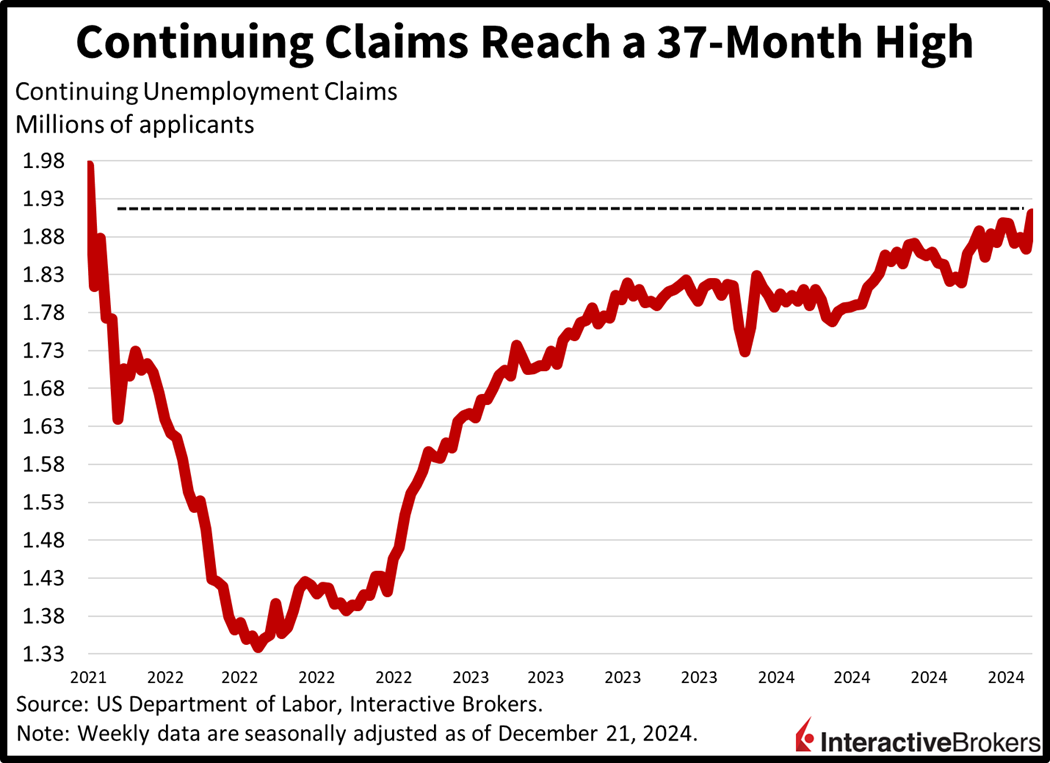

One might have thought that the loftiest level of continuing unemployment claims in over three years would have pushed yields south, but similar to sports and the weather, Wall Street isn’t short on surprises. Rates are jumping in bear-steepening fashion as IBKR ForecastTraders and investors alike begin to consider the possibility of an extended Fed pause. Meanwhile, the long-end is shifting toward a more traditional relationship relative to its shorter-dated counterparts, as market participants factor the impacts of firmer growth expectations, stickier inflation figures and the US’s fiscal imbalance against the backdrop of a $44 billion Treasury auction this afternoon. Turning to the global economic calendar, it’s a quiet day on that front, with just Japanese construction orders and Singaporean industrial production.

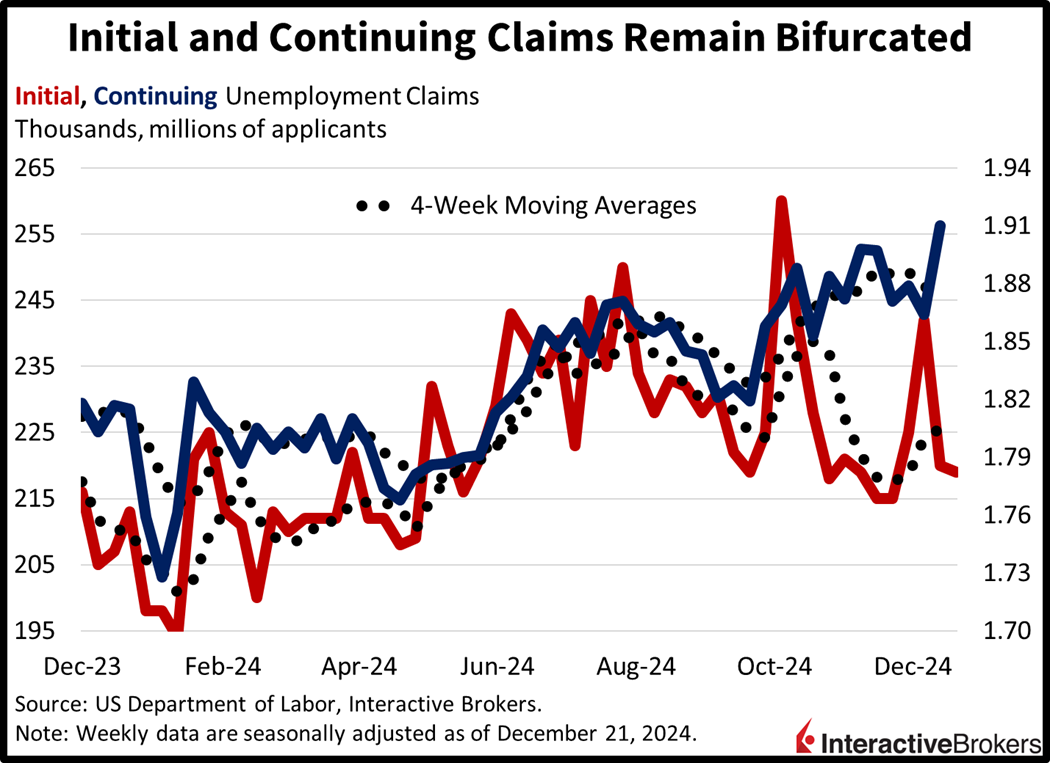

Hiring and Firing Are Muted

The trend of human resource departments focusing on projects other than hiring and firing has continued with moderate numbers of initial requests for unemployment benefits occurring while claims among the already out-of-work population climbing. For the week ended December 21, initial unemployment claims fell from 220,000 to 219,000, signaling that employers are being cautious with distributing pink slips, while continuing claims for the week ended December 14 climbed from 1.864 million to 1.910 million. The latter metric hit the highest level in more than three years, pointing to businesses’ reluctance to add workers. While initial claims were lighter than the expected 223,000, continuing claims exceeded the 1.880 million forecasted by analysts. Four-week moving averages, however, depicted increases in both initial and continuing claims with the numbers increasing from 225,500 and 1.877 million, respectively, to 226,500 and 1.881 million.

Singapore’s Electronics Demand Spikes

Singapore’s electronics manufacturing activities surged in November and pushed the country’s industrial production up 8.5% year over year (y/y), a notable improvement from the 1.2% gain in the preceding month but below the expected 10%. On a y/y basis, the electronics segment strengthened 26% with factories cranking out semiconductors, computer peripherals and data storage, and consumer electronics. Biomedical products, transport engineering, general manufacturing and chemicals, however, weakened. On a seasonally adjusted basis, industrial production sagged 0.4% compared to the 1.2% expansion in October.

Japan Construction Falters

After jumping 44.6% year over year in October, Japan’s construction orders sank 10.2% last month, largely a result of a 41.1% drop in foreign requests for new projects. Weakness wasn’t limited to foreign investors, however, with domestic orders subsiding 8.6%. Demand for civil engineering slid 9.1% while building construction descended 10.6%.

False Signals from Unemployment Data

Investing can often require forecasting economic data and then assessing how investors will react to the data. Today’s unemployment claims illustrate the challenges associated with making both calls accurately. For example, in many instances, investors would perceive high levels of continuing unemployment claims as an indicator that the economy is weakening, which would normally cause yields to decline. But the bar for recession risk is tall at the moment, considering that the business community is optimistic that President Trump’s platform of lighter taxes and regulatory relief will support corporate earnings and economic growth. Today’s data also illustrate the appeal of ForecastTrader contracts. More specifically, IBKR ForecastTraders who make correct forecasts can benefit without having to properly anticipate how markets will react to data.

I wish you are all an enjoyable holiday season. Thank you.

To learn more about ForecastEx, view our Traders’ Academy video here