Written by: Scott Krauthamer

Investors have parked record piles of cash on the market’s sidelines amid concerns about high valuations and volatility. But short-term safety comes at a price. By clearly defining long-term goals, investors can put idle cash to work with confidence, despite uncertainty about the path to recovery.

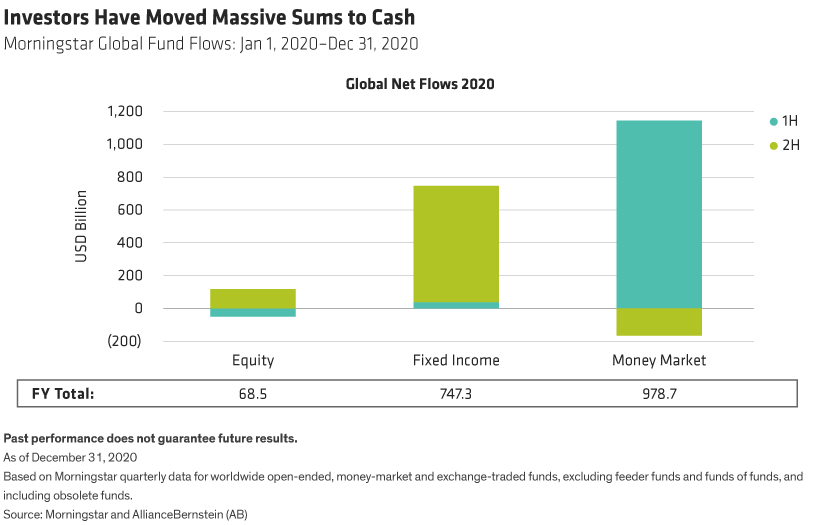

When markets crashed in early 2020, many investors liquidated holdings to cash. Yet during the subsequent rebound, relatively little cash was put back in the market. Net flows to worldwide money-market funds exceeded $978 billion in 2020, the highest in over a decade, outpacing flows to stock and bond funds, according to Morningstar data (Display). Despite some outflows from cash in the second half of the year, total money-market assets increased to a record $6.24 trillion in 2020.

Cash is comforting in uncertain times. It offers a safety cushion against unsettling bouts of volatility, which were common even in last year’s recovery. But cash is returning next to nothing with interest rates at record lows—and negative rates prevailing in many developed markets. So, investors pay a steep opportunity cost for staying out of the market. Meanwhile, the steepening yield curve on US Treasuries in early February 2021 is widely seen as a sign of strengthening economic growth and corporate earnings to come.

High Valuations Don’t Always End in Disaster

For many investors, elevated valuations are an obstacle to deploying cash today—particularly in US stocks, which climbed to new record highs in early February. However, our research suggests that equities have delivered solid returns over time, even for investors who entered the market when stocks looked relatively expensive.

In fact, since 1950, the S&P 500 has been at or near record highs in 43% of all months (Display). And if you invested equal amounts at each market peak, US stocks would have delivered average annual returns of 9.6%. That’s 1.9% lower than the returns generated by investing at each bear market bottom, but a solid outcome over time, in our view.

High valuations don’t always end in disaster. But today’s valuations have been shaped by unusual market trends, adding concerns for investors. Rising price/earnings valuations of US stocks have been driven mostly by a surge in share prices, not by earnings growth. In other words, investors have pushed up share prices in anticipation that a global growth recovery will fuel a rebound in corporate earnings.

That’s a tall order. We believe earnings are unlikely to rise simultaneously across the market, given uncertainties about how countries will emerge from the pandemic, the pace of economic recovery and business challenges in many industries. So, investing in exchange- traded funds (ETFs) to gain passive, low-cost market exposure may not be the best way to redeploy cash to capture recovery potential.

Three Questions to Find the Appropriate Investments

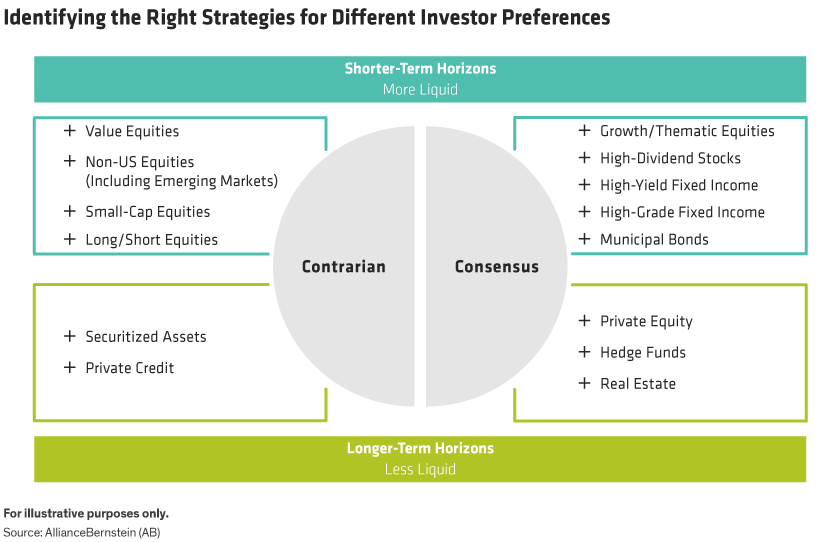

Instead, we think investors should consider a broad array of active options that are suitable for their individual needs, risk appetites and personal views about the markets. Three questions can help frame the right investment options (Display):

- Is your investment horizon longer-term or shorter-term?

- Must your assets be liquid and accessible, or can you tolerate illiquidity?

- Do you prefer consensus opportunities, or are you comfortable investing in unpopular, out-of-favor assets that may offer better valuations?

For shorter time frames, consider liquid equity and fixed-income funds. Investing in growth stocks was especially successful—and popular—in 2020, but this part of the market poses the most acute valuation concerns. High-yield fixed income offers access to an asset class that tends to be uncorrelated with equities and offers better downside risk reduction, as well as higher return potential than the broader bond market.

Investors willing to swim against the tide may consider more contrarian portfolios. For example, underperforming value stocks showed signs of life in late 2020 and may stage a stronger rebound if an economic recovery accelerates. Value stocks trade at a discount to growth that hasn’t been seen since the tech bubble 20 years ago. Stocks outside of the US and small-caps also did well late last year, and they often offer more attractive valuations than US peers.

Investors with longer-term time frames might want to explore illiquid options. These could include private equity portfolios and hedge funds that have become consensus alternative investments in recent years, or they could include contrarian options such as securitized assets or private credit. Each taps a distinct return stream, while locking up funds for an extended period, which avoids volatile market swings associated with traditional investments in public markets.

Better to Be Invested

While a market pullback is likely at some point this year, given the macro environment and all the cash on the sidelines, we think a correction won’t be very deep. Over time, most asset classes are likely to do better than cash, especially at today’s rates. And since it’s nearly impossible to time market inflection points, we think it’s better to be invested in the market rather than not—even in today’s fluid market conditions. With risk-aware, active investing approaches, investors can redeploy cash with conviction to selectively capture diverse sources of return potential, even as concerns about the future remain unresolved.

Related: GameStop Frenzy Reinforces Need for Quality in US Stocks

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.