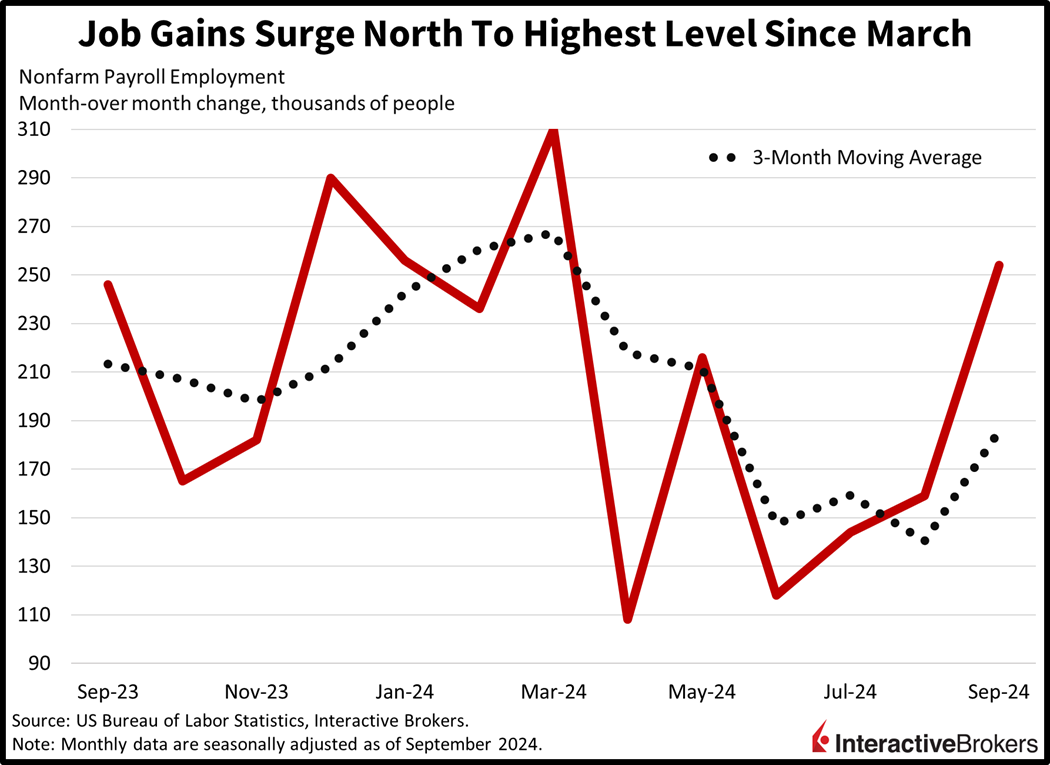

Yields are surging on this Jobs past Friday as the stateside economic calendar delivered yet another fiery data point last week. News that the pace of hiring accelerated for its third consecutive month to the loftiest level since March is sending rates to the nosebleeds, as bond vigilantes sniff out an inflation problem down the road. Wage pressures, the unemployment rate and payroll revisions didn’t offer much sympathy to monetary policy doves either, with compensation increases and joblessness arriving stronger-than-expected, while previously reported job gains were upgraded. Stocks initially surged at the sound of the opening bell in response to dwindling recession concerns, but they have aggressively pared back those earlier advances in light of market participants no longer anticipating another 50-bp reduction from the Fed this year. Furthermore, the long end is yelling that the central bank won’t be able to lower fed funds to 3%, leaving the terminal rate to land 50 to 100 bps higher than current projections.

Jobs Week Finishes Strong

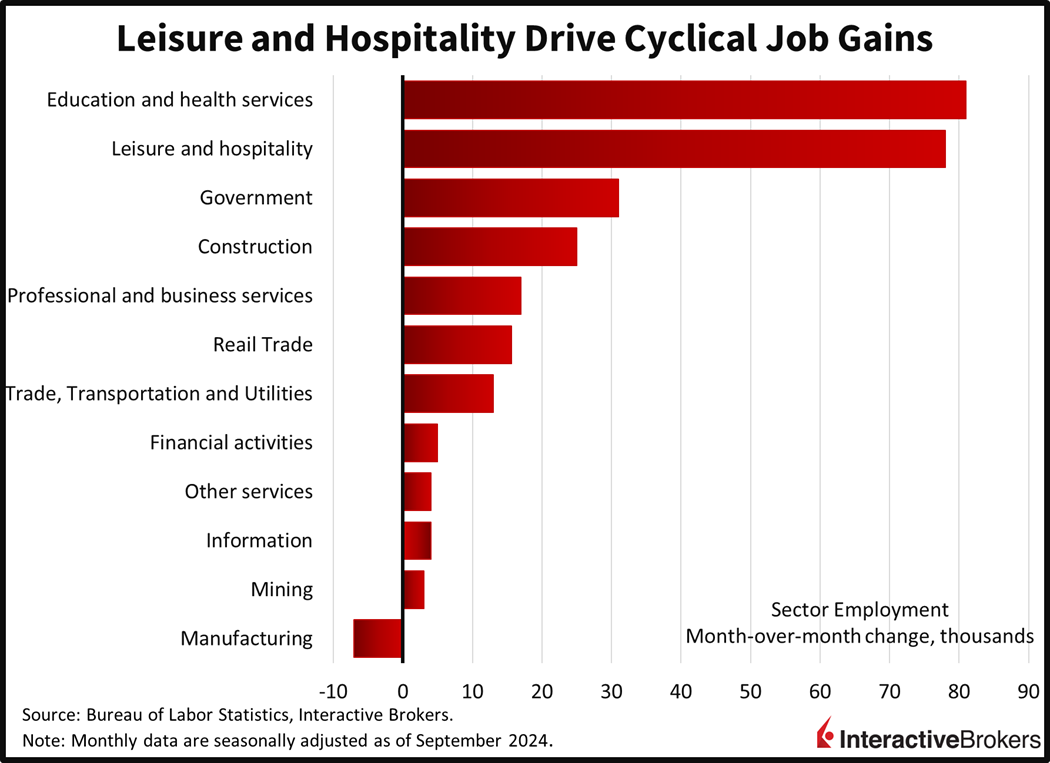

Labor data this week has generally indicated that corporate appetite for workers remained strong last month, with the US economy adding a whopping 254,000 jobs. September’s figure arrived well ahead of the 140,000 median estimate as well as the previous two month’s upwardly revised 159,000 and 144,000. Job growth did offer a non-cyclical tilt though, with education, health services and government comprising about 45% of total gains at 112,000. Amongst the cyclical industries, leisure and hospitality led by a wide margin, adding 78,000, while construction, professional/business services and trade/transportation/utilities expanded by 25,000, 17,000 and 13,000. Meanwhile, financial activities, other services, information and mining contributed modestly with additions below 5,000. Manufacturing was the sole laggard, dropping rosters by 8,000.

Wages Up, Unemployment Down

Wage pressures and subdued unemployment offered additional reasons for optimism and helped to sideline economic slowdown worries. The unemployment rate declined for the second consecutive month to 4.1%, while average hourly earnings decelerated 10 basis points (bps) to 0.4% month over month, stronger by a tenth of a percent on both fronts and in different directions, down because of joblessness but up for compensation. Paycheck increases accelerated on a year over year basis to 4%, much greater than the 3.8% projected and slightly higher than the 3.9% reported in August. Turning to the labor force, it expanded by 150,000, but the participation rate remained steady at 62.7%. The length of the average work week did decline to cycle lows of 34.2 hours, matching January and July.

Inflation Fears Replace Recession Worries

Markets are mixed as recession worries are replaced by inflation concerns, but a suspension of the longshoreman strike on East and Gulf ports is helping to offset some of the anxiety stemming from continued Middle East tensions. Indeed, WTI crude oil traded above $75 per barrel today, its priciest level since August, as commodity watchers are nervous that an Israeli attack on Iranian energy infrastructure could disrupt facilities and lead to a wider-spread conflict. The region is home to roughly a third of the world’s energy inventory. Investors have viewed the turbulent landscape as an opportunity to hedge their books and position in areas of the market that benefit from higher costs for the critical liquid and that happen to carry lighter valuation multiples. Baskets of energy (XLE) and oil services (OIH) stocks have gained strongly in response, with the former up 12% off its September 11 low while the latter has appreciated by 15%. Finally, the posturing is also being helped by value investor folks that think the overall equity market is too expensive at above 21 times forward earnings, with the energy areas trading at sharp discounts from 35%-65% to overall stocks, generally speaking.

Liquidity Conditions Appear Fragile

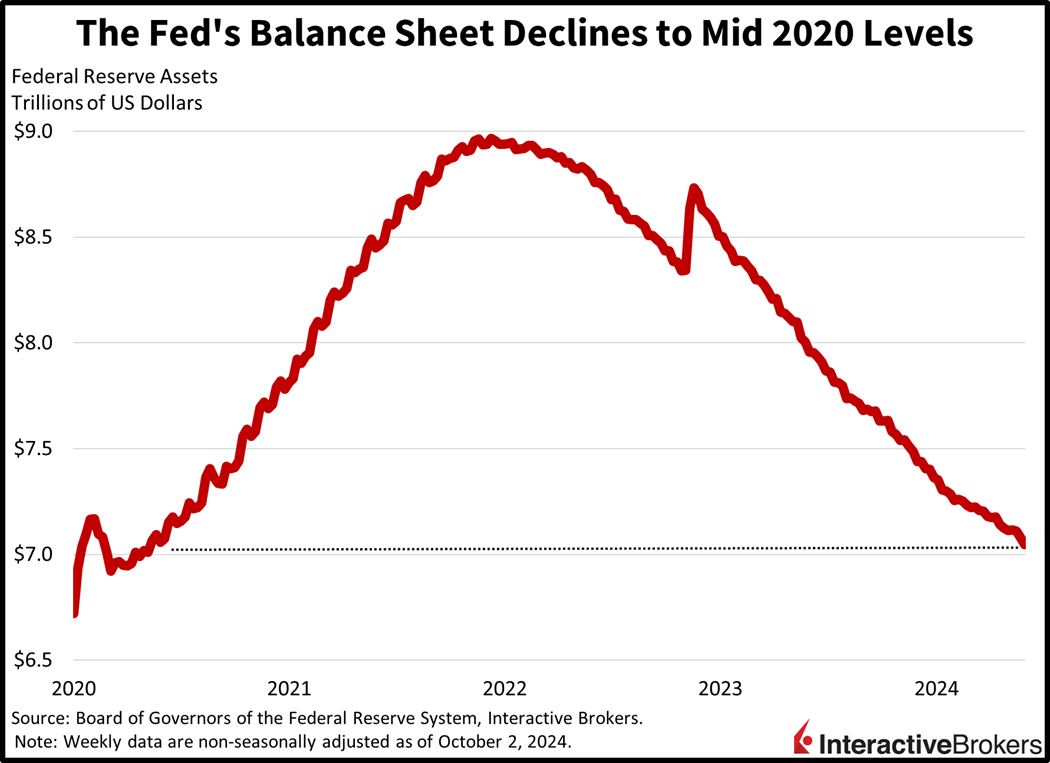

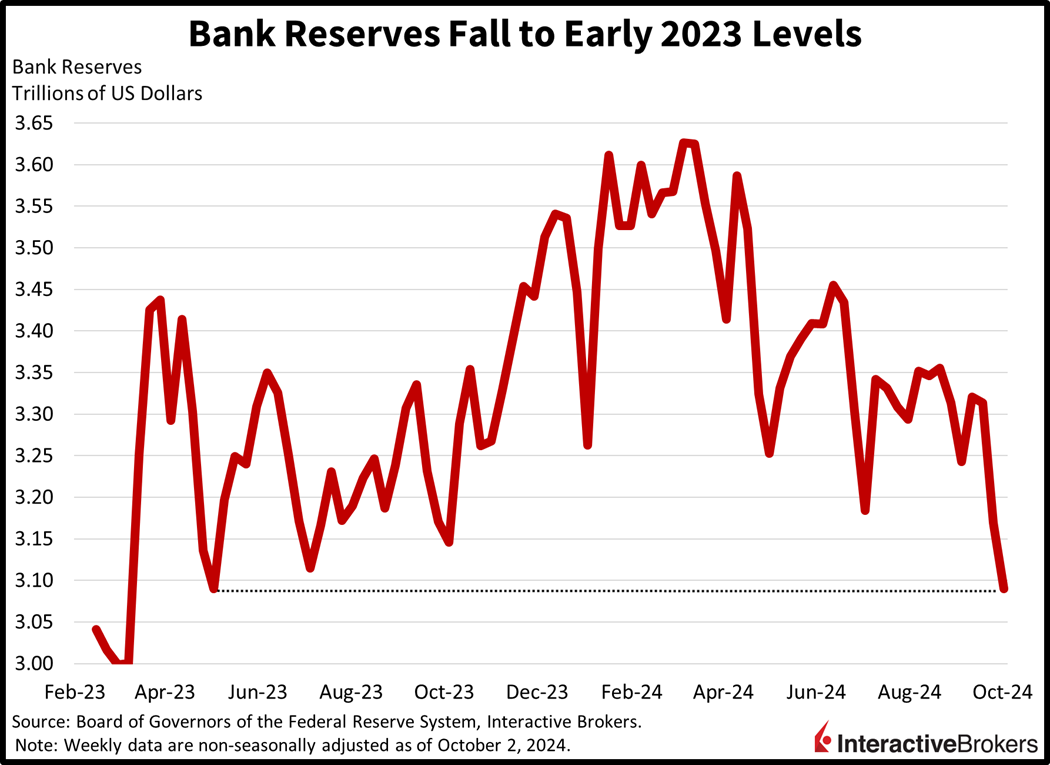

The apprehension has also extended to yields, which are bumping inflation expectations and growth projections due to heightened geopolitical worries as well as robust economic data. The 2- and 10-year Treasury maturities are changing hands at 3.90% and 3.96%, 19 and 11 basis points (bps) heavier on the session. Borrowing costs for both instruments are currently the highest they’ve been since early September for 2s and early August for 10s. An additional source of restraint may be coming from the US central bank, with Federal Reserve data released yesterday reporting the lightest level of Fed assets and bank reserves since May 2020 and March 2023. I have a hunch that the adverse effects of quantitative tightening alongside the long and variable lags of previous rate hikes are coming home to roost, as the US Treasury looks to incrementally replace these faithful lenders with other players. Turning to currencies, soaring borrowing costs and improved relative economic performance is sending the dollar to the nosebleeds as well, with its gauge higher by 67 bps. The greenback is appreciating versus most of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. In stocks, all equity indices are pointing north on the session with the Russell 2000, Nasdaq 100, S&P 500 and Dow Jones Industrial benchmarks up by 0.9%, 0.4%, 0.2% and 0.2%. Sector breadth is positive with 8 out of 11 segments gaining and led by energy, consumer discretionary and technology, which are all up roughly 0.5%. The laggards are comprised of real estate, utilities and healthcare; they’re losing 1.2%, 0.6% and 0.3%.

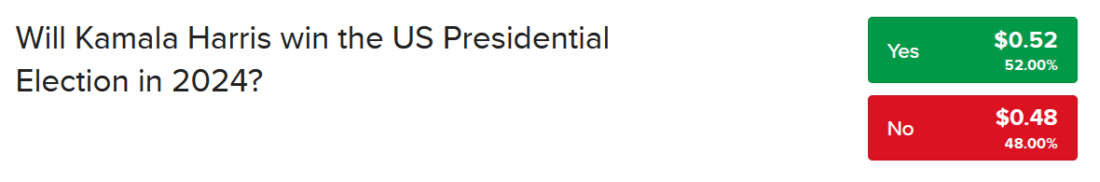

Harris or Trump?

With stocks appearing like they’re going to finish the first week of October in the red despite a week of strong economic data, a favorable materialization for the bulls has been the suspension of the port strike. The truce is welcome as an augmented standoff would have been significantly detrimental to economic conditions. But this market is no stranger to headwinds, especially as it has defied all odds this year. Top of mind today, however, ladies and gentlemen, are risks related to Middle East hostilities as well as the presidential election. Both occurrences certainly carry a wide range of outcomes, with important implications for investors. An exciting development is that the IBKR Forecast Trader, now enables customers to hedge against the outcomes of the 2024 US elections. So far, Vice President Harris is leading former President Trump by a narrow margin as our market participants initiate their positions, but don’t forget that contracts are also available for the House and Senate as well. I’m expecting a turbulent October following a stellar September for markets, with a presidential and senatorial forecast contract offering an alternative investment that is interest bearing up until settlement next month.

Source: ForecastEx