Stocks are soaring following yesterday afternoon’s Fed pivot in which the central bank kicked off its easing cycle with a 50-bp jumbo rate reduction. Fed Chair Powell cited sufficient progress on inflation and a neutral balance of risks between price pressures and unemployment. The super-sized move didn’t come without protest, however, as Fed Governor Bowman dissented, preferring a typical quarter-point cut instead. Furthermore, the long end of the yield curve isn’t happy either, as bond vigilantes sold off duration yesterday and today, resulting in a steeper spread following the recent de-inversion. Meanwhile, today’s economic calendar featured a pause by the Bank of England, lighter-than-expected weekly layoffs and the weakest pace of existing home sales this year.

Powell Rushes to Neutral

Federal Reserve Chair Jerome Powell spoke about recalibrating monetary policy to a more neutral stance, considering that the central bank’s key benchmark yield is at a mid-point of 4.87% while annualized inflation figures are running near 2.5%. Powell discussed that risks are no longer one-sided to stable prices and the institution now needs to equally focus on labor market conditions. Against the backdrop, the group will continue its balance sheet runoff program since its decline hasn’t weighed on ample bank reserves, absorbing liquidity from the reverse repo facility instead. Tilting to the Summary of Economic Projections, the committee sees 2 more 25 basis point (bp) trims by year-end, slower economic growth, decelerating inflation and slightly higher unemployment.

London Pauses Though

Across the Atlantic in London, however, the Bank of England (BoE) decided to leave borrowing costs unchanged. BoE Governor Andrew Bailey referenced elevated services inflation while favoring a gradual approach to easing. Moreover, the institution will continue its pace of quantitative tightening, similar to the Fed, as Bailey alluded to the need to create space, or theoretically purchase some insurance, in case the central bank needs to enact increasingly accommodative practices in the future.

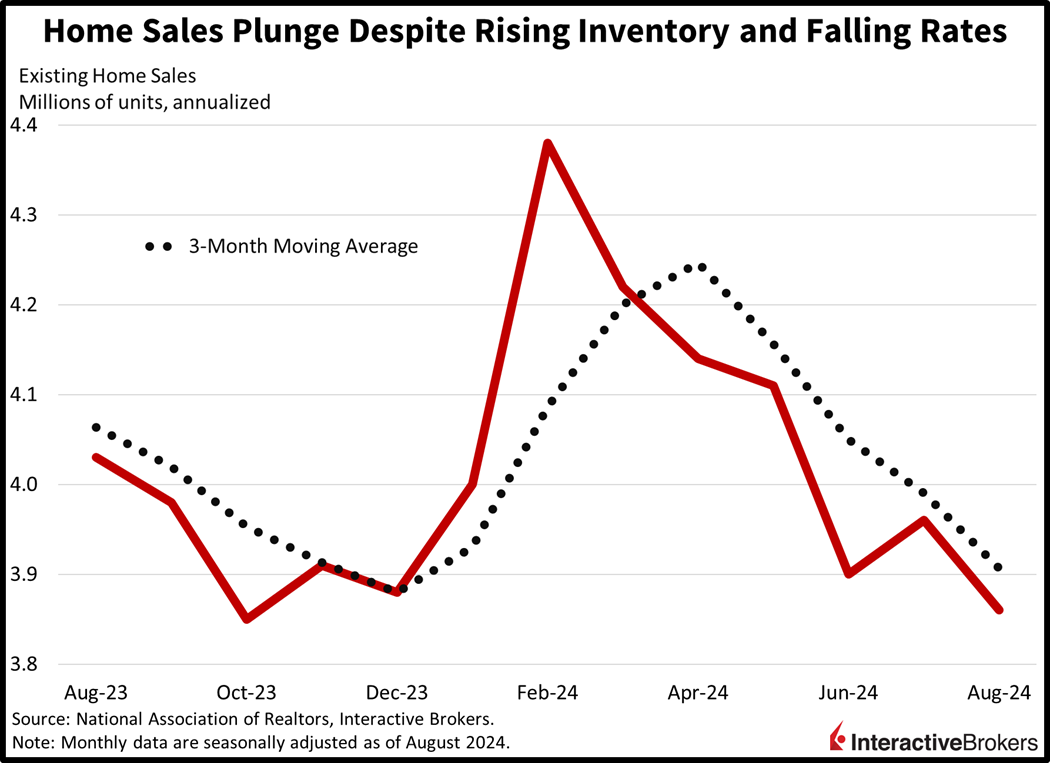

Inventory, Rates Fail to Aid Realtors

Shifting to economic data, the pace of existing home sales fell to their slowest pace of the year even as mortgage rates slipped and inventory grew. Existing home transactions fell 2.5% month over month (m/m) to 3.86 million seasonally adjusted annualized units in August, below the median estimate of 3.9 million as well as July’s 3.96 million. Weakness was broad-based across regions, with the South, West and Northeast declining 3.9%, 2.7% and 2% m/m, while the Midwest remained at the same pace. Single-family closings dropped 2.8% while the condominium and cooperative segment came in unchanged.

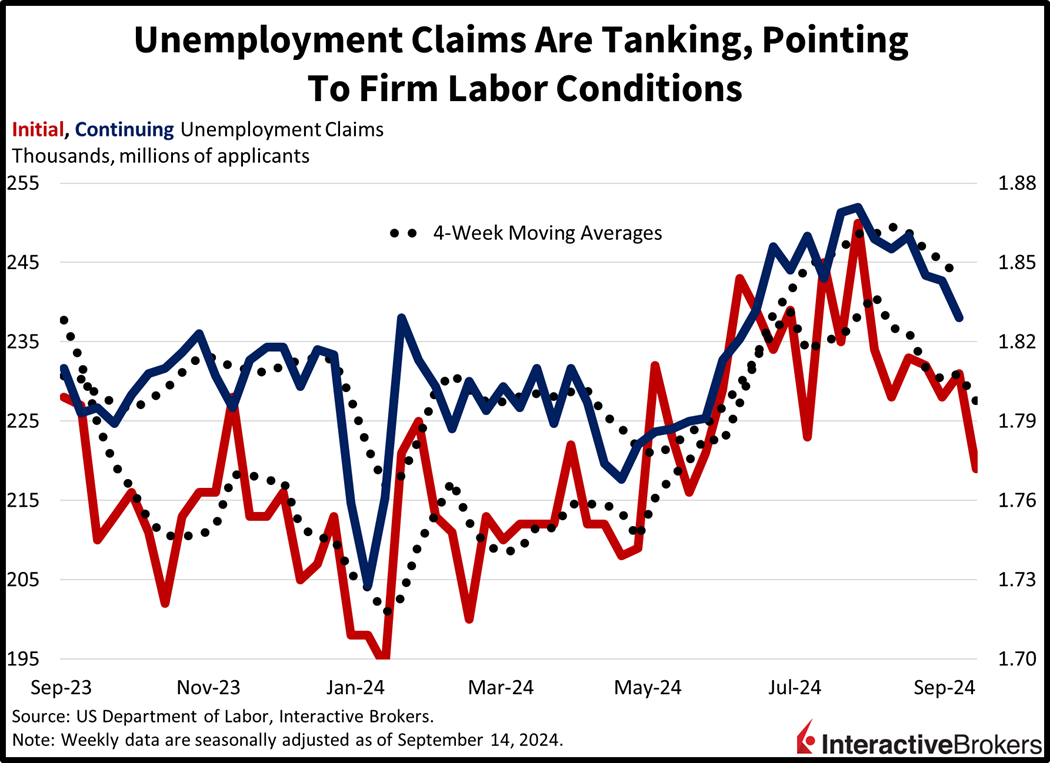

Layoffs Tank as Labor Conditions Firm

Turning to the labor market, unemployment claims have declined over the past two weeks, pointing to continued appetite for labor amongst employers. Initial claims fell to 219,000 during the week ended September 14, beneath both the anticipated 230,000 and the previous period’s 231,000. Telling a similar tale were continuing claims, which declined to 1.829 million for the week completed on September 7, also below projections of 1.850 million as well as the prior interval’s 1.843 million. The 4-week moving average trends ticked south on both fronts from 231,000 and 1.851 million to 227,500 and 1.844 million, respectively.

Stocks Tantalize Bears

Stocks are pumping hard following yesterday’s Fed pivot and intraday reversal in the afternoon. The Dow Jones Industrial and S&P 500 benchmarks have once again reached fresh all-time highs and are up 0.9% and 1.6%. The Russell 2000 and Nasdaq Composite indices remain distant from their trading maximums but are still gaining impressively at 1.5% and 2.6%. Sectoral breadth is positive with 8 out of 11 sectors adding and being led by technology, consumer discretionary and communication services; they’re up 2.8%, 2% and 1.8%. The laggards are made up of utilities, real estate and consumer staples; the groups are losing by 0.9%, 0.5% and 0.5%. Treasuries are mixed across the curve with the short end lighter but the long end heavier. The 2- and 10-year maturities are changing hands at 3.60% and 3.73%, 2 bps of change in both directions. The Dollar Index is near the flatline as the greenback appreciates versus the franc and yen but depreciates against the euro, pound sterling, yuan and Aussie and Canadian dollars. Commodities are bullish across the board on Fed easing signals with silver, crude oil, copper, gold and lumber higher by 2.7%, 2.4%, 1.5%, 0.9% and 0.1%. WTI crude is being offered at $70.65 per barrel as the demand outlook improves on synchronized monetary policy easing while supply prospects are hurt by rising hostilities between Israel and Tehran-backed Hezbollah in Lebanon.

Bearish Reversal Was Short-Lived

Yesterday’s down day was the first in 8, and equity bears felt motivated that the Fed’s first cut meant a regime change in markets, especially considering the sharp reversal following Powell’s retreat from the podium. The bulls had another mantra in mind shortly after though, and that’s “don't fight the Fed”. Since the global financial crisis, the central bank has undoubtedly been a trusted companion for bullish investors, with the institution’s messaging serving to quell volatility in the name of financial stability while generating further upside for asset prices, namely homes, stocks and bonds. The shift doesn’t seem to be going away anytime soon folks, but the tradeoffs are severe, especially considering the other side of the bifurcated consumer that struggles to achieve homeownership and humbly dollar cost averages into values that extend further and further. Asset price inflation is a critical societal problem that is especially crushing the younger generations, but that’s not something on the radar of monetary and fiscal authorities.

Think They’re Cutting Again?

Finally, the Fed is likely to reduce rates again in November, and the No IBKR Forecast Contract which expresses this view is priced at $0.77 at the moment. The instrument provides what I consider to be attractive odds, since a hold is not priced into the fed funds futures curve at all. If the central bank cuts, the $0.77, become $1.00 plus the interest accumulated during the 7-week period, adding up to a 31% return.