Written by: Aditya Raghunath

John Koenig coined the term software-as-a-service or SaaS model in March 2005. The emergence of the SaaS model came as more businesses became global. They needed to bring their global workforce, customers, and suppliers on one platform that is agile, flexible, scalable, cost-efficient, user-friendly, and keeps data secure.

A SaaS company hosts its software in the cloud and allows users to access the software on the internet in return for a subscription fee. Users can upgrade or cancel their subscription anytime as per their business requirements.

A SaaS business is any software that helps other companies run more efficiently. Companies are using SaaS applications, mainly for engineering, sales, and business operations. The largest SaaS segments with the highest growth rates are Collaboration, Customer Relationship Management (CRM), and Human Capital Management (HCM).

SaaS market players

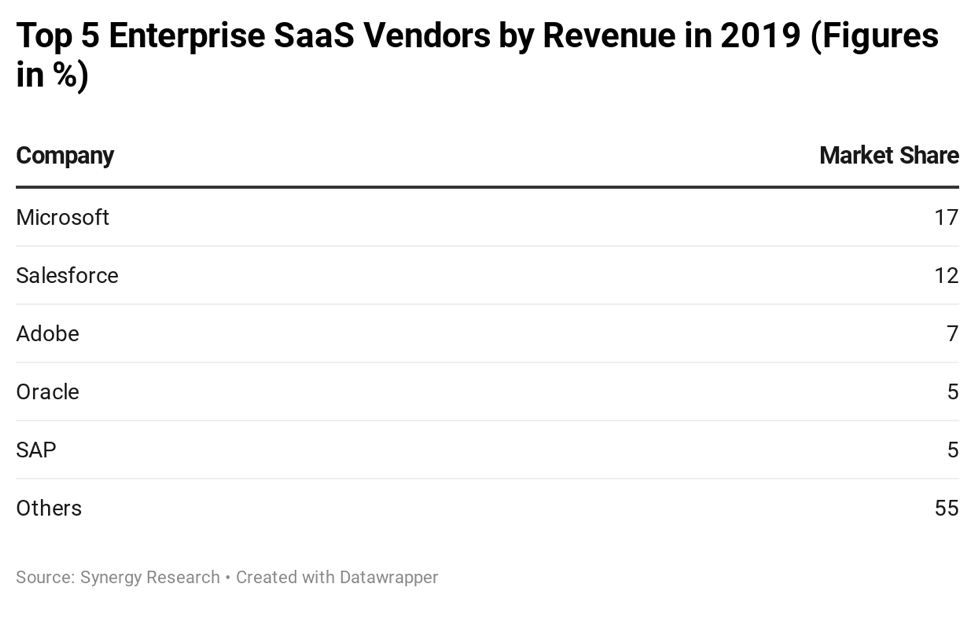

Founded in 1999, Salesforce was the first SaaS company. It helps businesses of all sizes across different verticals make their sales process efficient. Microsoft (NASDAQ: MSFT) is the world’s largest SaaS company, commanding a 17% market share. It helps businesses improve their process and productivity through applications like Dynamics line, LinkedIn, and Office 365.

The SaaS market is made up of three types of companies:

- Traditional enterprise software vendors like Microsoft and Oracle

- Built-on-cloud companies like Zendesk and ServiceNow

- Large IT vendors looking to expand into software like Cisco

SaaS companies are also catering directly to consumers. For instance, Netflix (NASDAQ: NFLX) offers video streaming services, and Shopify (NYSE: SHOP) helps retailers set up e-commerce stores for a subscription fee. Besides the publicly traded companies, around 10,000 private SaaS companies generate less than $3 million in revenue.

Advantages of SaaS model to users

Unlike traditional software, SaaS users do not need to spend a large sum on buying the one-time user license to activate the software. They don’t need expensive IT infrastructure to host the software. Users can access the SaaS software on any computer with stable internet and a strong network. A SaaS model reduces the total cost of owning the software and helps businesses to improve efficiency.

As SaaS platforms are hosted on the cloud infrastructure, the software is scalable, giving users the flexibility in handling workload. For instance, e-commerce platform Shopify enables retailers to handle high online sales volumes during Black Friday. Users can upgrade, downgrade, or end their subscriptions any time, enabling them to adapt to the changing market environment.

Food and grocery shops like Loblaw and Heinz (NASDAQ: KHZ) opened their online stores on Shopify during the COVID-19 lockdown. Moreover, the encrypted data is stored in a centralized location, which protects the data even if the hardware is damaged.

The above advantages are encouraging businesses of all sizes – large, medium, and small – and across different verticals – finance, retail, telecom, media, and healthcare – adopt SaaS. In 2019, 23% of the total enterprise software spending was in SaaS, according to Synergy Research.

How a SaaS company earns money?

While the SaaS business model might generate profits in the long term, it would burn cash in the early stages until it starts recognizing sizeable revenue growth.

A SaaS business model alone is not profitable. As SaaS companies primarily earn revenue from subscription fees, the right pricing structure can maximize customer value and drive growth. Some companies adopt seat-based pricing while some adopt usage-based pricing.

Most SaaS companies’ top growth strategy is customer acquisition, followed by retaining existing customers, upselling, and add-on sales. Many SaaS companies like Atlassian (NASDAQ:TEAM) and Adobe (NASDAQ:ADBE) adopt the freemium model to attract new customers.

Under this model, users are offered a free trial for a few days before committing for a paid plan. Some companies offer discounts on annual pricing plans to retain existing customers. Beyond subscriptions, SaaS companies earn through upsells like premium plans, affiliate programs, and ads.

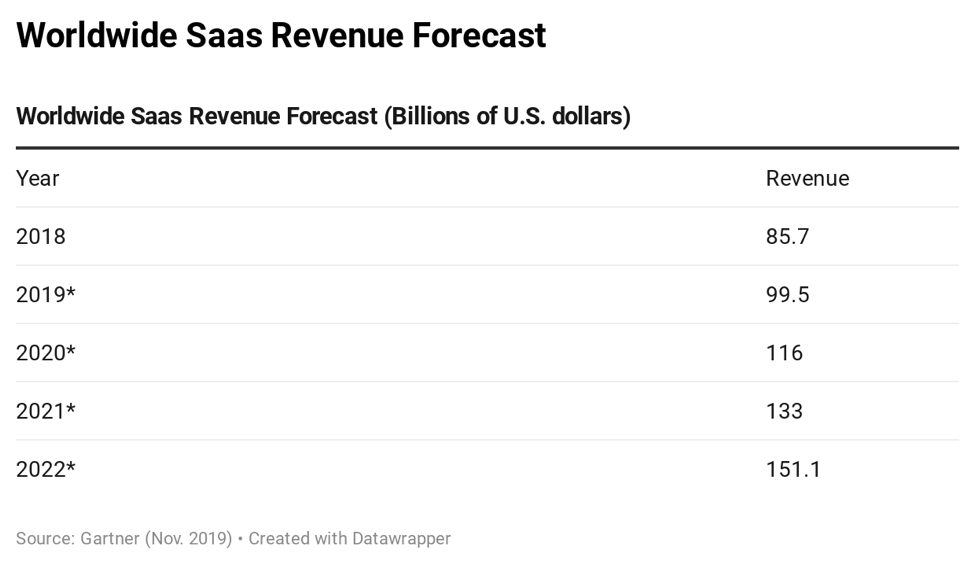

This flexible model has become hugely popular among several businesses and this should drive worldwide growth as seen in the below table.

Advantages of SaaS model to vendors

The advantages of SaaS over licensed software are similar to that of renting an apartment over buying one. In SaaS, a user rents the software on a monthly or annual basis. The software vendor gets recurring income and an opportunity to increase the subscription fees annually and upsell premium packages.

The recurring revenue helps SaaS vendors achieve the break-even point faster than Licensed Software vendors and earn higher profit in the long-term. Licensed software companies like Microsoft and Adobe have moved to subscription models to increase their profits. Subscription sales ensure a steady stream of predictable and recurring income which help companies tide over business cyclicality in an uncertain environment or during an economic downturn.

SaaS companies such as ServiceNow (NYSE: NOW) are benefitting from robust customer retention rates. As enterprises spend heavily on employee training, switching costs among SaaS products remain high which also positively impacts retention rates and drives top-line growth.

An ideal scenario for a SaaS vendor would be more customers subscribing to its premium plans for longer-term and fewer customers cancelling or downgrading their plans. These parameters determine a SaaS company’s ability to generate future revenue. Moreover, the sustainability of a company also depends on its ability to generate higher recurring revenue from lower cost.

Annual recurring revenue is a key metric

ARR (Annual Recurring Revenue) is the most popular parameter to determine a SaaS vendor’s revenue growth. The ARR is high when the company has a high customer retention rate. The Scale Studio looked at over 300 public and private SaaS companies and found that most companies having ARR of $10 million report 80% to 115% revenue growth. The firm noted that a SaaS company growing consistently could increase its ARR from $1 million to $100 million in six to eight years.

SaaStr CEO and founder Jason Lemkin told TechCrunch that almost all publicly-listed SaaS companies have a revenue retention rate of 120%-140%. If companies continue to increase revenue while maintaining their retention rate, over 100 companies can reach $1 billion in ARR over a period of time. In 2019, market leaders Microsoft and Salesforce earned ~$17 billion and $12 billion in annual revenue from their SaaS business.

Revenue Churn

A SaaS company not only wants a higher revenue growth rate but also a lower churn rate. A churn rate measures the percentage of recurring revenue/customers lost due to cancellation or downgrading of subscriptions. The churn rate depends on the SaaS business growth rate. A higher revenue growth rate slows the impact of the churn.

According to SaaS statistics, companies with over $10 million in revenue have an average churn rate of 8.5%, and those below $10 million have a churn rate of 20%. In order to retain its customers and reduce the churn rate, SaaS vendors promote annual subscriptions, offer discounts on longer-term contracts, and provide support services and features.

Cost efficiency

While it is important to acquire new customers and retain them, the cost of doing so also plays a crucial role. Sales efficiency measures the Sales and Marketing effectiveness of a company to generate and retain revenue. The Scale Studio noted that the first $10 million in revenue is crucial for sales efficiency. Beyond $10 million, it is difficult to change the sales efficiency.

For enterprise SaaS vendors, a better measure is CAC (Cost Acquisition per Customer) and LTV (long term value) as they have a consistent deal size and low churn rate. Enterprise SaaS vendors incur high hosting costs and customer support costs. The CAC will result in higher revenue only when customers stay for an extended period.

Operating income

In the early stages, SaaS companies burn cash as they spend on developing the software, sales and marketing, and other administrative costs. Even when the company earns revenue, it incurs hosting costs. A SaaS model benefits from economies of scale, for which it needs faster revenue growth. Slower revenue growth of less than 20% makes it difficult for SaaS companies to meet their expenses.

The Scale Studio noted that on an average, SaaS companies with $10 million in revenue are losing 63% of its revenue in running its business. A company needs a strong cash reserve to fund its operations for a few years until it breaks even.

Several high growth SaaS companies including Okta (NASDAQ: OKTA) and Twilio (NYSE: TWLO) are posting a GAAP loss despite stellar revenue growth over the years.

How to choose the SaaS stock?

The subscription model of the SaaS market has attracted many software vendors and customers. But not all SaaS companies succeed. Many fail during the hyper-growth stage as they cannot control the scaling cost and churn rate, which negatively impacts their ARR and operating income.

A good SaaS business is the one that is reporting stable growth instead of hyper-growth in customers. Stable growth would enable the SaaS vendor to optimize its operations and plan its expenses efficiently.

Investors should also look at the retention rate of customers as that ensures longer recurring revenue for a low customer acquisition cost. The best company is the one with increasing ARR, higher LTV, and lower CAC and churn rate.

As the CAC is high in the early stages, investors value a SaaS business on high growth rather than profits. For instance, Adobe stock is trading at 15 times its sales while Salesforce is trading at 8.3 times its sales.

Why invest in SaaS stocks?

The SaaS revenue rose at an average annual rate of 39% between 2009 and 2019, according to Synergy Research Group. Gartner expects SaaS revenue to reach $150 billion by 2022 from $100 billion in 2019. You can take a look at the performance of software stocks at Finscreener’s dashboard.

The SaaS stocks are highly volatile. Some outperform, and some underperform the S&P 500 market. A good way to get exposure to the overall growth in the SaaS market is through the PowerShares Dynamic Software ETF (AMEX: PSJ), which has more than 65% exposure to software companies. The ETF rose 37% in 2019, outperforming the S&P 500, which rose 30%.

The COVID-19 lockdown is ideal for a SaaS vendor as most businesses and users have shifted to the cloud. A majority of SaaS companies like Zoom and Shopify are trading at their all-time highs. The PSJ rose 14% in 2020, easily surpassing the S&P 500 index, that’s trading in the red.

Related: Why Roku Is the Ultimate Growth Stock?

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.