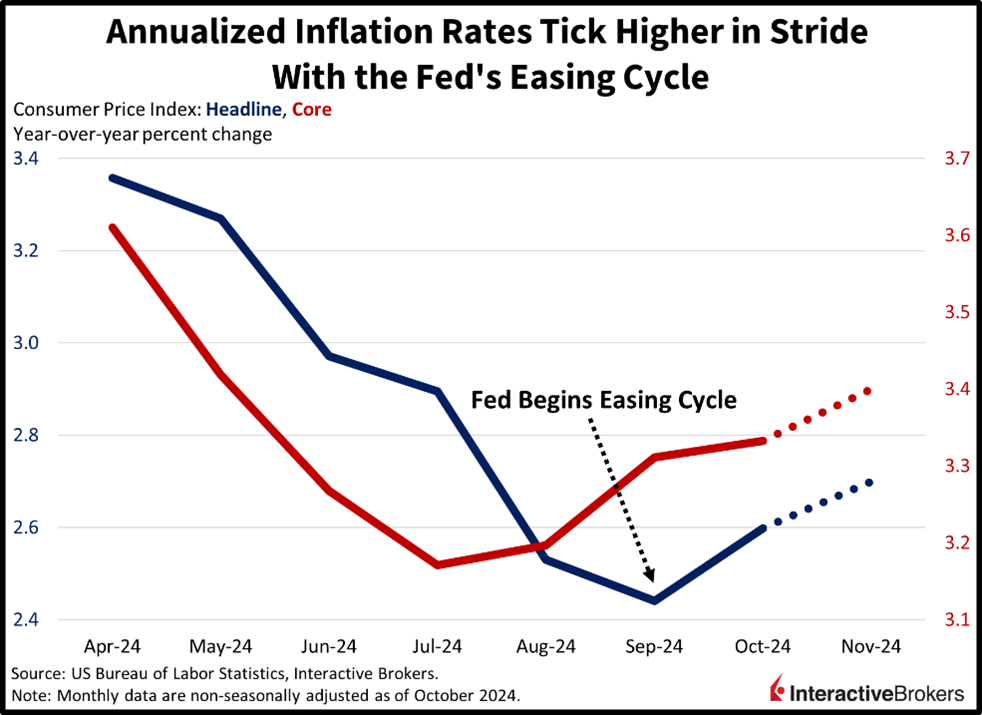

US stocks are stalling near all-time highs as investors await this year’s final CPI report, which is expected to reflect another increase in the annualized headline figure. Indeed, price pressures began to pick up following the Fed’s 50-bp interest rate reduction in September and the outlook into next year is complicated by the incoming administration, whose policy mix includes tariffs, tax relief, lighter regulations and a made in America manufacturing push, proposals that carry the potential to propel costs from both the demand and supply angles. Still, the Fed is expected to trim its key benchmark next Wednesday, following projections that the central banks of the European Union, Canada and Switzerland will cut this week. Against this backdrop, however, the ECB faces the challenge of engineering monetary policy while budget turmoil grabs Paris and Berlin and the continent teeters on the edge of recession. The BoE, meanwhile, is likely to maintain its current rate at its gathering this month, ahead of resumed talks between London and the EU on improving their economic relationship in a post-Brexit world.

ECB Debate Rages

Members of the European Central Bank (ECB) are debating if rate cuts can help thwart a potential recession considering significant structural and geopolitical issues on the continent. Inflation hawks maintain that the region’s economy is hobbled by a lack of business investment, an overreliance on manufacturing, high energy prices, weak demand, aging demographics and a labor shortage. Potential tariffs could be another headwind, with some of Europe’s largest economies, such as Germany, France and the Netherlands, dependent on exporting. Those concerns are countered by policymakers who believe a large reduction could help stimulate growth by reducing interest expenses and propelling consumption and investment as a result.

China’s Exports Decelerate

Shifting east, China’s balance of trade expanded last month, but its exports decelerated meaningfully, a sign of sluggish manufacturing activity ahead of the Trump administration’s return. And while some government leaders from around the world have embraced the former president with a welcome back attitude, officials in Beijing have been preparing early for tit-for-tat actions against Washington, especially after learning the lessons from last time. The Trump overhang looms large in the Far East powerhouse, as protectionist trade policies have and continue to stand in the way of President Xi Jin Ping’s lofty ambitions. Looking under the hood, exports rose 6.7% year over year (y/y), beneath the median estimate of 8.5% and the former month’s 12.7% growth rate. But imports declined 3.9% y/y, also missing expectations of 0.3% and falling faster than the previous period’s 2.3% drop. Meanwhile in Seoul, President Yoon Suk Yeol is in a precarious position following his attempt at martial law, with the opposition determined to oust him amidst the arrest of the nation’s former defense minister.

AI Is a Bright Spot

Oracle (ORCL) revenue and earnings grew 9% and 26% (y/y) but fell short of analyst expectations during its fiscal second quarter. Encouragingly, record-high demand for AI drove a 52% increase in sales for the company’s Oracle Cloud Infrastructure product. Oracle also announced it will provide cloud services for Facebook owner Meta (META), which is developing large language models. However, the company’s guidance was weaker than anticipated and its share price dropped more than 7% last night. MongoDB (MDB), which provides document-based database technology used by application developers, posted a 22% y/y revenue jump that along with adjusted earnings exceeded expectations. MongoDB’s provided upwardly revised full-year guidance that was strong than analyst expectations. In the real estate sector, homebuilder Toll Brothers (TOL) produced a 25% y/y increase in the number of homes it delivered, but the dollar value of its backlog of orders contracted 7%, causing the company’s shares to drop approximately 4% last night. Its recent-quarter earnings and revenue exceeded Wall Street estimates. Auto parts and tool provider AutoZone (AZO), however, posted results that missed expectations. Its comparable US and international sales climbed only 0.3% and 1% compared to estimates of 0.74% and 1.02%, respectively.

Investors Wait and See

Today’s trading features a stronger greenback and taller borrowing costs amidst flat stocks, with investors waiting for an all-clear CPI signal to add risk to portfolios. All major domestic equity benchmarks, including the Russell 2000, Dow Jones Industrial, S&P 500 and Nasdaq 100, are nearly unchanged. Similarly, sector breadth is split, with 6 out of 11 segments gaining on the session and led by communication services, consumer discretionary and energy, which are higher by 1.4%, 0.7% and 0.6%. The laggards, meanwhile, are represented by real estate, materials and utilities, which are lower by 0.9%, 0.7% and 0.7%. Treasurys are getting sold as rate watchers hesitate a bit ahead of tomorrow’s big CPI print. The 2- and 10-year maturities are changing hands at 4.17% and 4.24%, 4 and 3 basis points (bps) heavier on the session. Loftier borrowing costs are assisting the dollar, with its benchmark flying north by 39 bps as the US currency appreciates against the euro, pound sterling, franc, yen and Aussie and Canadian tenders. It is depreciating relative to the yuan though. Commodities are tilted bullishly, with crude oil, gold and silver higher by 1.3%, 1.2% and 0.5% while copper and lumber are flat. WTI crude is trading at $69.01 per barrel as Middle East nervousness bolsters prices.

Markets Brace for CPI

An acceleration of monthly and annualized Consumer Price Index (CPI) figures is being penciled in by Wall Street economists and IBKR ForecastTrader participants alike as a supportive Fed, accommodative fiscal policy, tight labor conditions and buoyant capital markets stoke demand. November’s CPI is expected to jump 0.3% month over month (m/m) and 2.7% y/y, up from 0.2% and 2.6% in October. And while my headline estimate is in-line with the consensus, I am anticipating core to come in at 0.3% m/m and 3.4% y/y, a tenth loftier than the median estimate for the annualized number. Diving into segments, shelter, used and new automobiles, transportation services, medical care, apparel and food are likely to support higher charges while energy costs provide relief. Finally, the Fed will realize after its reduction next week that the neutral rate is closer to 4% rather than 3.5% and is likely to respond with long pauses in monetary policy adjustments next year.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Related: Bitcoin Movement Gains Momentum with Trump’s Atkins Pick