Written by: New York Life Investments

A Fourth Tailwind Emerges... Wait, What?!?!?!?

Only experience can alert one to a milestone moment in real time. We just observed one in August when Chairman Powell described an evolution to the dual objectives of the Fed - a more “broad-based and inclusive goal” for maximum employment and the flexible use of “average inflation targeting,” which enables monetary policy to “aim to achieve inflation moderately above 2 percent for some time” following periods when inflation has been below that level.

Translation: We will have a near-zero Fed Funds rate for many years.

Implication: Growth stock valuations will remain elevated for many years.

As growth investors, we have a front row seat to the secular forces of deflation caused by the digitization of our economy. Consumer price transparency and the productivity of digital technology are powerful forces to keep costs and prices down. From a cyclical lens, everyone can observe the years of slack in the economy caused by the pandemic by observing current unemployment and factory utilization levels. We are years away from cyclical pressures driving inflation up to the Fed’s threshold and we may never get there because of secular forces keeping it down.

Growth stocks are the biggest winners from a sustained reduction in the risk-free rate, as their discount rate is more impacted by changes in the risk-free rate than a value stock whose discount rate is largely made up of company-specific risk premium. Further, the long duration of growth stocks make them even more sensitive to changes in discount rates in general.

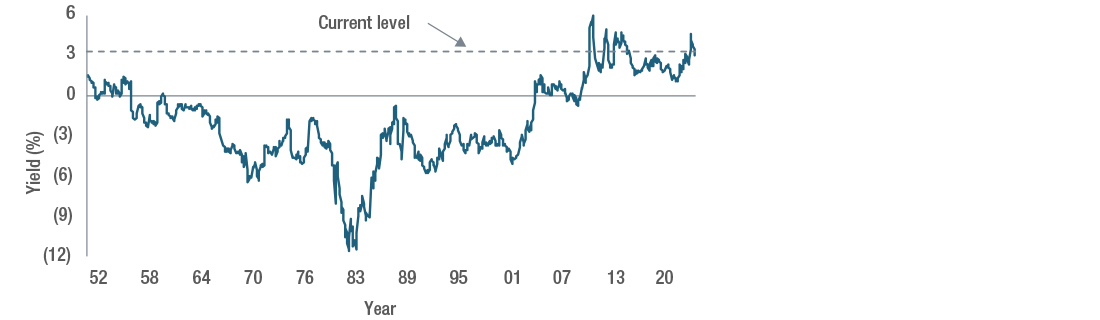

Free Cash Flow Yield Less that of the Ten-Year Treasury Bond

Source: Federal Reserve Board, Corporate Reports, National Bureau of Economic Research, Empirical Research Partners Analysis. Excludes financials, REITs and utilities; capitalization-weighted data. Data as of 9/30/2020 for the period 3/1/1952 (start of available data) to 9/30/2020.

While large cap growth stocks continue to outperform other asset classes, the evidence suggests that they are not yet pricing in the prospect for near-zero rates for many years to come. This margin of safety may explain why the equity market never declines as much as many predict.

We believe a changing perception about sustained low rates will keep growth stock valuations elevated compared to historical levels. However, we do caution that unlike most other the developed economies, the tailwinds the U.S. has from technology leadership and demographics suggest we will again one day exit QE and the Fed Funds rate should reach 1-1.5% at the next peak. We are not so sure about Europe and Japan ever getting out of rates at the zero bound. In the long-term this is US$ bullish.

We have been reluctant to talk about this fourth tailwind to large cap growth stocks because prior to August, we were unclear if the reduction in the risk-free rate would be mostly cyclical. The speech at Jackson Hole changes our view. We now have four very strong tailwinds behind large cap growth that make it a very difficult asset class to beat.

- A substantial growth premium to the average company in a slow growth world

- The digitization of the economy is a net positive to their business

- Substantial free cash flow margin advantage more important in a slow growth world

- Biggest beneficiary of a sustained reduction in the risk-free rate