Most cryptocurrencies have staged a rebound in the first nine weeks of 2023, driving shares of Coinbase (NASDAQ: COIN) higher. In the first two months of 2023, higher crypto prices have allowed COIN stock to gain 66%. But it’s still trading 83% below all-time highs.

Let’s see how Coinbase performed in the December quarter and if it will continue to outpace the broader markets this year.

Coinbase reports results for 2022

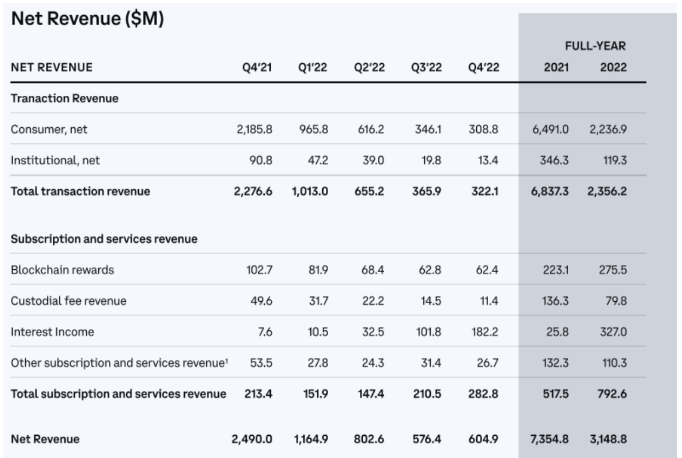

Coinbase, the second largest crypto exchange globally, reported net revenue of $3.14 billion in 2022, a decline of 57% year over year.

Crypto exchanges typically derive a majority of their sales from transaction fees and commissions. In a bull market, rising crypto prices results in higher transaction fees. But when market sentiment turns bearish, trading activity falls off a cliff, lowering overall sales.

So, the performance of Coinbase is closely tied to the prices of digital assets traded on the platform, such as Bitcoin and Ethereum.

In 2021, transaction sales for Coinbase accounted for 93% of total revenue. However, in recent months, the crypto heavyweight has diversified its revenue base, as transaction sales accounted for 74.8% of total revenue in 2022.

Its other business segments include:

Blockchain rewards: These rewards are derived through blockchain protocols that reward users for performing activities on the blockchain, such as participating in proof-of-stake networks. Revenue from blockchain rewards totaled $275.5 million in 2022, compared to $223 million in 2021.

Custody fees: It is based on a percentage of the daily value of crypto assets that are held under custody in cold storage. Here, fees fell to $80 million in 2022 from $136.3 million in 2021.

Interest income: Income earned non-fiat funds under a revenue-sharing agreement with the issuer of USDC. Coinbase also earns interest income on loans issued to customers. Interest income surged to $327 million in 2022 from just $25.8 million in 2021.

Other: This segment includes subscription and services sales primarily from Coinbase Cloud. Here, sales for 2022 stood at $110.3 million, compared to $132.3 million in 2021.

Will this diversification in revenue streams allow Coinbase to stage a comeback in 2023.

What next for COIN stock price and investors?

Last week, Coinbase announced the testnet launch of Base, which is a layer 2 network built on the Ethereum blockchain. Base aims to offer a secure, low-cost network for developers to build decentralized applications or “dapps”.

Base will make it easier to build dapps while providing access to Coinbase’s products, users, and tools. Integrations with Coinbase products will be seamless, enabling developers to serve 110 million verified users with $80 billion in assets under management.

Despite its widening ecosystem, Coinbase reported a net loss of $2.6 billion in 2022, including $694 million in unrealized non-cash crypto asset impairment charges. In Q4, its adjusted EBITDA loss stood at $124 million, while this figure was much higher at $371 million in 2022.

But Coinbase is well-equipped to handle the ongoing macro-environment, which is quite challenging. It ended Q4 with $5.5 billion in $USD resources which includes cash & cash equivalents, USDC, and custodial account overfunding.

Basically, custodial account overfunding represents customer transaction fees that have been paid but are still not transferred into a corporate bank account.

In case you are bullish on the long-term prospects of cryptocurrencies, you should invest in Coinbase stock right now. Valued at a market cap of $15.4 billion, COIN stock is priced at five times trailing sales which is not too expensive.

Coinbase enjoys a leadership position, and its wide economic moat allows it to attract customers from global markets. It's also a company that enjoys high operating leverage, as it reported a net income of $3.6 billion on sales of $7.4 billion in 2021.

Related: Coinbase Stock Beats Wall Street Revenue and Earnings Estimates in Q4