The S&P 500 keeps extending its consolidation – is this a potential bottoming pattern?

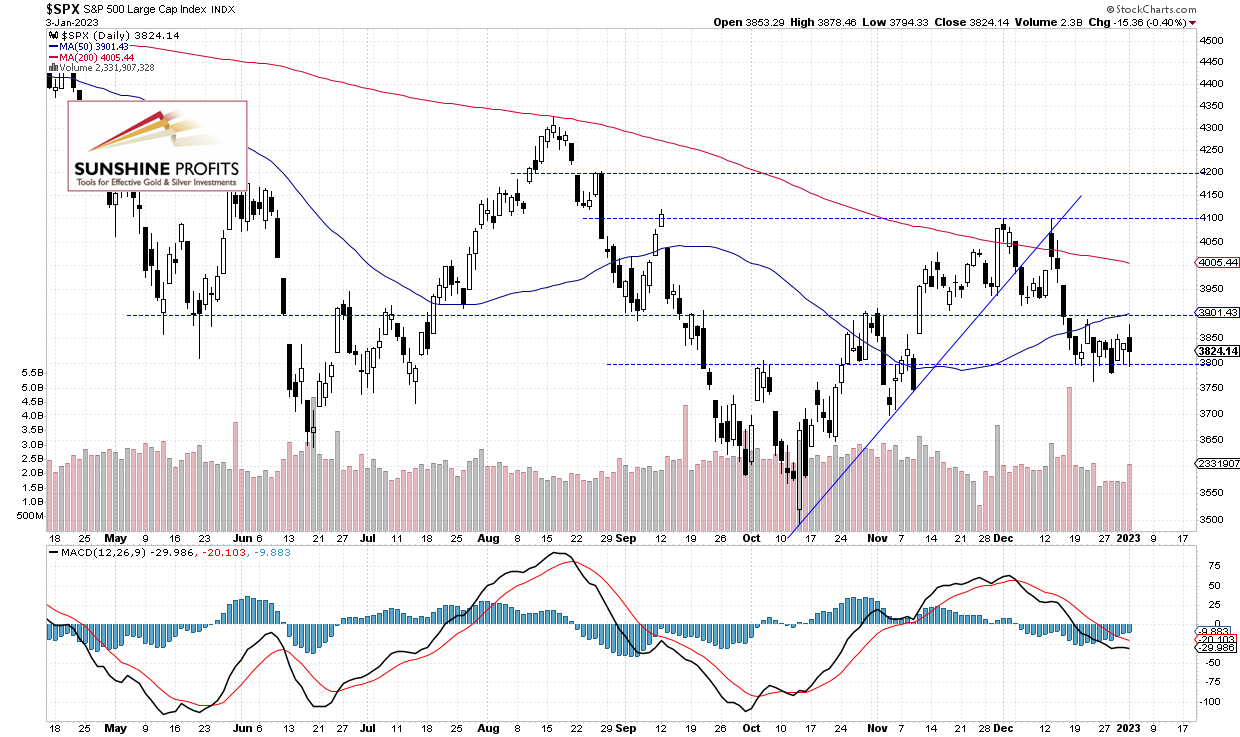

The broad stock market index lost 0.40% on Tuesday, after opening above its last Friday’s closing price. It extended an over two-week-long consolidation along the 3,800 level. On previous week’s Thursday it reached new medium-term low of 3,764.49, before bouncing back above 3,800. Overall it kept extending a consolidation following the decline from 4,100 level. In mid-December the S&P 500 has been negatively reacting to the December 14 FOMC interest rate hike, among other factors.

The S&P 500 will likely open 0.3% higher this morning. We may see another attempt at breaking above the recent trading range. The S&P 500 index trades within an over two-week-long consolidation and above the 3,800 level, as we can see on the daily chart:

Futures Contract Bounces Back and Forth

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it came back to the resistance level of around 3,900, but then it fell closer to the support level of 3,800 again.

Conclusion

The S&P 500 is expected to open slightly higher on Wednesday. The market will be waiting for the important ISM Manufacturing PMI, JOLTS Job Openings releases at 10:00 a.m. and the FOMC Meeting Minutes release at 2:00 p.m. So it may see more volatility today. There have been no confirmed positive signals so far. However, stocks may be forming a bottom here.

Here’s the breakdown:

- The S&P 500 index continues to trade within its short-term consolidation.

- There have been no confirmed positive signals so far, however, stocks may be forming a bottom.

- In our opinion, the short-term outlook is bullish.

Related: Stock Prices Go Sideways — Are They Forming a Bottom?