Written by: Natalia Gurushina

EM successfully rebuilt their international reserves after the COVID-related loss. Countries with high real rates – like Malaysia – have room for more rate cuts.

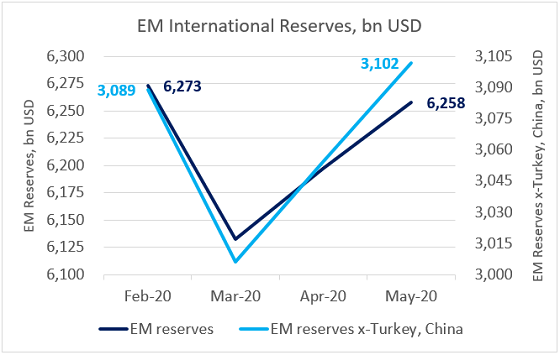

It only took a couple of months for key emerging markets (EM) to rebuild their international reserves after the COVID-related loss (which was not huge to begin with). Outside of Turkey (truly in a class of its own) and China (steady but still opaque), EM reserves now exceed February’s level (see chart below). The reason EMs were able to bounce back so quickly is that most of them learned their lessons and now explicitly target international reserves. Currency “stability” is kind-of important, but many EMs really like the idea of using FX as a shock-absorber, which help to minimize macroeconomic imbalances and improve competitiveness. The fact that both the markets and population consider these policies (largely) credible keeps the FX-inflation pass-through low, which is a big change vs. the old days.

The monetary easing cycle in EM is getting to a close, but we continue to get some “residual” rate cuts here and there. Malaysia just lowered its key rate by 25bps to 1.75%, with dovish bias firmly in place. The reason the central bank can afford to be dovish is that the real policy rate is high (perhaps some DMs should take notice). As regards future easing, the pace of recovery and the government’s fiscal policy would be key factors to keep an eye on.

Alert! We have another upside inflation surprise in EM – this time in the Philippines. Level-wise, the number looks OK (2.5% year-on-year), giving credence to the central bank’s view that pressures should remain contained for the time being (which can translate in another rate cut this summer). However, this is the fourth sizable upside surprise in EM this month (including Turkey, Poland, and Thailand) – and if this trend continues, the EM disinflation narrative can get challenged.

Chart at a Glance: EM Successfully Rebuilding International Reserves After COVID Shock

Source: VanEck Research, Bloomberg LP

Related: Mobile Gaming: Innovation in Action