Written by: David Lebovitz

2022 has seen a volatile start, with many of the growth names that performed well in the initial stages of the pandemic – as well as over the prior cycle – under pressure. The Federal Reserve’s abrupt, hawkish shift at the beginning of the year sparked a sharp move higher in interest rates and rate expectations, in turn leading valuation multiples to compress. As a result, and despite a late quarter bounce, much of the index experienced a meaningful pull back and the Russell 1000 Growth index closed the first quarter down 9%.

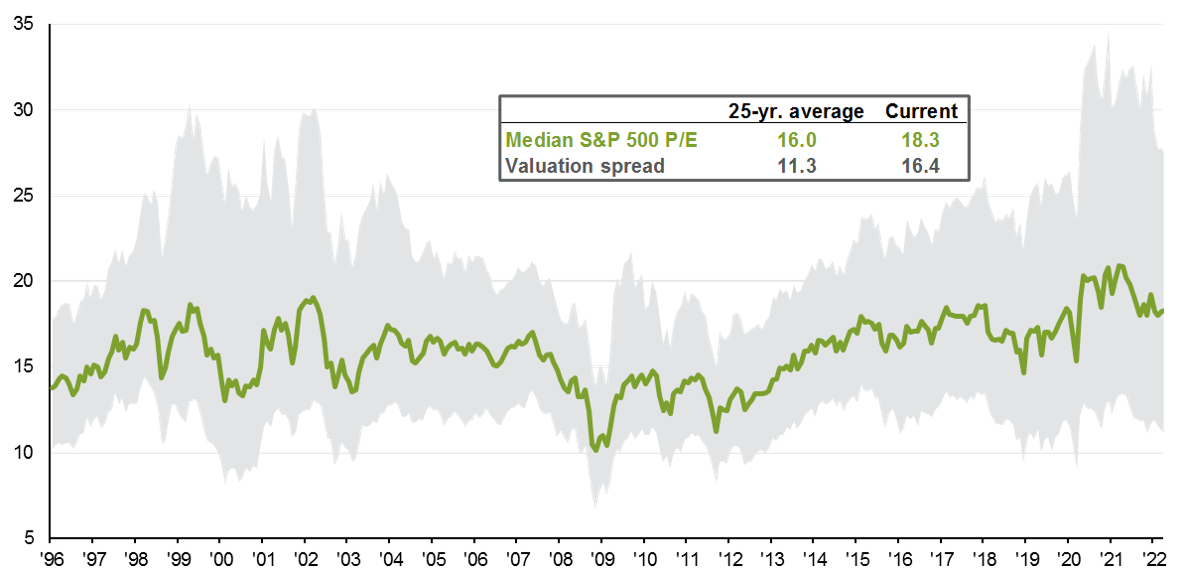

Large, high growth companies were at the center of the storm, as they came into the year looking expensive and carrying high expectations. This was evident in valuation spreads, which rose to historical highs; with rates expected to rise further this year, caution in this part of the market continues to be warranted. Outside of these high-flyers, however, we have seen a significant reset in valuations against a backdrop where fundamentals have largely remained intact. In fact, approximately two-thirds of the companies in the Russell 1000 Growth index have seen consensus sales and earnings estimates maintained or increased for FY2023 and FY2024. With that said, being selective and mindful of position sizing is critical as valuation risk remains.

Furthermore, investing in growth does not mean allocating to a specific group of sectors in a way that resembles the benchmark. Despite what headlines may suggest, the growth universe is far broader than the high-flyers that tend to get the most time in the spotlight. There are plenty of growth companies that will continue to exhibit robust and durable profitability, and those names that look set to exceed expectations are particularly attractive. These companies exist across a variety of sectors including financials, industrials, consumer and, more recently, health care. Importantly, these companies are utilizing technology to enable their next leg of growth.

We have often written about the idea of owning growth and renting value. Ultimately, the long term forces of innovation and structural change are alive, and a dedicated allocation to growth stocks will be necessary to benefit from these trends. However, in a world characterized by a variety of crosscurrents, prudent risk management will remain as a key determinant of investor success.

Valuation dispersion remains near its widest levels on record

Valuation dispersion between the 20th and 80th percentile of S&P 500 stocks

Related:

Sources: Compustat, FactSet, Standard & Poor's, J.P. Morgan Asset Management. Data are as of April 6, 2022.