Written by: Kurt Feuerman and Anthony Nappo, CFA

What a difference a year makes. After a series of banking failures in early 2023, financial stocks are showing signs of life again. If the technology sector’s dominance gives way to broader returns across the market, we think financials could be poised for a rerating.

In April 2023, the US financial sector was reeling from a banking crisis, triggered by the failure of Silicon Valley Bank and several regional lenders. When the dust settled, the casualties were limited to specific banks that were compromised by deposit flight and mark-to-market balance-sheet stress in a sharply rising interest-rate environment. Still, investors were understandably spooked and needed time to fully assess the damages and health of the banking system.

Banking Meltdown Averted

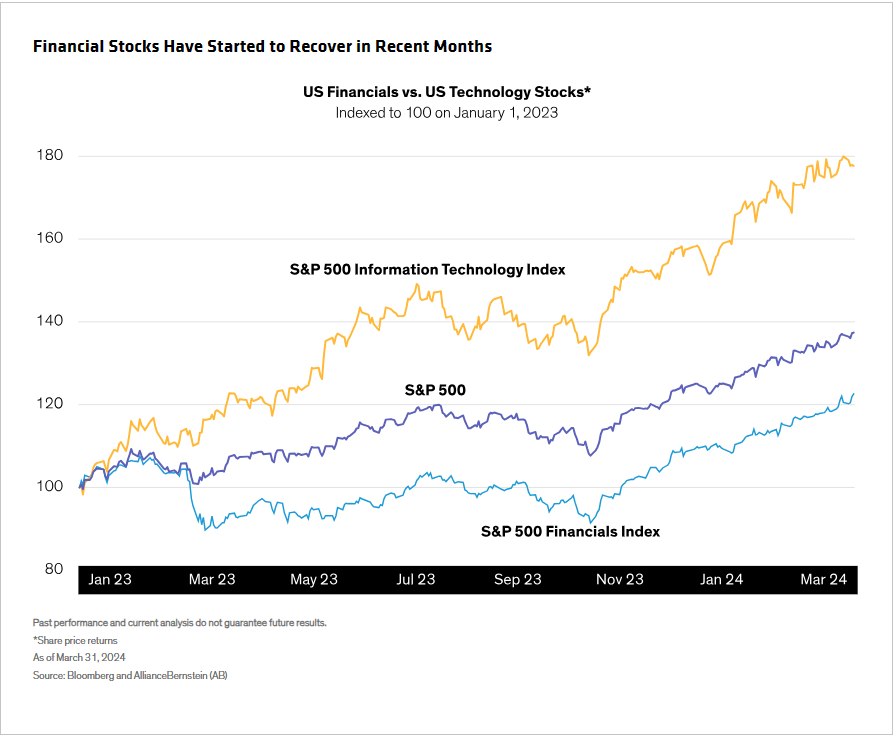

Sentiment has started to shift. Financial stocks rallied in the last five months, signaling growing investor confidence that a wider systemic meltdown has been averted. The S&P 500 Financials Index surged 30.4% from November 2023 through March 2024, outperforming the benchmark’s 25.2% gain over the same period. Since November, returns of financials were almost as strong as technology stocks’—but they still have a long way to go to catch up with the market (Display).

Five months may be a small sample, yet given technology’s persistent dominance, it’s notable. Tech-stock returns have outpaced all sectors for the last decade, driven by superior earnings growth, balance-sheet strength and, recently, enthusiasm over artificial intelligence.

First-quarter trends suggest that market returns may be poised to broaden. That’s good news for financials. To be sure, investors must be vigilant of lingering vulnerabilities, seen in the struggling commercial real estate industry and the recent collapse of New York Community Bank. However, we think the banking system is stable, while fundamental indicators and industry developments are creating a positive backdrop for select financial stocks to thrive.

Bank Balance Sheets Look Healthy

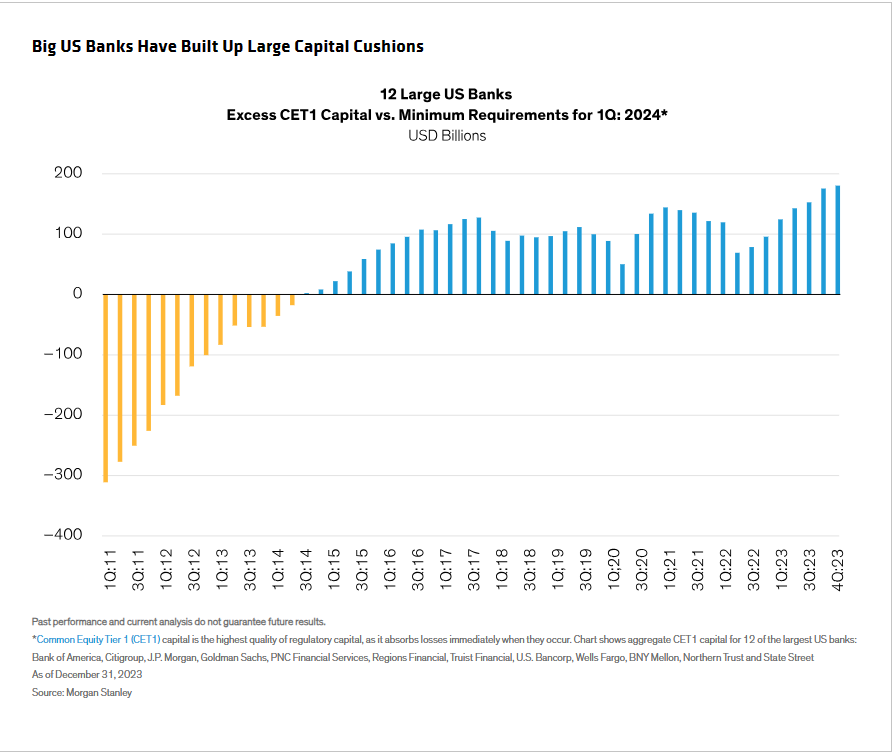

Large US banks have strong capital positions, in our view. At the end of 2023, 12 of the largest US banks in aggregate held excess capital of $180 billion above the minimum regulatory requirements (Display). Excess capital helps protect lenders from financial stress in a crisis, while enabling shareholder value creation through dividends, buybacks and consolidation.

Strong capital positions also help banks cope with regulatory pressures—which may have peaked. Banks are trying to restrain the latest regulatory proposal, known as the “Basel III Endgame,” arguing that higher capital levels and restrictions aren’t needed and would hurt the economy. Fed Chairman Jerome Powell spoke out against the proposal in March. The market cheered at the prospect of regulations being watered down.

Relatively High Inflation and Interest Rates Are Helpful

Beyond regulatory issues, financial firms are also sensitive to macroeconomic trends. We think the US economy has returned to the "old normal," whereby inflation is here to stay. Annual inflation has come down from a peak of 9.1% in mid-2022 to 3.2% in February, and is unlikely to revert to extremely high levels. But we expect upward pressures on inflation in the coming years, rather than the pervasive downward pull experienced from 2008 through 2021.

That’s not necessarily bad for risk assets. On the contrary, in this environment, nominal growth rates are also likely to be higher, which should support earnings. Indeed, S&P 500 companies defied forecasts of big declines last year and eked out earnings growth in 2023. We believe upward revisions and decent growth are in store for 2024 and 2025.

Higher nominal growth isn't free. Even if the Fed cuts rates this year as widely expected, market rates may stay firm or even rise. All else being equal, we believe this creates an advantage for financials, as many business models in the sector enjoy profitability benefits when rates are higher.

What if growth and inflation move lower along with interest rates? In our view, this should support risk assets, though quality and defensive sectors might do better. While spread-based financial businesses that rely on higher rates might lag, select stocks in the sector could hold their own. In this scenario, we believe that capital markets trading, investment banking and asset management would prove resilient.

Taking the Pulse of Business Trends

For now, we’re seeing favorable trends in key industry segments. Some major auto insurers have reported double-digit pricing growth. Alternative asset managers are also seeing strong organic revenue growth amid growing interest for nontraditional investment products.

Meanwhile, the recent rally in financial markets is good news for traditional asset and wealth managers. And investment banking revenues have picked up recently from depressed levels.

What about commercial banks? Following last year’s shock, vital signs look stable. Credit costs continue to normalize higher after years of extremely low levels, which bodes well for lenders. We believe that select large, diversified banks with large deposit franchises are well-positioned for the evolving environment. These banks were resilient during last year’s crisis and continue to gain market share in a fragmented industry.

Valuations Remain Attractive

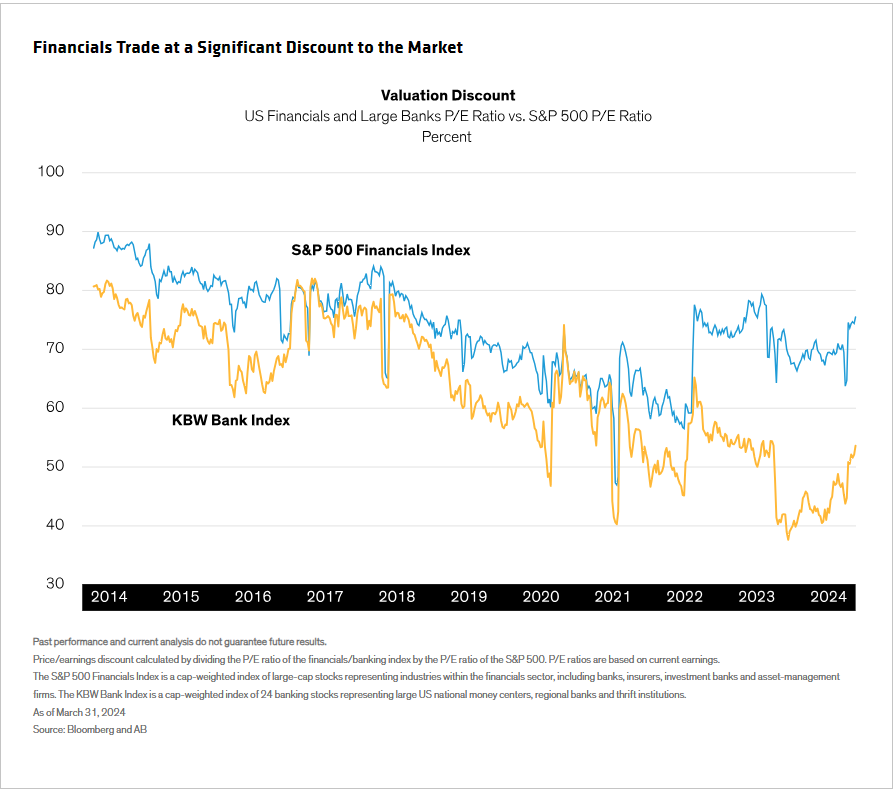

Improving industry fundamentals are not yet reflected in valuations. Both the broader S&P 500 Financials Index and the KBW Bank Index trade at meaningful price/earnings discounts to the market (Display).

The time is right for equity investors to take a fresh look at financials. Look for select companies with positive earnings revisions, driven by favorable business trends. And remember that financials are more than just banks. By combining a diversified approach to the sector and a discriminating view of company fundamentals, we believe investors can capture the pent-up potential for a broader recovery in financial stocks that have been unloved for too long.

Related: Private Credit Forecast: Optimism Amid Rising Rates