Written by: David Lebowitz

2022 was a year characterized by the highest rates of inflation since the 1970s, an unprecedented tightening in monetary policy, rising geopolitical risks, and excessive public market volatility. Against this backdrop, private market alternatives delivered exactly what investors expected, helping to diversify portfolios at a time when stock/bond correlations turned positive while simultaneously providing income and the opportunity for alpha generation. Looking ahead to 2023 we see slower growth, a gradual deceleration in inflation, and monetary policy that remains tight; as always, this will create risks, as well as opportunities, across the spectrum of alternative investments.

Global economic activity deteriorated into the end of 2022, and consensus is now calling for a recession in 2023. While we recognize that the probability of recession has risen, we are unsure whether it should be viewed as a foregone conclusion. Labor market strength may help major economies avoid recession this year, particularly in the U.S. where the Federal Reserve may not be forced to create significant labor market slack to bring wage growth down to more normal levels. Meanwhile, a warmer winter in Europe and the successful stockpiling of natural gas seems to have removed some downside risk to growth, while China should see activity bounce in the second half of 2023 as the pandemic gradually fades.

Against this softening growth backdrop, inflation has remained resilient. We have likely seen peak inflation, but it will take time for price growth to decelerate to levels consistent with central bank mandates. As we think about the trajectory of inflation, healthy supply chains and cooler wage growth will be essential if central bankers are to achieve their desired outcome, while elevated home prices and rents will limit the pace with which inflation can decline. This should lead the Federal Reserve and other developed market central banks to continue tightening policy in the near term; futures markets are expecting rate cuts later this year, but we believe the bar for an easing in policy remains quite high.

This disconnect between investor expectations and central bank forecasts will be a source of volatility in 2023. This volatility, coupled with higher cash rates, will support hedge fund performance, particularly across relative value and global macro strategies. At the same time, we anticipate a continued re-rating in private market valuations, which will provide an opportunity for investors who are actively raising funds. Finally, middle market direct lending continues to look well-positioned in the current environment given higher underwriting quality and the ability for lenders to renegotiate terms if the economic backdrop becomes increasingly challenging.

The U.S. real estate market is expensive in aggregate, but this masks significant dispersion beneath the surface. Industrial assets remain expensive, whereas vacancy rates in the office and retail sectors are near all-time highs. As we look ahead, private real estate assets seem well-positioned to deliver stable cash flows and public market diversification, even if capital values decline. Looking across real assets more broadly, infrastructure can help hedge against inflation, and transportation assets should benefit as global trade continues to normalize.

Alternatives have benefitted from an environment of easy money for the better part of the past decade, and it seems like this may be coming to an end. The new combination of higher rates and demand for capital will allow for more differentiation between winners and losers, and potentially support active management going forward. We still see value in adding alternatives to a portfolio for the long-run; the reality, however, is that taking an outcome-oriented approach and focusing on manager selection will be more important than ever in the year ahead.

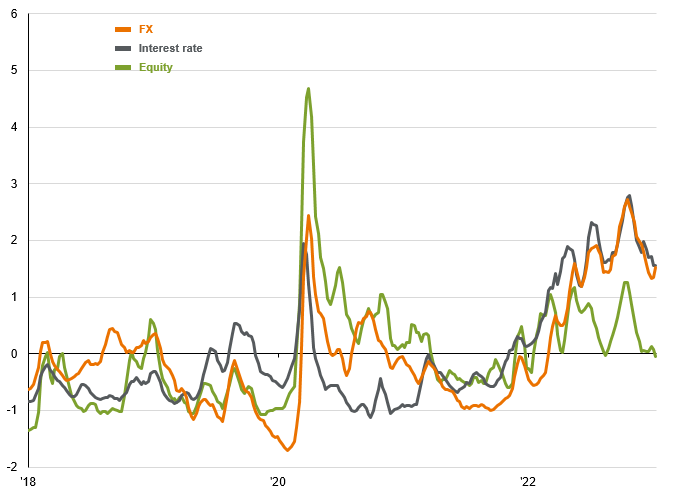

Equity volatility will "catch-up" to rates & FX

Equity, interest rate and foreign exchange volatility, z-score, 4-week moving average

Source: Bloomberg, CBOE, ICE BofA, J.P. Morgan Index Research, J.P. Morgan Asset Management. Equity volatility is represented by the VIX Index, interest rate volatility is represented by the MOVE Index and foreign exchange volatility is represented by the J.P. Morgan Global FX Volatility Index. Data are as of January 19, 2023.

Related: Will the U.S. Run Out of Funding After Reaching the Debt Ceiling?