Next week US automobile giants Ford (NYSE: F) and General Motors (NYSE: GM) are due to report full-year (FY) results as the 2020 earning season kicks into high gear.

A quick look at Finscreener.org's earnings calendar reveals Wall Street's diverging expectations of the outcome. Ford reports first on February 9th before the open, and analysts expect a 4Q20 EPS of negative $0.07 and FY20 EPS of just $0.01. The quarterly figure is a 22% improvement compared to 90-days earlier, and the earnings rating is a "strong buy." General Motors reports the next day, and analysts expect it to report a 4Q20 EPS of positive $1.62 and FY20 EPS of $4.53. The quarterly figure is a 30.6% improvement in analyst expectations from 90-days previous. GM is also rated "strong buy."

Ford is a slightly larger company with the latest 12-month (LTM) revenue of $91.2 billion against GM's $85 billion, but GM's LTM profit (EBITDA) margins at 15.8% are two times better than Ford's at 7.3%. Other measures of financial strength such as total-debt-to-equity are also in GM's favor. This ratio is a measure of a firm's total liabilities to total shareholder equity and is only 2.73x at GM compared to 4.8x at Ford. Worse still for value investors is that Ford's stock looks expensive with a forward PE ratio of 10.6x relative to GM at 8.56x.

One benefit to investors from Ford's lagging performance is the dividend yield, which is a ratio of annual dividends per share to the price per share. Despite Ford's lower total dividend payout of $0.60 per share compared to GM's $1.52 per share, Ford's dividend yield is 5.3% compared to GM's 2.95%.

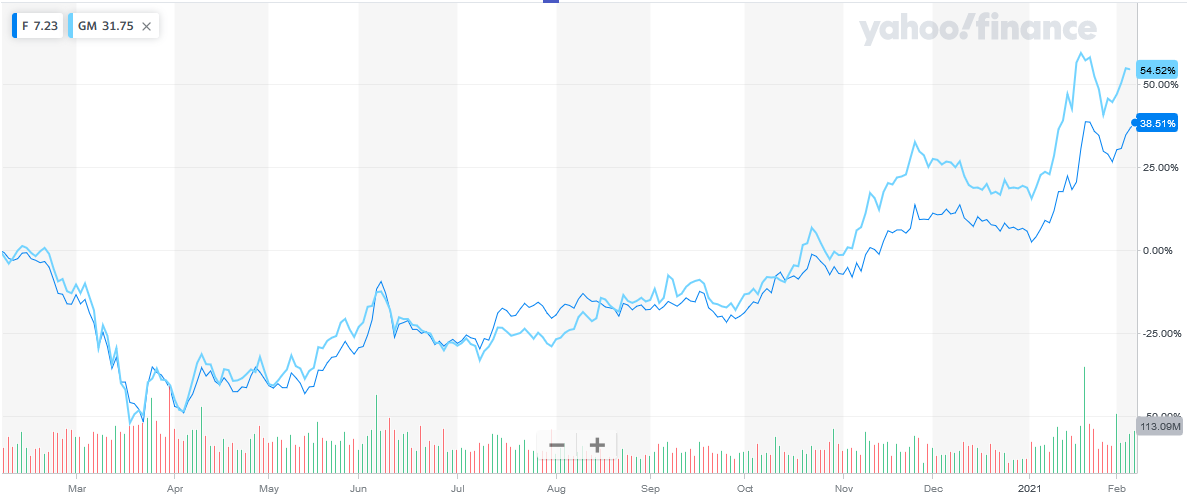

GM's more robust fundamental performance is also reflected in the share price performance over the past 12 months, up 54.52% compared to Ford, which is up 38.51%. There is no doubt that both automakers' share price suffered during the global Covid-19 pandemic reaching a low in 1Q20. Still, GM had outperformed Ford, especially in 4Q20 when price action diverged after crossing back into positive territory, as seen in the chart below.

The big question investors will be asking next week is if GM's stock still has some room to run after this year's impressive performance and if Ford has a credible plan to improve its financial metrics and boost its share price performance. Vehicle electrification is the big trend in the automotive industry, and GM says on its website that it is setting the "foundation for an all-electric future." (For more on electric vehicles see: XPeng: Is This Electric Vehicle Stock a Buy?). Credible plans to put electrification into action will be a significant catalyst for both companies' future earnings growth and cash flow sustainability.

Related: 3 Stocks That Can Double In 2021

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.