jumping considerably in November to 112.8, the Conference Board’s Consumer Confidence Index dropped this month to 104.7. Analysts expected the score to hit 112.9. Among categories, the measurement of sentiment regarding short-term expectations for income, business and labor conditions sank 12.6 points to 81.1 while the gauge of current conditions sentiment fell from 141.4 to 140.2. Among write-in responses, consumers expressed concerns regarding politics and tariffs. In one special question, 46% of respondents expected import levies to raise the cost of living. However, 21% said the trade measures would create US jobs. Regarding the labor market, 37% of respondents said jobs were plentiful and 14.8% said jobs were hard to get.

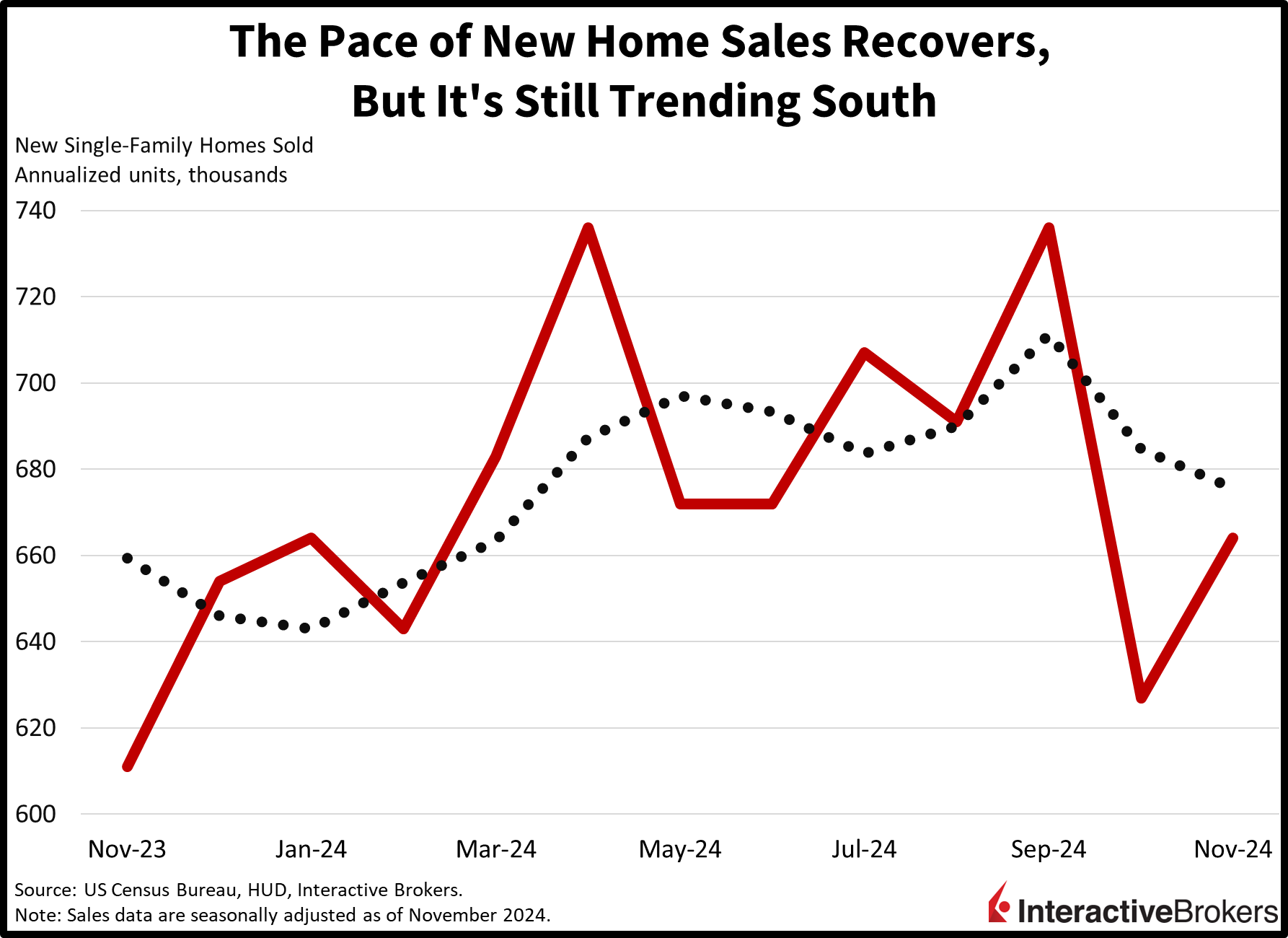

New Homes Sales Climb

After dropping 14.8% in October m/m, new home sales climbed 5.9% last month, with transactions occurring at a seasonally adjusted annualized units (SAAU) rate of 664,000, according to the US Census Bureau. In October, sales hit a pace of 627,000 SAAU. The November number exceeded the analyst expectation of 650,000. Declines of 41.0% and 7.5% in the Northeast and West were offset by transactions jumping 17.3% and 13.9% in the Midwest and South. On a national level, overall results were supported by the median sales price dropping 8% to $402,600. Meanwhile, inventories, as measured by the ratio of new houses for sale to new houses sold, shrank from 9.5 months to 8.9 months.

Canada’s GDP Sinks

Canada’s gross domestic product (GDP) contracted 0.1% m/m in November, the first decline of the year, according to advance data from Statistics Canada. The contraction follows October’s 0.3% expansion, which exceeded the analyst consensus of 0.1% and September’s rate of 0.2%. Sectors that contributed to last month’s disappointing results included natural-resources extraction, transportation and warehousing, and finance and insurance. Conversely, the accommodation and food services group and real estate, rental and leasing activity expanded.

Singapore Inflation Eases

Singapore’s consumer price index for November was flat m/m and up 1.6% y/y, compared to the preceding period’s 1.4% but below the analyst expectation of 1.8%. The core gauge climbed only 1.9% y/y, which fell below the 2.10% expectation, which would have been the same rate as October. The core figure was the lowest number since the November 2021 result of 1.6%.

Markets Soften on Weak Volume

Markets are tilted to the downside amidst low volume trading with stocks, bonds and commodities taking losses while the greenback gains. In equities, the Russell 2000, Dow Jones Industrial and S&P 500 benchmarks are lower by 0.5%, 0.4% and 0.1%, but the Nasdaq 100 Index is higher by 0.2%. Sectoral breadth is deeply negative, however, with 10 out of 11 segments losing, while technology is the only gainer; it’s up 0.4%. Representing the laggards are the consumer staples, materials and real estate categories, which are losing 2.1%, 1.3% and 1.2%. Treasurys are experiencing heavier borrowing costs with the 2- and 10-year maturities changing hands at 4.34% and 4.56%, 2 and 3 basis points (bps) loftier on the session. The Dollar Index is up 26 bps, benefiting from costlier interest rates as the greenback appreciates versus most of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are facing selling pressure with crude oil, copper, gold and lumber down 1.3%, 0.3%, 0.3% and 0.2%, while silver is up 0.4%. WTI is trading at $68.59 per barrel on news that sanctioned Russian supplies are making their way to markets.

CapEx Illustrates Business Optimism

Stronger capital expenditure figures that occurred during the month of election day signal elevated confidence amongst corporate leaders of incoming policies. Businesses may be rushing to expand production capacity ahead of measures that could lead to accelerating consumption, investment and hiring. But a reacceleration in inflation and rising interest rates as a result pose some risk to the economic cycle and asset price appreciation as we move to next year, especially as valuations remain rich. Still, corporate earnings are likely to catch a tailwind in the cyclical, value and small-cap areas of the equity market, because those companies tend to be more domestically oriented and they are the most levered to the benefits of lighter stateside taxation, relaxed regulations and the reshoring of manufacturing activity. I’m expecting profit momentum to be supported by stronger economic growth next year, although risks related to trade and geopolitics may weigh on the outlook.

Related: US Economic Growth Surges as Inauguration Day Looms