Markets are breathing a sigh of relief on the back of mixed retail earnings and better-than-feared downward revisions to nonfarm payrolls. In fact, news that employment was adjusted lower by 818,000 rather than one million for the 12 months ended March 2024 is hampering recession worries. Against this backdrop, yesterday’s equity losses broke an eight-day winning streak following a powerful V-shaped recovery from the Japanese-yen induced 10% equity correction. Still, morning trading has been bumpy, and an afternoon reversal engineered by the bears cannot yet be ruled out.

Off-Price Retailers Ride Wave of Bargain Hunters

Discount retailers are continuing to benefit from budget-conscious consumers seeking bargains, while at least one large retailer has reported weakness among affluent customers. Meanwhile, lower financing costs, favorable demographics and a shortage of housing has prompted Toll Brothers to issue an optimistic outlook for the next 18 months. Consider the following second-quarter results:

- Target (TGT) shares jumped more than 14% in early trading after the company posted a strong beat for both earnings and revenue expectations and announced that it experienced an increase in visits to its stores and website. Among other products, sales of clothing and other discretionary items grew substantially. The discount retailer said overall revenue climbed 3% year over year (y/y) while internet transactions expanded at nearly three times that rate. In May, Target reduced prices on more than 5,000 items and added new merchandise, helping to attract shoppers during the recent quarter, but the company this morning stuck with its previous guidance for total cash register amounts to increase in the flat to 2% range for the full year. Target Chief Operating Officer Michael Fiddelke told CNBC and other reporters that Target took a “measured approach” with its outlook because of uncertainty regarding consumer sentiment and the economy.

- TJX (TJX), a deep discounter with brands such as TJ Maxx, HomeGoods and Marshalls, released results that exceeded expectations, but its guidance fell short of analysts’ estimates despite the company upgrading its outlook. For the quarter, TJX sales climbed from $12.76 billion in the year-ago quarter to $13.47 billion, while its earnings per share climbed from $0.85 to $0.96. Also during the quarter, same-store sales climbed 4% compared to analysts’ expectations of 2.8%. TJX shares rose more than 4% in premarket trading.

- Macy’s (M) posted results that point to higher end consumers curtailing their spending, with weak sales occurring across the retailer's brands, including Bloomingdales, which caters to more affluent individuals. For the recent quarter, earnings exceeded the analyst consensus estimate, but revenue missed expectations and declined on a y/y basis. Overall results were hurt by an increase in promotions and consumers being more selective. For the current year, Macy’s expects comparable sales, a metric that strips out store openings and closings, to decline in the range of 2% to 0.5% compared to its previous guidance range of a 1% decline to a 1.5% increase. It lowered its full-year outlook for overall revenue, causing its share price to drop more than 9% in premarket trading. In February, the company disclosed it would shutter approximately 150 of its Macy’s branded stores.

- Toll Brothers’ (TOL) earnings and revenue for its fiscal third quarter ended July 31 exceeded analysts’ expectations with sales climbing approximately 2% y/y. The number of homes delivered increased 11% y/y and the net value of contracts signed grew by the same amount. Gains were partially offset by a decrease in land transfers. Douglas Yearley Jr., chairman and CEO of Toll Brothers, says the company is optimistic that the recent decline in mortgage rates, favorable demographics and an imbalance in supply and demand will contribute to solid results in the next 18 months. The company also upgraded its full fiscal-year guidance with an earnings per share range that exceeded analysts’ expectations.

Dow Languishes as Other Benchmarks Climb Slowly

Asset prices are mixed with most stock indices advancing while the Dow Jones Industrial moves in the opposite direction on the back of consumer spending uncertainty and mixed economic data. The Russell 2000, Nasdaq Composite and S&P 500 benchmarks are up 0.3%, 0.2% and 0.1%. The Dow Jones Industrial Average is the sole loser out of the majors, with the gauge lower by 0.1%. Sectoral breadth is positive with 8 out of 11 segments higher as consumer discretionary, energy and materials lead; they’re up 0.9%, 0.9% and 0.8%. Financials, real estate and healthcare are trading south by 0.6%, 0.4% and 0.1%. In fixed-income land, Treasurys are changing hands at 3.94% and 3.79% across the 2- and 10-year maturities, 5 and 2 basis points lighter on the session. The dollar is flat, however, as the greenback appreciates versus the Aussie dollar, yuan and yen but depreciates relative to the euro, pound sterling, franc and Canadian dollar. Commodities are taking their cue from reduced borrowing costs, with lumber, copper, crude oil and silver up 0.5%, 0.5%, 0.2% and 0.1%, but gold is lower by 0.3%. WTI is trading at $74.27 per barrel in response to deeper than projected inventory draws for crude, gasoline and distillates.

Volatile Spending Patterns Create Opportunities

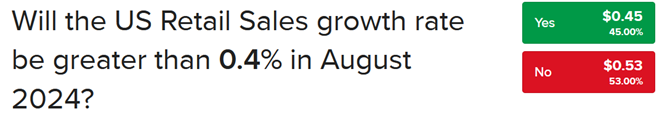

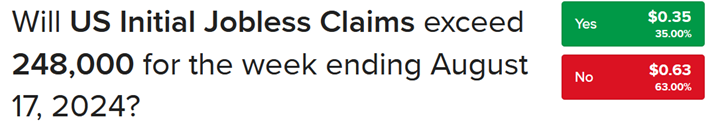

Traders that are examining recent earnings may want to initiate a position in August retail sales with our IBKR Forecast Trader platform asking, “Will the US Retail Sales growth rate be greater than 0.4% in August.” The highest-priced bids are $0.45 for the Yes and $0.53 for the No. I’m favoring the No, ladies and gentlemen, as consumption patterns have been volatile. During my interview yesterday with FintechTv, I explained that households are managing their budgets like light switches. Folks are hunkering down one month to recover from the expenses of the previous, only to come back the following in stride. Overall, the pressures of lofty prices, restritive interest rates, reduced credit availability and elevated uncertainty are generating sharp ebbs and flows in consumer spending. Turning to the labor market, tomorrow morning’s initial unemployment claims are expected to come in at 230,000. Investors with a hunch can check out the Forecast Trader contract with a threshold at 248,000. The Yes or over version is priced at $0.35 while the No or under, which I’m favoring, is at $0.63. Good luck!

To learn more about ForecastEx, view our recent podcast with CEO David Downey here.

Related: Stock Bulls and Bond Bears Yell “No Recession” at the Party