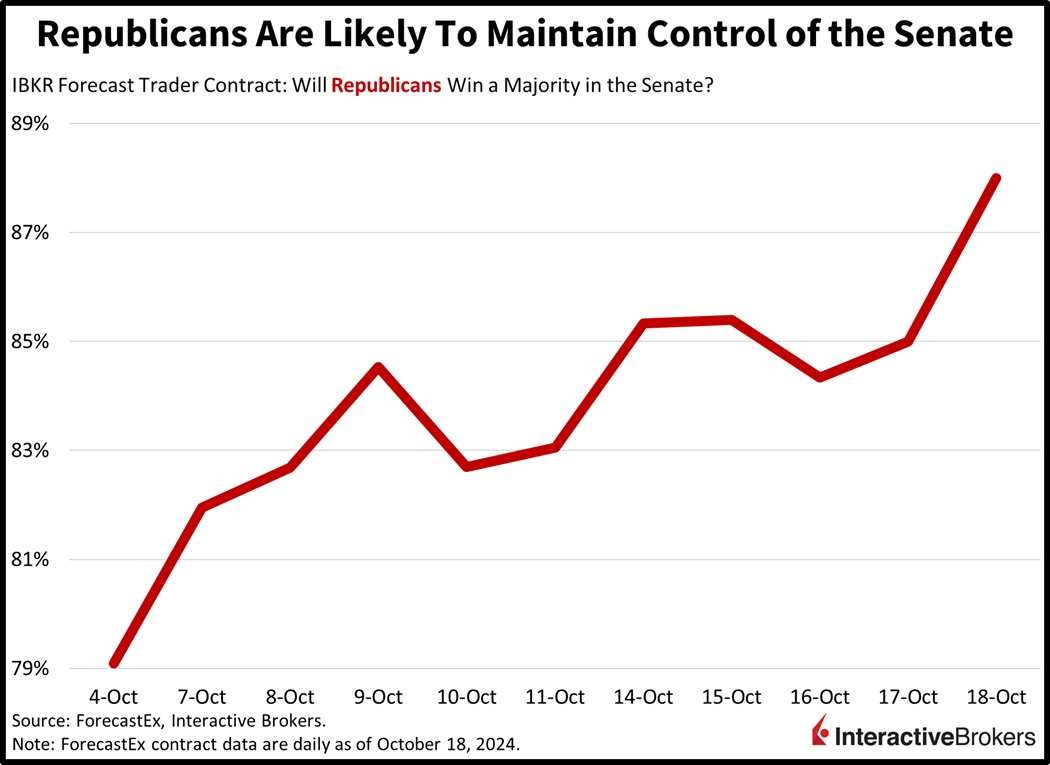

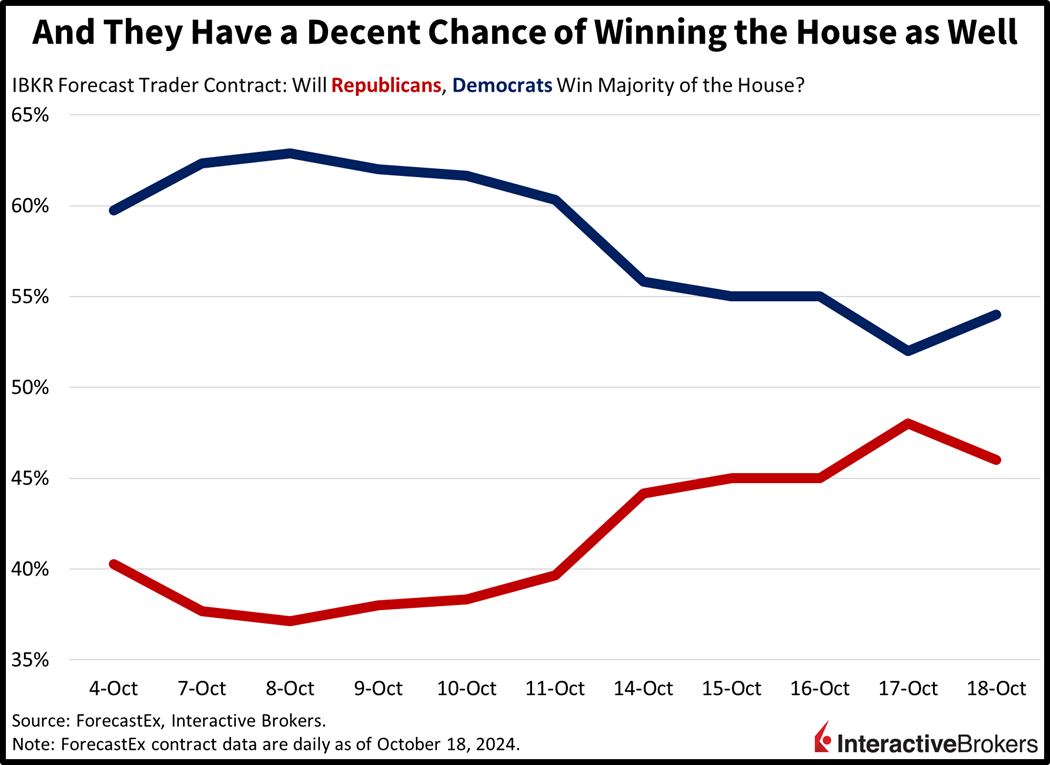

Interest rates and oil prices are drifted south last last week on news of worse-than-expected economic growth out of Beijing amidst continued sluggishness in the stateside real estate sector. But equities aren’t gaining much on this monthly options expiration day, as market participants gear up for elections which are just 17 sunsets away. Forecast contracts, probability data and polls suggest that the GOP is gaining momentum on all fronts, with odds favoring control of the White House and Senate. And while a red sweep seemed out of reach for Republicans a few weeks ago, the path for control of the House is widening as well.

Surprise Jump Weighs on Housing

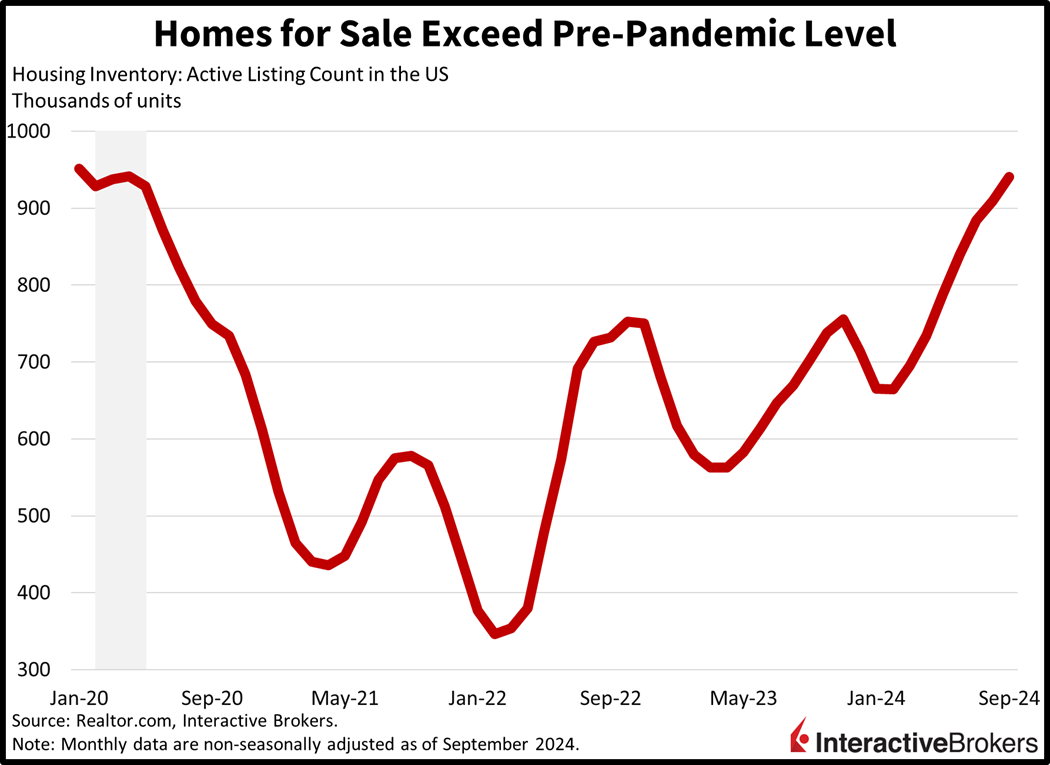

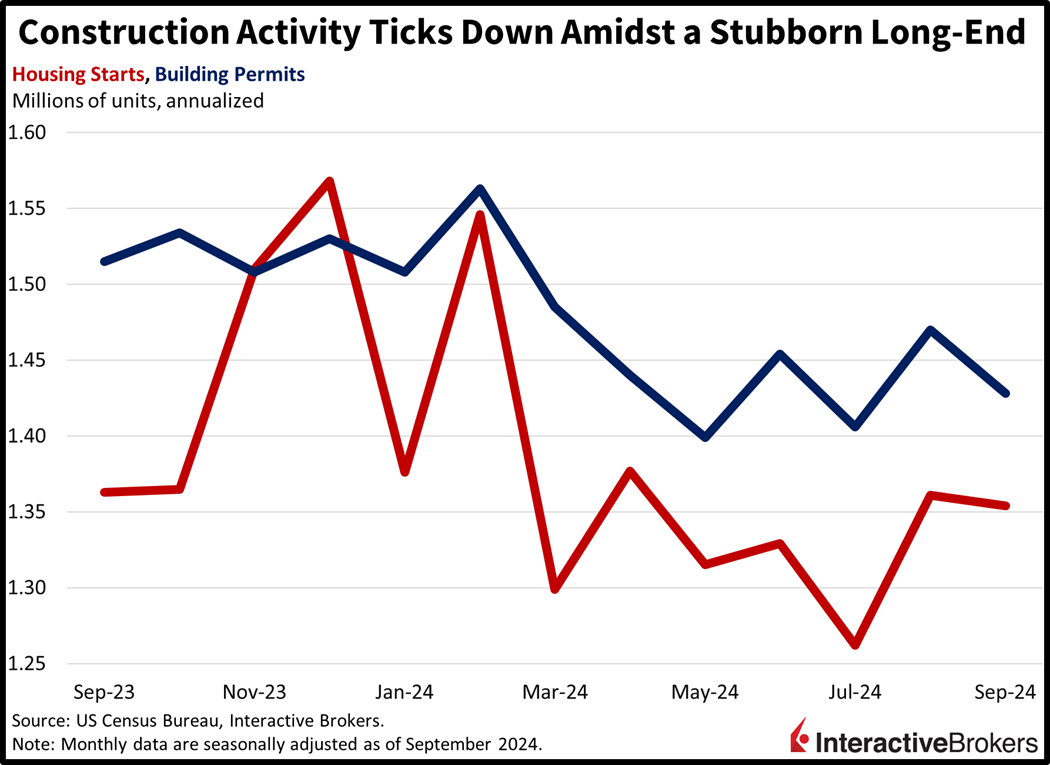

After picking up slightly in August, housing construction weakened last month as the industry continues to languish, a result of record-low home affordability and a surprise jump in long-end yields following the Fed’s 50 basis point (bp) reduction. In addition to high prices, mortgage rates have climbed from a September low near 6% to north of 6.6% today. My contacts in the space have been anxiously calling me, because they expected the central bank’s move to drive transaction volumes, but their computer screens reflected loftier, not lighter, borrowing costs shortly after the Fed’s action. They’re not alone: channel checks reveal automobile dealerships and furniture showrooms are suffering from the same phenomenon. The central bank’s relief plan actually stifled deal flow in these sectors. Furthermore, active real estate listings just exceeded pre-pandemic levels last month and are expected to continue climbing, as prospective seller patience is painfully tested.

Housing Starts and Permits Falter

September housing starts and building permits declined in August to 1.354 million and 1.428 million seasonally adjusted annualized units. Starts exceeded the median estimate of 1.350 million but fell 0.5% from a 1.361 million pace recorded in August. Permits, which are issued before breaking ground, furthermore, missed the estimate of 1.450 million and declined 2.9% from a rate of 1.470 million in the preceding month.

Apartment Buildings, Labor Hampered Results

For single-family projects, starts and permits climbed 2.7% and 0.3% m/m, respectively. Conversely, apartment building starts and permits contracted 4.5% and 10.8%. Among regions, a 57.9% m/m increase in housing starts in the Northeast dampened the impact of declines in the South, West and Midwest of 3.4%, 10.1% and 9.1%. Permits increased 10.9% in the West but fell 13.1%, 2.9% and 6.1% in the Northeast, Midwest and South.

Labor developments are also weighing on activity with a recent survey by Arcoro and the Associated General Contractors of America determining that 94% of contractors are having a hard time filling open positions. The study found that 54% of contractors are experiencing project delays due to workforce shortages. Among other measures to address the issue, contractors are creating training programs and increasing base pay.

China Disappoints

Beijing dished out a disappointing economic growth print this morning with its third-quarter GDP expanding only 4.6%, below the Chinese Communist Party’s 5% target. While the result exceeded the consensus forecast of 4.5%, it fell 0.10% from the previous quarter and was the weakest growth in 18 months. On a positive note, retail sales picked up in September, a result of the country seeking to stimulate its economy with an appliance and goods trade-in program. Fixed-asset investment and industrial production and fixed-asset investment also strengthened but the housing sectored continued to bog down growth. Investors are hoping that stimulus measures boost activity figures, but doubt is prevalent considering the response of Asian markets.

Markets Are Quiet as Investors Gear Up

Markets are quiet heading into the weekend with participants awaiting more earnings reports and additional insight from Washington. For stocks, the Nasdaq 100 and S&P 500 benchmarks are gaining 0.5% and 0.2% while the Dow Jones Industrial and Russell 2000 baskets are losing 0.2% each. Sectoral breadth is green, however, with 10 out of 11 segments higher and led by communication services, materials and utilities; they’re up 0.8%, 0.5% and 0.4%. Energy is the sole loser as crude oil gets punished due to disappointing activity figures out of Beijing and milder geopolitical conditions on a relative basis. Energy equities are lower by 0.4% in response to WTI crude shaving 1.6% off its price to $68.95 per barrel. All other major commodities are higher though, with silver, copper, lumber and gold up 3.3%, 1.2%, 1% and 0.9%. Gold reached a fresh all-time high earlier. The dollar is finally losing steam after a long winning streak in the face of dwindling yields. Indeed, the 2- and 10-year Treasury maturities are being offered at 3.97% and 4.08%, 1 and 2 bps lighter on the session while the greenback’s gauge is down 22 bps. The US currency is depreciating relative to most of its significant counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders.

Possible Volatility Ahead

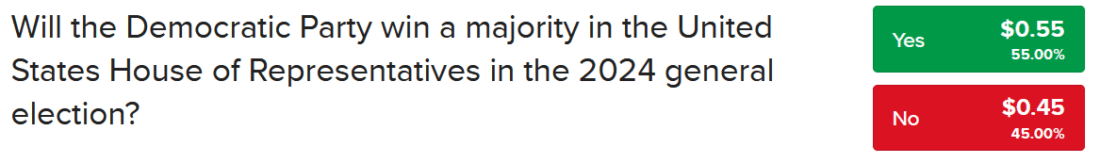

As we close in on election day, there is no shortage of upcoming economic data and central bank speakers. In fact, next week’s domestic calendar features the Conference Board’s leading economic index, unemployment claims, flash PMIs, new and existing home sales, durable goods, the central bank’s beige book and regional surveys and more. We’ll also hear from the Fed’s Logan, Kashkari, Schmid, Harker, Bowman, Hammack and Barkin as well as the ECB’s Lagarde, McCaul, Lane, Cipollone and Buch. Finally, I’m expecting markets to increasingly focus on election outcomes amidst rising turbulence as investors examine strong GOP odds of securing the White House and Senate while the IBKR Forecast Trader carries a 45% probability of the Republicans controlling the House of Representatives. Yields are likely to move higher, while equities pare gains as a result.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here.

Related: Wall Street Gears up for Trump 2.0